Investing.com’s stocks of the week

Streaming device stock Roku Inc (NASDAQ:ROKU) is up 0.5% at $53.48 in afternoon trading, as the options market gears up for the company's fourth-quarter earnings, slated for after the market closes tomorrow, Feb. 21. Below, we will take a look at what the post-earnings moves the shares have been priced in for, and how ROKU has been faring on the charts.

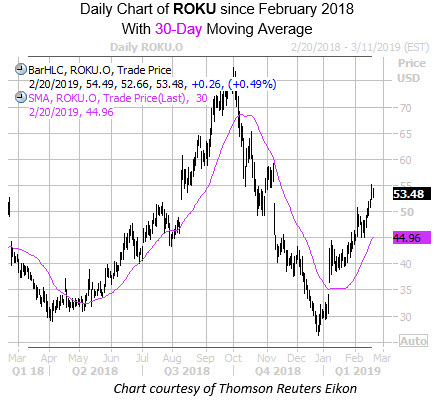

ROKU shares have been on the mend, and have more than doubled since hitting an annual low of $26.30 Dec. 24. Further, in early January the stock saw an impressive bull gap and moved back above the 30-day moving average -- a trendline that had performed as a ceiling for the shares since October of last year. What's more, ROKU's 14-day Relative Strength Index (RSI) was docked at 74 at Tuesday's close -- well into overbought territory.

Looking toward the streaming name's earnings history, the stock has closed lower the day after three of its total five reports, including a 22.3% drop in November. From a broader standpoint, the shares have averaged a 23.6% swing the day after reporting, regardless of direction. This time around, ROKU options are pricing in a slightly lower 20.5% swing for Friday's trading.

In closing, Roku stock has tended to make bigger-than-expected moves than what the options market was pricing in. This is per its Schaeffer's Volatility Scorecard (SVS), which stands at a lofty 88 out of 100.