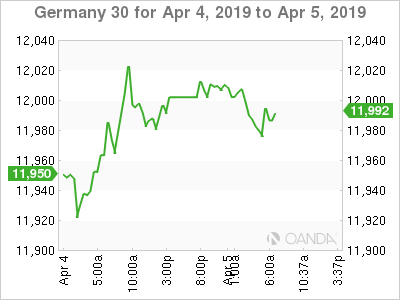

The DAX index has ticked lower on Friday, after a string of winning sessions. Currently, the DAX is at 11,973, down 0.11% on the day. The DAX has jumped 3.7% this week, and on Thursday, the index touched at its highest level since October 2018. In economic news, German industrial orders climbed 0.7%, edging above the forecast of 0.6%. In the U.S., the focus will be on employment numbers. If the forecasts are accurate, job data will be soft, which could sour investors and drag down equity markets.

German manufacturing data has been weak, as the manufacturing sector has been damaged by the fallout of the global trade war. This has dampened demand for German exports, such as vehicles and auto parts. German manufacturing PMI is showing contraction and factory orders have declined for four straight months. However, there was positive news on Friday, as industrial production posted a strong gain of 0.7%, ending a streak of four successive declines. The improvement is a result of a surge in construction, but with demand from abroad remaining soft, the manufacturing sector is likely to face further headwinds.

There is growing optimism with regard to the U.S-China trade talks, which have continued this week in Washington. The sides have made substantial progress, with reports that an agreement between the world’s two largest economies is 90% complete. The outstanding issues include enforcement mechanisms and the removal of trade tariffs. There has been positive news out of China this week, as manufacturing PMI posted a 14-month high, and the China 50 index has climbed to its highest level since March 2018.

Economic Calendar

Friday (April 5)

- 2:00 German Industrial Production. Estimate 0.6%. Actual 0.7%

- All Day – Eurogroup Meetings

- 8:30 US Average Hourly Earnings. Estimate 0.3%

- 8:30 US Nonfarm Employment Change. Estimate 172K

*All release times are DST

*Key events are in bold

DAX, Friday, April 5 at 6:40 EST

Previous Close: 11,998 Open: 11,993 Low: 11,968 High: 11,998 Close: 11,975