Strayer Education Inc. (NASDAQ:STRA) reported second-quarter 2017 earnings of 92 cents per share, beating the Zacks Consensus Estimate of 88 cents by 4.5%. Also, earnings increased 28% year over year.

Revenues increased 4% to $112.7 million from $108.5 million in the same quarter last year, primarily buoyed by higher enrollment which was partly offset by lower revenues per student.

Enrollment Details

Total enrollment at Strayer University increased 6% to 43,411 students from 41,029 in the prior-year quarter. New student enrollments rose 8% and continuing student enrollments increased 5%.

Operating Results

Operating margin increased 40 basis points (bps) to 12.3%. Bad debt expenses, as a percentage of revenues, were 4.5% in the second quarter, reflecting a year-over-year increase of 70 bps.

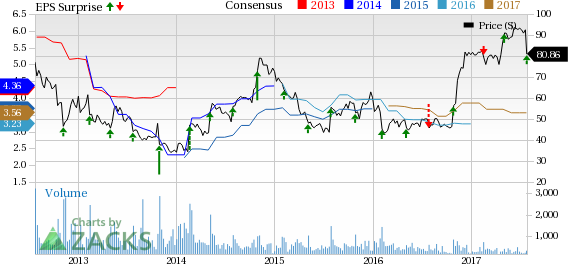

Strayer Education, Inc. Price, Consensus and EPS Surprise

Financial Details

Strayer Education ended the quarter with cash and cash equivalents of $147.9 million, as of Jun 30, 2017, compared with $129.2 million at 2016-end.

The company generated $32.7 million in cash from operating activities in the first half of 2017, compared with $22.4 million in the year-ago period. Capital expenditures totaled $8.4 million in the first half of 2017, compared with $3.9 million in the same period last year.

The company had $70 million worth of share repurchase authorization as of Jun 30, 2017. Notably, no shares were repurchased in the second quarter of 2017.

Q3 Guidance

Total enrollments at Strayer University are expected to grow 7% to approximately 41,600 students from the prior-year quarter.

New student enrollments are anticipated to increase approximately by 7%, slightly lower than the company’s prior guidance of 8% growth. Continuing student enrollments are likely to increase approximately 8%, up from the prior expectation of 5%.

Revenue per student in the quarter is likely to decline between 1% and 2%.

2017 Guidance

The company expects revenue per student to decline between 1.5% and 2%.

Zacks Rank & Peer Release

Strayer Education currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Capella Education Company (NASDAQ:CPLA) reported adjusted earnings of 90 cents in the second quarter of 2017, which surpassed the Zacks Consensus Estimate of 80 cents by 12.5%. Adjusted earnings however declined 3.2% year over year.

Upcoming Peer Releases

American Public Education, Inc. (NASDAQ:APEI) is scheduled to report second-quarter results on Aug 8. The Zacks Consensus Estimate for quarterly earnings is pegged at 23 cents.

Adtalem Global Education Inc. (NYSE:ATGE) is slated to release its fiscal fourth quarter 2017 numbers on Aug 17. The Zacks Consensus Estimate for earnings is pegged at 72 cents.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential.

See these stocks now>>

American Public Education, Inc. (APEI): Free Stock Analysis Report

Strayer Education, Inc. (STRA): Free Stock Analysis Report

Capella Education Company (CPLA): Free Stock Analysis Report

DeVry Education Group Inc. (ATGE): Free Stock Analysis Report

Original post