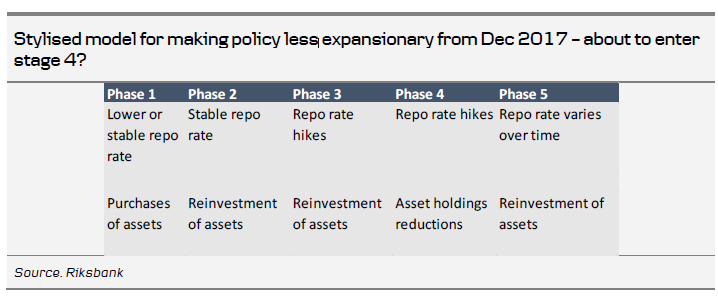

Sell SGB1061 (Nov 2029) ASW @-56bp. Carry: -0.3bp/3M. P/L: -46/-63bp. In December 2017, the Riksbank (RB) provided a crude roadmap for normalising monetary policy (see below). After the hike in December 2018, we are now at phase 3. In our view, the RB could very well enter phase 4 by deciding not to extend QE purchases beyond June.

We note that the RB in December 2018 chose not to extend the mandate for FX interventions – another non-standard measure. The need for more bond purchases can obviously be questioned in an environment where the RB remains intent on hiking rates.

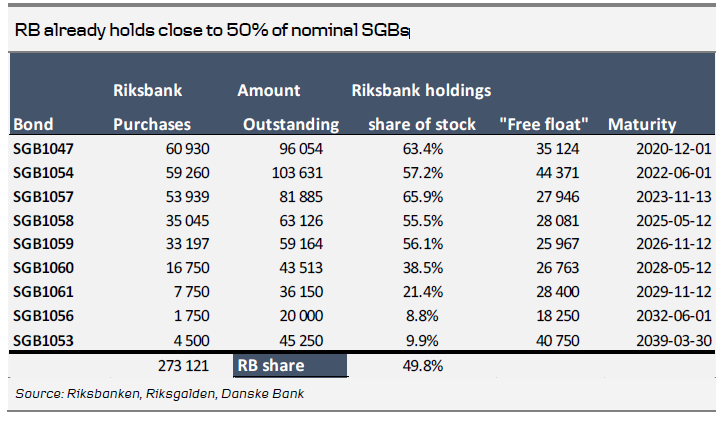

On top of that, despite the bond purchases being very modest relative to the size of GDP, the RB holds an impressive share of the outstanding volume, just below 50%. No doubt, this has affected market liquidity. Turnover in government bonds has decreased relative to turnover in covered bonds. The Riksbank’s own December 2018 survey points to some investor dissatisfaction with bond market liquidity. In addition, the SNDO appears to remain worried about potential long-term harm to the investor base. We note that many nominal SGBs trade close to 40bp expensive relative to the RB repo rate.

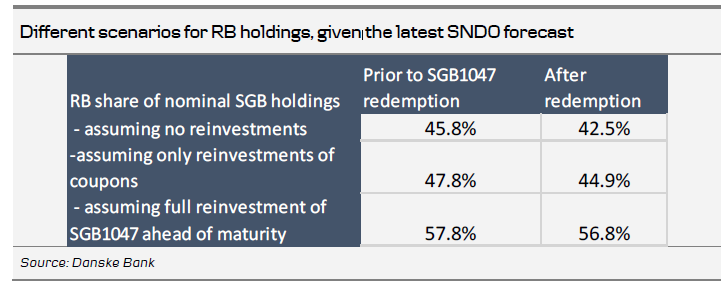

Below, we have done some simple simulations, based on the latest issuance forecast from the SNDO. The question the RB will have to address at the April meeting is whether to reinvest SGB1047 early (which matures as late as December 2020). The extreme scenario would mean reinvesting all holdings early. That would imply the RB’s holding increases to around 57% of the outstanding volume, a number that would stand out internationally. A more moderate scenario would imply reinvesting only coupon payments. In that scenario, the RB’s holding relative to the outstanding volume would only decrease marginally.

Considering the questionable need for more bond purchases and the strain on the bond market, we think a logical step for the RB at this point would simply be to end bond purchases. Even under our scenario, the RB balance sheet would remain mostly intact up until December 2020.

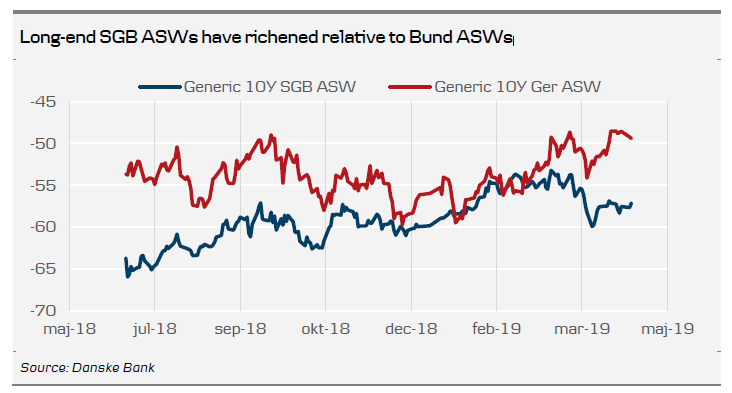

Earlier this year, we were hesitant about selling long-dated SGBs vs swaps, as they had cheapened significantly relative to Bund ASWs. However, in recent months, 10Y SGB ASWs have become significantly more expensive, partly supported by the upward pressure on the 3M (NYSE:MMM) fixings (which however, seems to be abating for the time being).

Thus, entry levels now appear more attractive. We especially recommend to sell SGB1061, the current 10Y benchmark bond. The loan is noticeably cheaper in the repo market (trading around -0.45%), and is unlikely to be squeezed in the near term as it is still “under construction”, i.e. being regularly tapped by the SNDO.

Thus, we recommend selling SGB1061 ASW. We generally expect the short-end of the ASW curve to continue to outperform the long end, as the short end should benefit from the proposed LCR rules putting upward pressure on fixings (especially as we near the large June redemptions) and from the general lack of short-dated government bonds/bills.