We all have seen the ‘V’ bottom in the market and in stocks that we either own or have been following. One that sticks out to me is Johnson & Johnson (NYSE:JNJ). It is in that large cap slice of the market that has been doing so well. And it is healthcare related, also a plus. It was also at all-time highs as the market sold off. The recovery brought it back to that all time high quickly. And it has done nothing for over a month since. Forget no more tears, it is keeping your baby powder dry. Both disappointing and uncharacteristic for it over the last year.

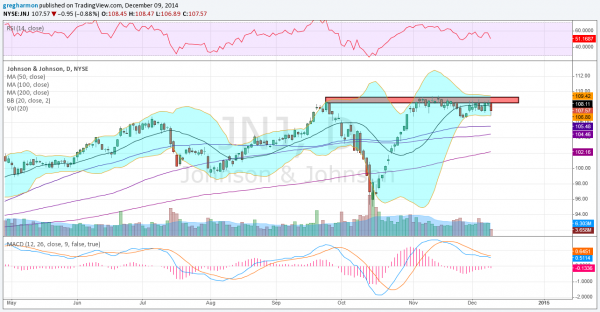

The chart above shows that price action. As it sits in a tight range between 106.50 and 109.50 the Bollinger bands have been tightening. The momentum indicators are drifting lower, with the MACD pointing to more downside while the RSI is holding over the mid line for now, remaining in the bullish zone.

So which way is it going to break? I do not know. But I have a plan to trade it now anyway. When you see a tight consolidation in a stock for a long time with tightening Bollinger bands® it often foretells a move. This type of action can be played with options using a Straddle or Strangle. This is just a combination of a long put and a long call to participate in a move in either direction.

For Johnson & Johnson I like a January 23 Expiry 107/108 Strangle (offered at about $3.75 as i write). To make money the stock needs to move beyond either strike by the premium paid, $3.75, by Expiry, so either lower that 103.25 or above 111.75. That maybe a comfortable range for you. But if it is too wide then look at selling shorted dated Strangles to recoup some cost and narrow the range where the trade becomes profitable. For example, selling a December 105/110 Strangle narrows the range by 40 cents. Even better, if the stock does not break that December Strangle range by Expiry, you can sell another Strangle in early January.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.