There's a new hashtag trending on Twitter that I feel is very relevant for myself and all of you as well.

Most of us are already familiar with the tag HODL, it was a misspelling of the word hold on a Bitcoin Forum Post and eventually evolved into a battle cry for crypto-investors.

Behind this idea is a simple message that traders, especially those who aren't experts, tend to lose money, while those who invest for the future are the ones who end up gaining.

With the cryptomarket down 23% overnight that sentiment is as relevant as ever. But more than that, neither our mood and nor our equity should be entirely hinged on a single market, no matter how promising that market seems.

As Warren Buffet said in a recent interview, "when you're just looking at the price of something, you're not investing."

The new hashtag #Buidl. Meaning, don't just sit on your hands and wait. Be proactive and build something. That's how you create value.

For me, it's an encouragement to build up a portfolio. By spreading equity among different stocks, commodities, cryptos, copying, and copyfunds, we can ensure that no matter which sector is performing poorly and which one is doing best, we can continue to see consistent results over time.

Today's Highlights

Seel + Water = Tariffs

The Euro is Unhinged

Jobs Day on Wall Street

Please note: All data, figures & graphs are valid as of March 9th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

President Trump formally adopted his tariffs yesterday. From now on, all steel sent to the US will be subject to a 25% fee and all aluminum will be 10%.

As many expected, the measures were in fact watered down from his original proposal. The tariffs on Canada and Mexico have been temporarily suspended, pending the upcoming NAFTA negotiations, and Trump will also allow other US allies to apply for an exemption, though it's still not clear on what basis such exemptions would be granted or denied.

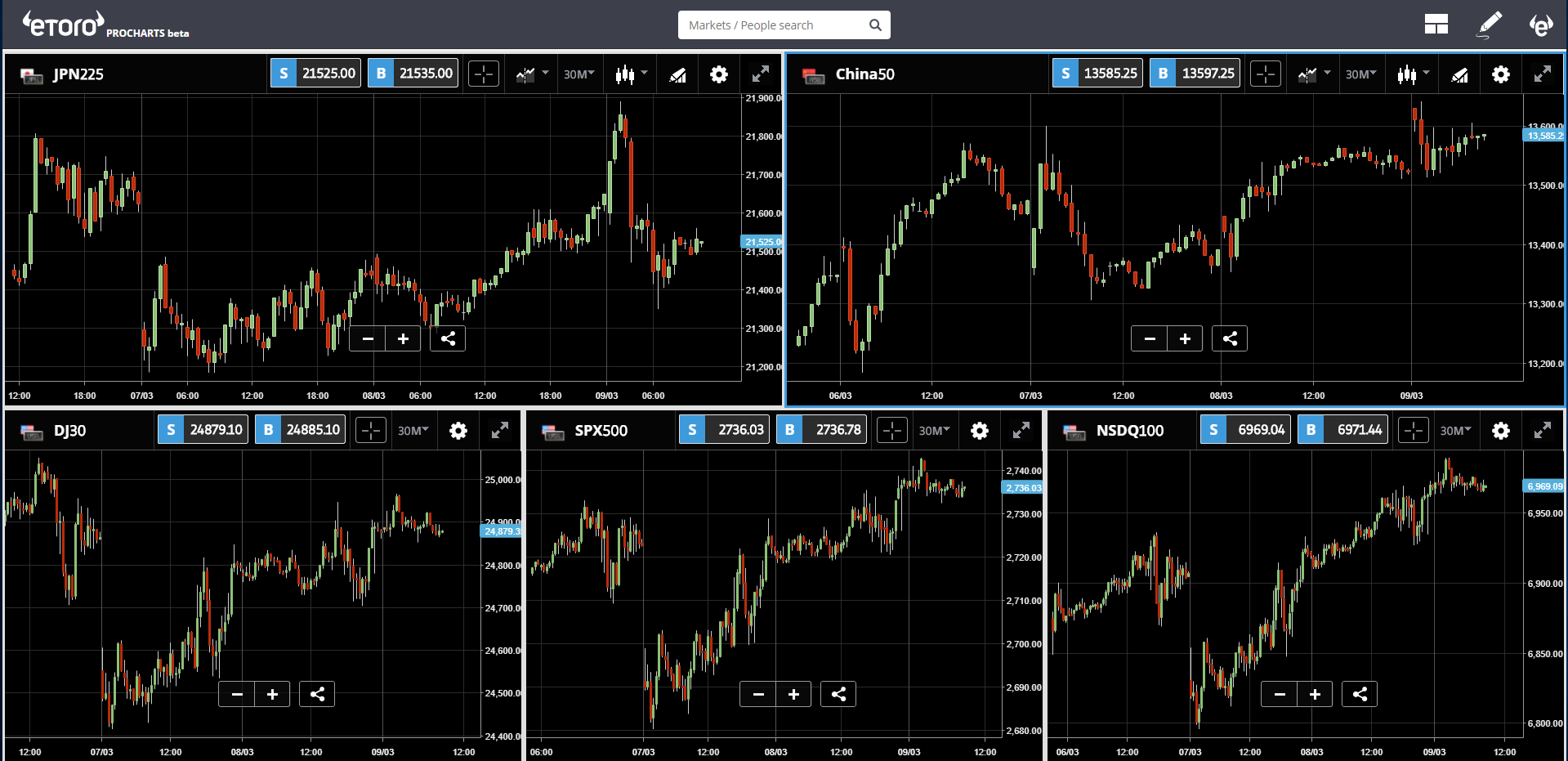

The stock markets held up surprisingly well and we did see rises from all three major indices on Wall Street and further gains in Asia this morning.

In these charts of the major indices, we can see the gap down, which is the Cohn Plunge we discussed on Wednesday and subsequent "recovery."

Euro Unhinged

The European Central Bank caused some action in the currency markets yesterday.

Six years ago, Mario Draghi, the governor of the ECB, saved the Euro with a single sound bite stating that the Central Bank will do "whatever it takes to preserve the Euro."

Ever since then, in every statement they've made on monetary policy, they have preserved this ideal that they stand ready to act if necessary.

Given the strong economy in the Eurozone, they finally feel confident enough to remove that pledge from their manifesto.

Of course, we all know that should things deteriorate they still stand ready to act, and in fact, their QE program is still injecting about €30 Billion monthly. However, it seems that they no longer need to make that statement.

It took a few moments (blue circle) for the markets to process this of course. The EUR/USD quickly rose to fresh highs before dropping to new lows. As we can see though, the range that's been intact since mid-January is still very much holding.

Hooray for Jobs Day

Though it's not the primary thing on the minds of investors today, do remember that today at 13:30 GMT we'll be getting the US NFP jobs report.

This is usually the number one market moving event each month and depending on the results could cause a few waves.

Analysts are expecting the report to show a solid 200,000 jobs added in February and if the actual figure comes out anywhere close to that we could see a very boring reaction from the market.

Just be on the lookout for any surprises in the data as that has been known to happen from time to time. A result greater than 250k or less than 150k could deliver a bit of a shock and spark additional volatility.

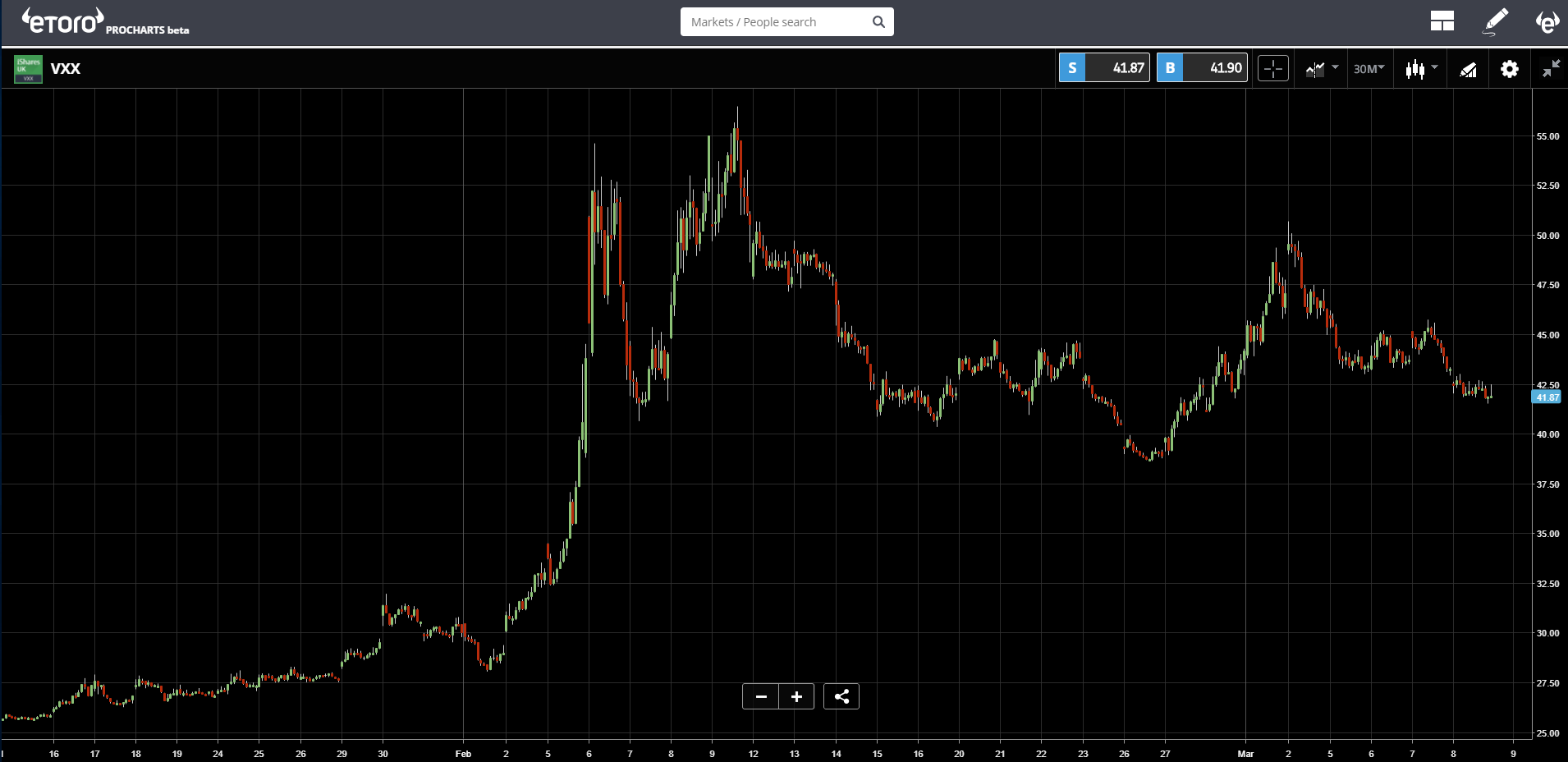

Here we can see the VXX, short term volatility graph, which spiked during the sell, off in early February but has since stabilized.

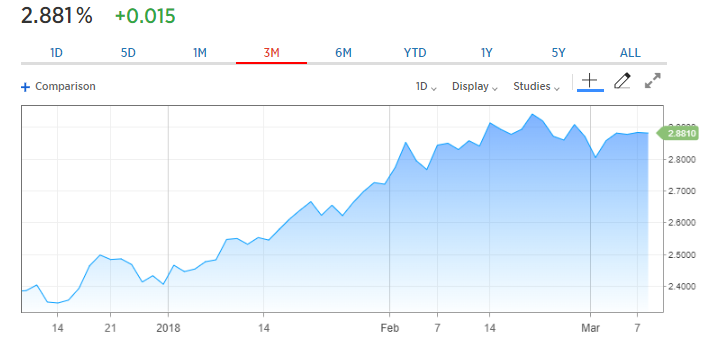

Same goes with the US 10 year...

Wishing everyone an amazing weekend. Whether you're doing more long-term investing or short-term trading. Stop focusing on the price. ;)

@MatiGreenspan

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.