Investing.com’s stocks of the week

It may prove to be a volatile trading session, with stocks and commodities falling at critical levels of resistance. It may suggest the pre-market gains may not last, or at the very least open lower giving back the current gains you may be waking up too, which appear to be slowly vanishing.

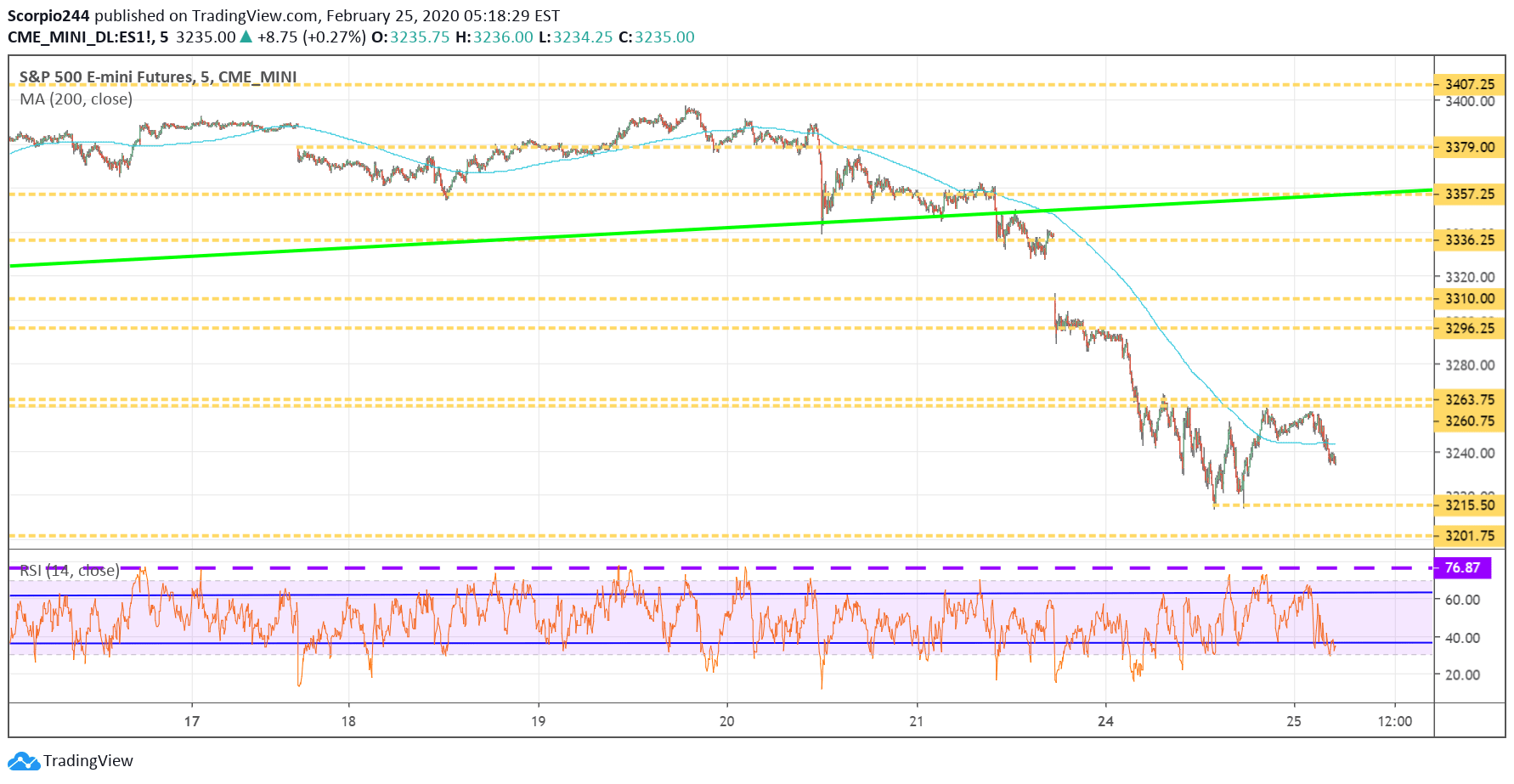

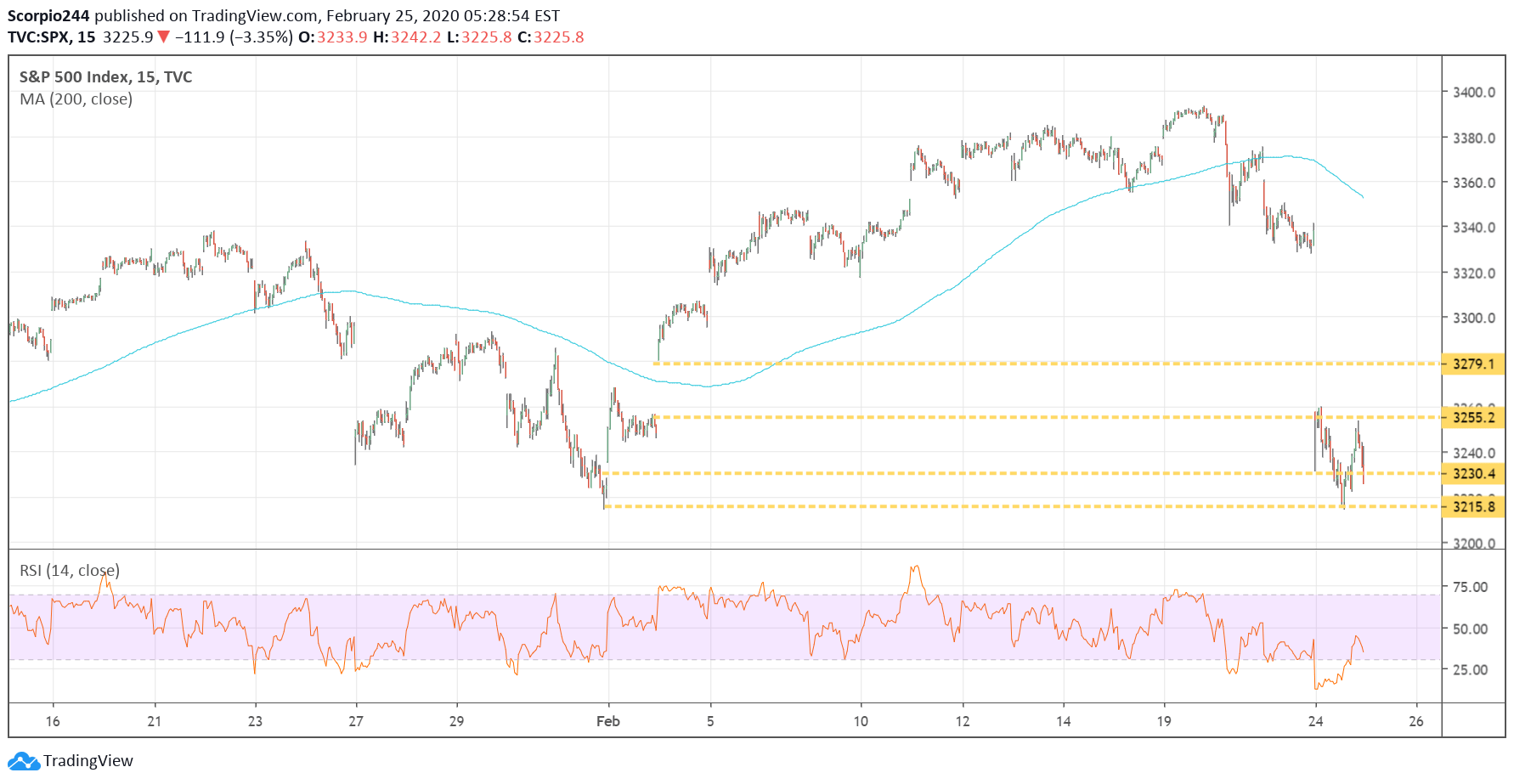

S&P 500

The chart of the S&P 500 Futures is showing what appears to be a nice potential double bottom. However, we can also see that the futures failed to break out and to confirm that double bottom. The futures happened to fail at resistance around 3,260 and have since traded lower.

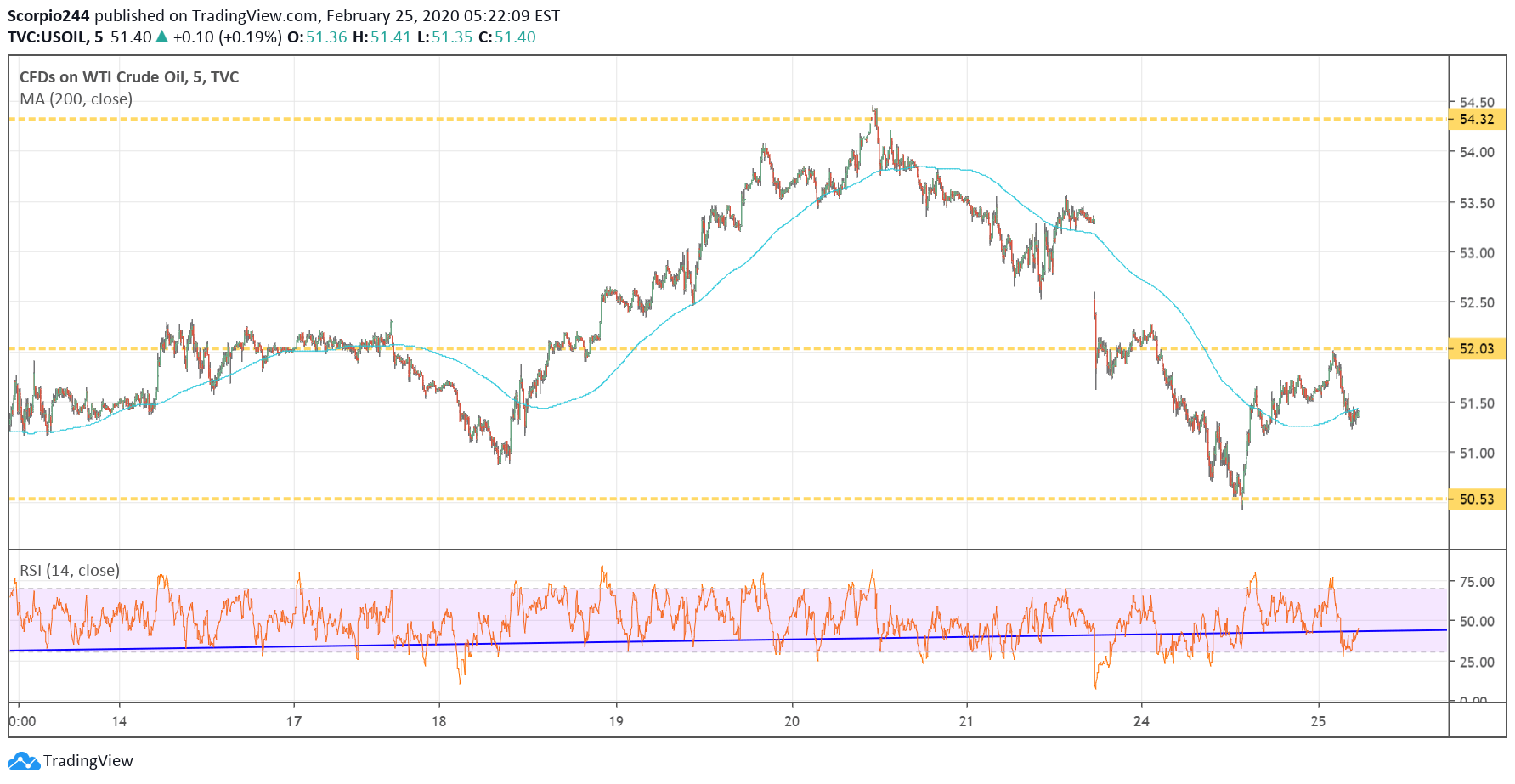

OIL

Oil price also rose to resistance this morning and failed at $52.

What it suggests to me is that the market is still in a prove me state, and all rallies should be considered suspect until resistance levels are broken. It creates a trading band in the S&P 500 that is likely to prove critical today, with 3,215 acting as support and resistance around 3,260.

GERMANY (DAX)

Meanwhile, the German DAX is trading at a technical level of support at 12,900. We can see that this level of support dates all the way to back the end of October.

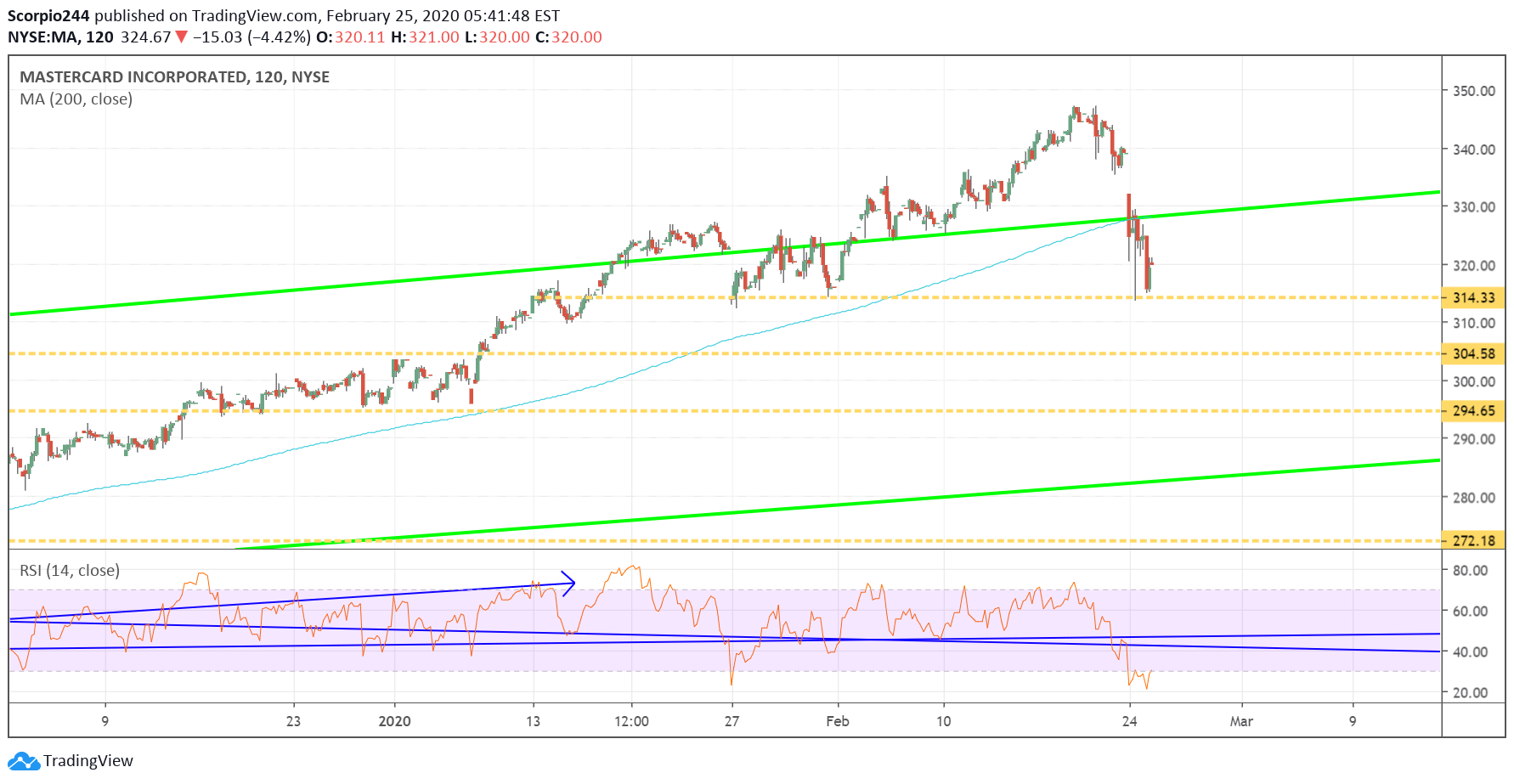

MASTERCARD (MA)

Mastercard (NYSE:MA) pre-announced its first quarter, now seeing revenue growth of about 9-10%. That is less than analysts estimates for growth of about 12%. It amounts to about $50 to $100 million less in revenue for the company. It doesn’t look disastrous from a company expected to do nearly $4.2 billion in total revenue. Support for the stock is around $315, and the potential to fall to about $305.

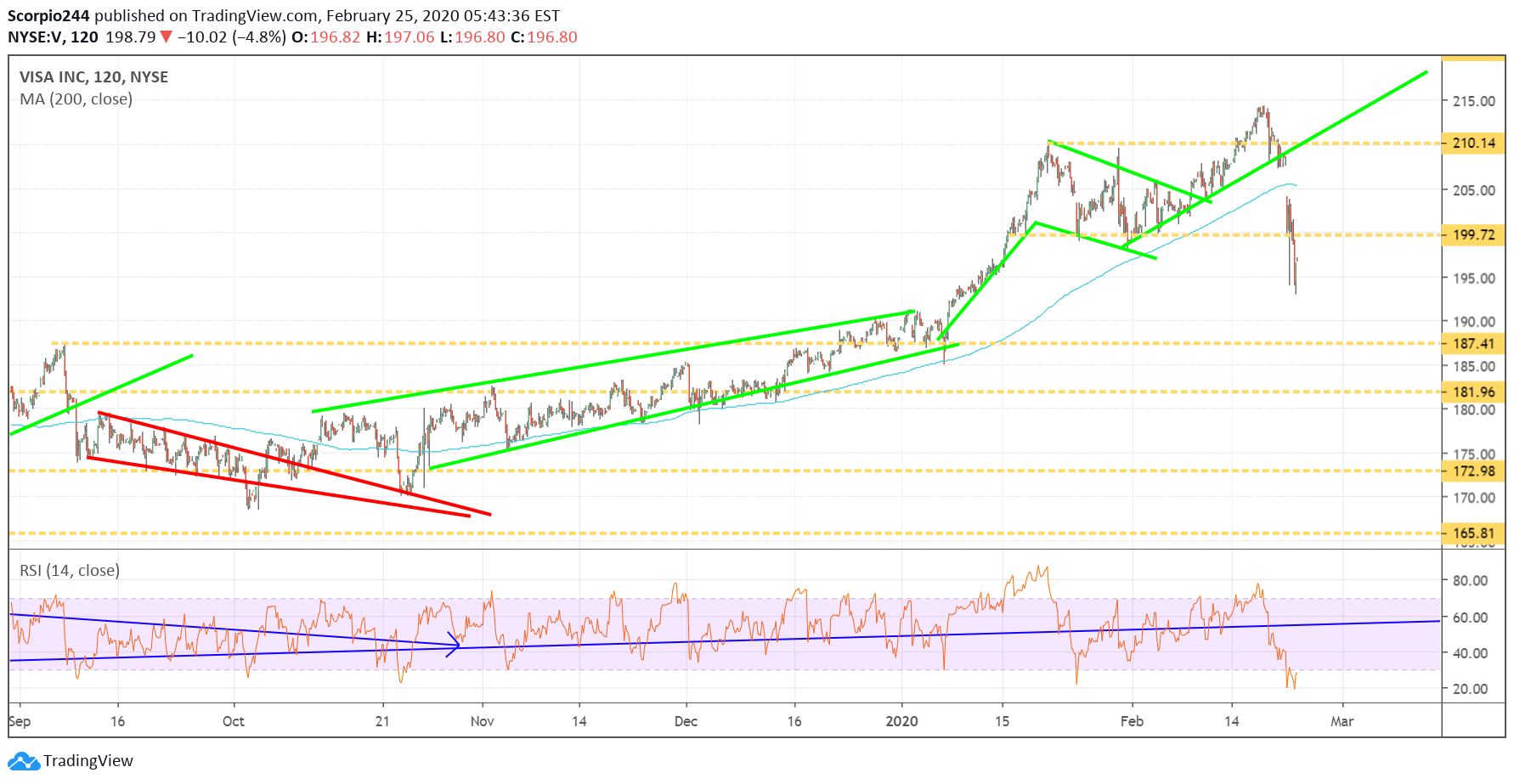

VISA (V)

Visa (NYSE:V) is also falling as well, with support around $187.

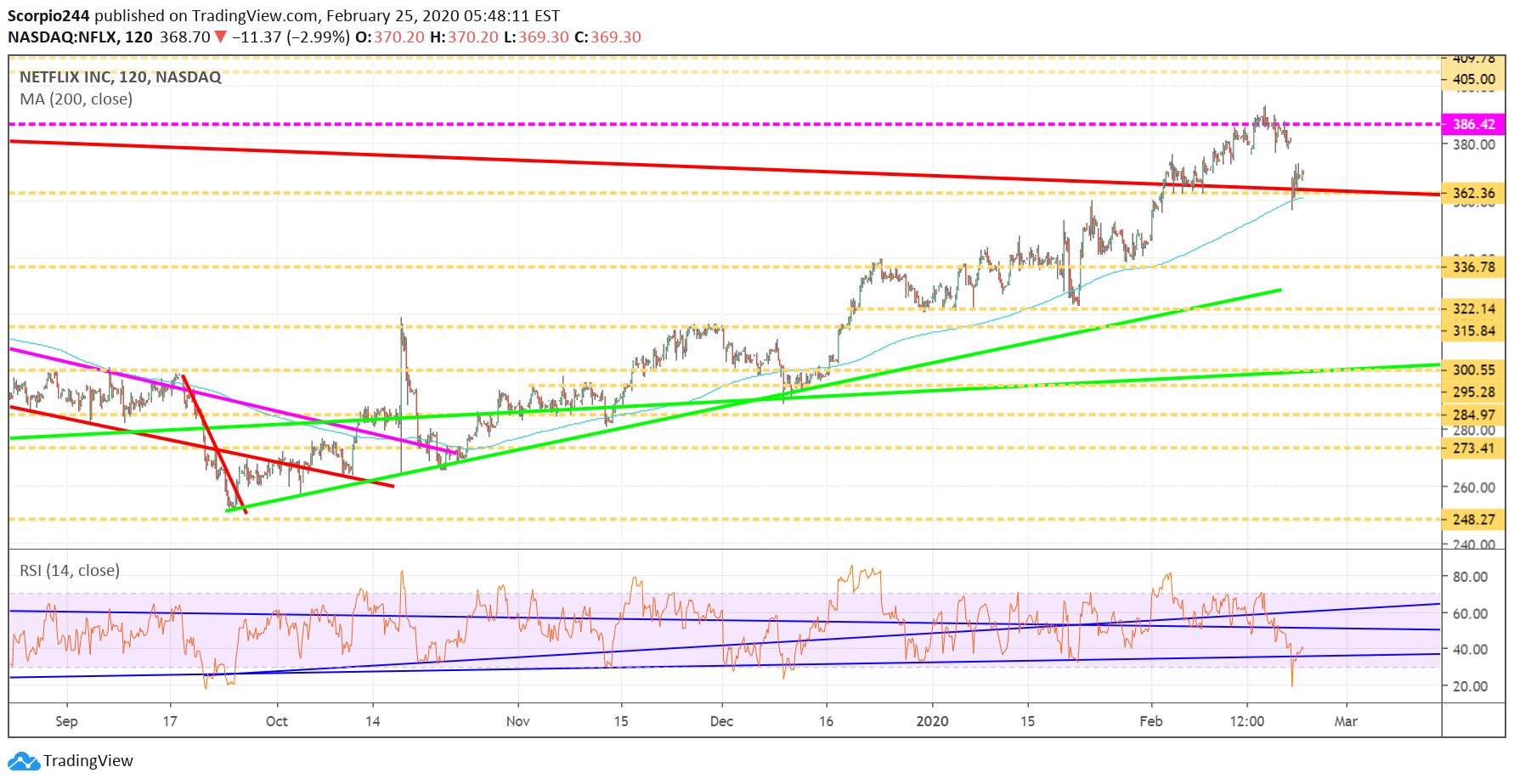

NETFLIX (NFLX)

Netflix (NASDAQ:NFLX) got some positive commentary out of Piper Sandler today, which noted that Netflix has pricing power, and based on a survey, could raise the price by as much as $2.40 per month. This seems important to me because there has been this view among investors that is rising “competition” would make that harder. Support for the stock remains around $360, with a gap fill up to $379.

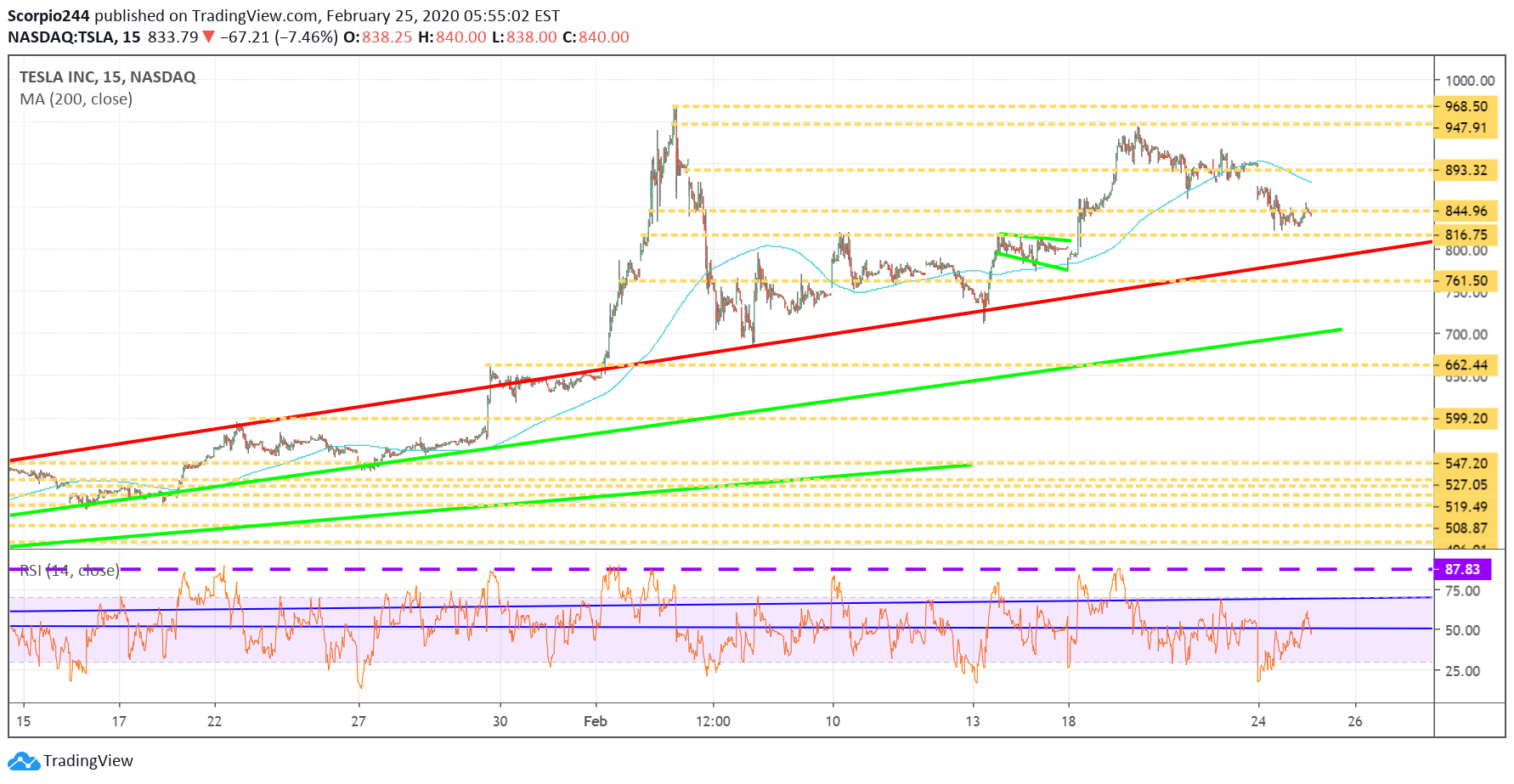

TESLA (TSLA)

Jefferies downgraded Tesla (NASDAQ:TSLA) today to Hold from Buy but raised its price target to $800 from $600. There appears to be a mild level of support in the stock in the $815 to $820 region, with a gap fill potential up to $900.

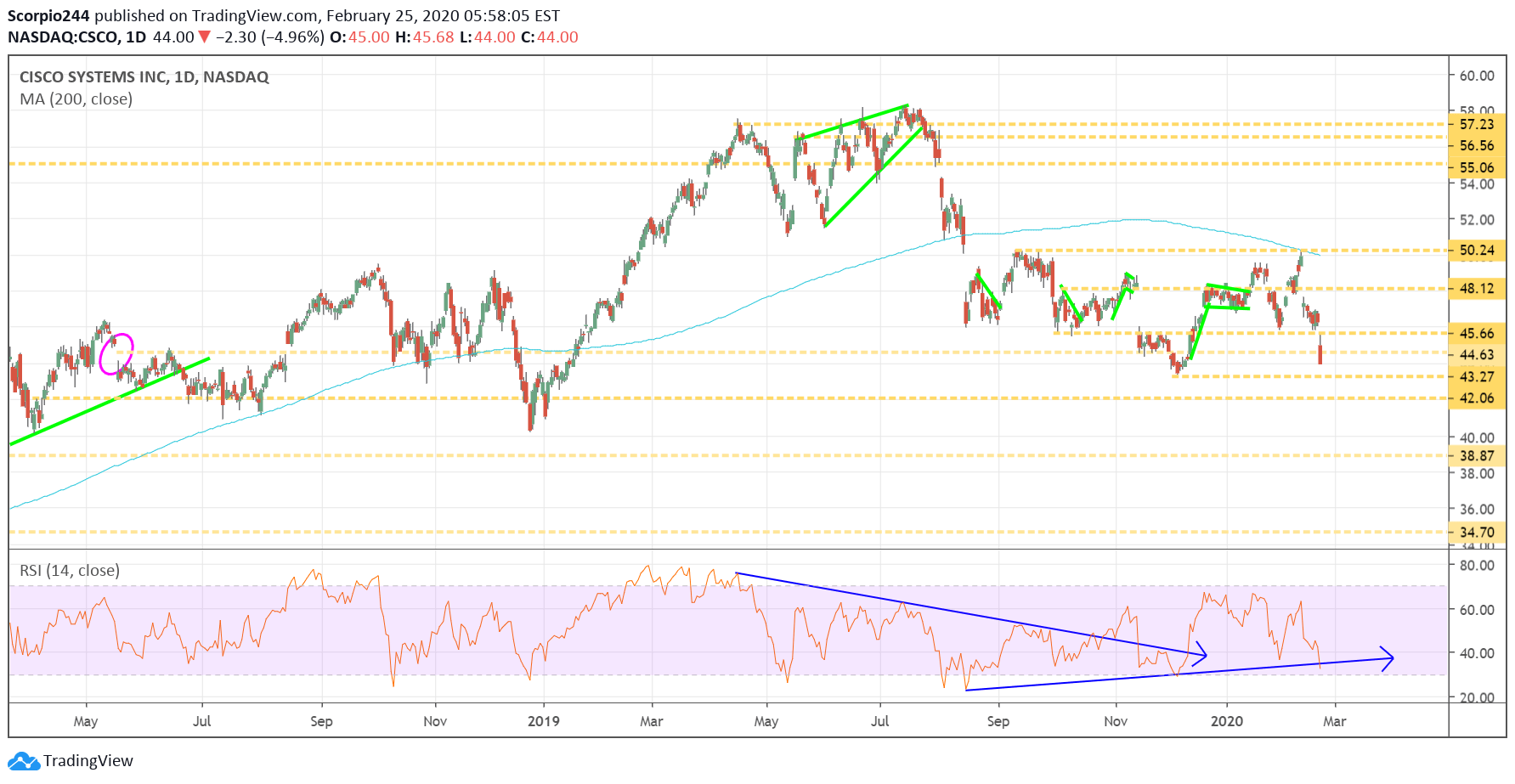

CISCO (CSCO)

Cisco (NASDAQ:CSCO) looks ok, not great. The stock has been struggling, and support at $43.25 needs to hold.