The fact is that the economy is kind of like a helium balloon. Its natural propensity is to float higher. Thus, it needs a strong opposing force to keep it down.

In terms of the stock market there are only two forces strong enough to beget a bear market:

- Recession

- Equity Bubble

Right now, there is no sound reason to worry about a recession. Even if one did seem to be emerging, it would finally put a nail in the coffin of high inflation that would allow the Federal Reserve to start cutting rates. That would be a catalyst to restart economic growth, leading to a quick turnaround in stock prices. As for an equity bubble...it’s not even worth wasting a moment longer contemplating that as we are far from that being the case.

So, with no reason to worry about a bear market...then we are left to talk about whether we have a mild, medium, or hot bull market on our hands.

To be fair, the hot phase has already happened given a greater than 50% rise from bear market bottom just 19 months ago. That is fairly typical new bull market behavior. At this stage, we are in a mild-to-medium bull market where annual gains for the main indices will come in closer to 10% per year.

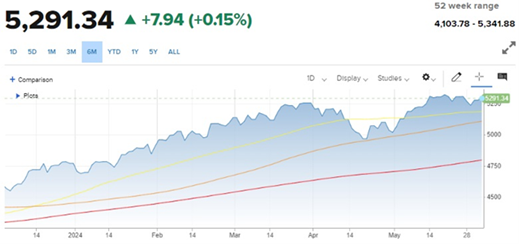

Shorter-term, we keep bumping up against the highs and don’t seem to get much higher. That’s because the long-awaited catalyst for further stock gains (Fed rate cuts) keeps not happening.

While we may need to wait all the way to the Fed meeting where the trigger is finally pulled, I liken this situation to a car idling at a red light. You know it will turn green soon enough...so you keep your eyes pointed ahead and ready to punch the gas pedal. This also means that any pullback or correction is likely to be relatively shallow and short lived.

The current top end is framed by the recent high of 5,341. Whereas 5,000 seems like pretty solid support on the downside...we may not need to slide that far with the 100-day creeping up on 5,100. That is a fairly standard-sized range to swash around in for the time being.

But once we have greater certainty on the timing of rate cuts, the more likely a bull run will start to press to the upper end of the range...and soon enough, a break to new highs will commence.

Back to the start of the conversation: We are in a bull market ‘til proven otherwise. Thus, best to be fully invested as the next bull run can start any time for any reason.