-

US stocks rally continues after Chairman Powell’s comments

-

French developments and ECB doves keep euro in check

-

China reacts to bond market rally, but real issues persist

-

Kiwi under pressure as RNBZ turns dovish

US Stocks Rally Despite Powell’s Lack of Dovish Shift

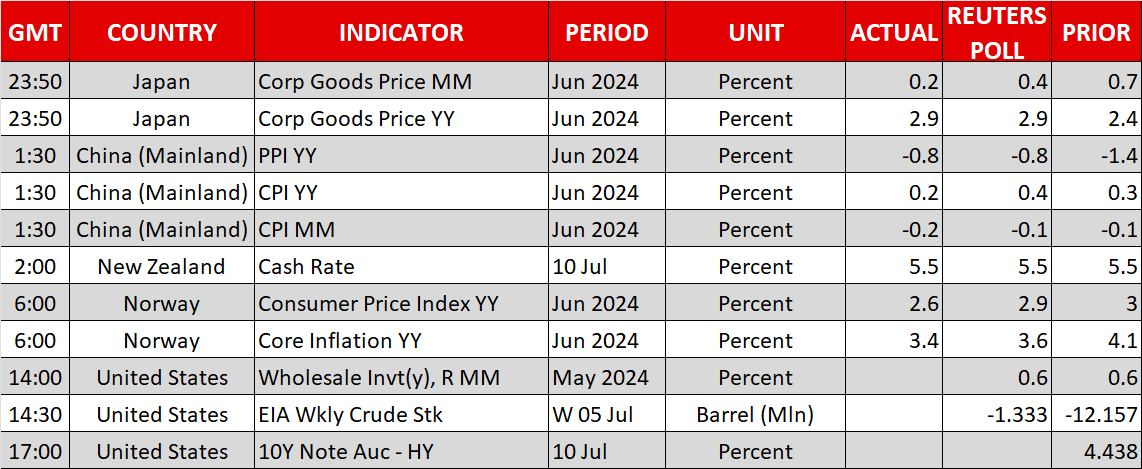

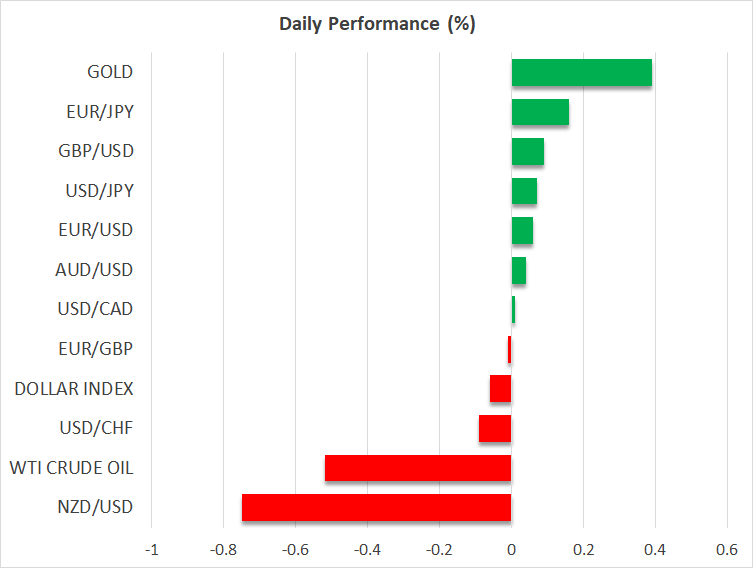

Fed Chairman Powell kept the cards close to his chest regarding the timing of the much-expected rate cut at yesterday’s Senate testimony, but he managed to satisfy the Fed doves by stating that considerable progress has been made towards the 2% inflation goal.

Despite expectations for a more dovish stance, following last week’s weak US labor market data, US stock indices managed to record new all-time highs. Barring a major surprise and after reflecting on the market's reaction, Powell will likely repeat his comments in today’s testimony at the House of Representatives. With the market already looking ahead to tomorrow’s CPI report, three Fed speakers will be on the wires today.

Bowman, Goolsbee, and Cook are unlikely to agree upon the next set of actions by the Fed as they belong to different camps, but the market will probably pay more attention to any dovish commentary.

Euro Survives the French Uncertainty

With the euro managing to maintain its recent gains against the US dollar, the behind-the-door discussions for the formation of the new French government continue. The current prime minister remains as a caretaker, predominantly to ensure that the 33rd Summer Olympic Games are hosted without major issues.

In the meantime, ECB doves continue to push for rate cuts. The ECB’s Panetta appeared confident that everything is progressing towards another rate reduction, while Centeno did not surprise by talking again about “a few more rate cuts this year” as growth is below potential.

The Bundesbank’s Nagel struck a more conciliatory tone, but his comment that “we don’t lower interest rates on autopilot” just confirmed that the battle for a September rate cut remains at large.

Nagel is scheduled to speak later today, and it would be interesting to hear any comments on the euro area wage rises jumping in June, according to one data source.

China’s Problems Multiply

China’s CPI and PPI managed to surprise on the downside today, with the latter pointing to some inflationary pressures down the line. However, the market is still digesting Monday’s announcement regarding the PBoC’s intention to use repos and reverse repos to manage liquidity.

This is a common way of managing liquidity in the banking system, but China’s problems are mostly economic and, more specifically, the ailing housing sector.

Interestingly, the third plenary session of the 20th Communist Party of China (CPC) Central Committee will be held on July 15–18. This session will most likely gain valuable press time as the market speculates that further support measures for the housing sector, on top of the May 2024 decisions, could be announced.

RBNZ Turns Dovish

The kiwi is on the back foot today against the dollar as the RBNZ managed to turn more dovish than most market participants expected. This is a significant shift from the May meeting, when the RBNZ kept the rate hike option on the table.

There was no press conference or projections published today, but it looks likely that a weak print at next week’s CPI report for the second quarter of 2024 could unlock a rate cut on August 14.

The market has quickly adjusted to the new conditions by pricing at a 60% probability for a summer rate cut, which will increase further if CPI surprises on the downside, and there will be a total easing of 47bps by year-end.