Since the 1987 Black Monday crash, within 30 years, we probably heard the word "Black Monday" more than 1000 times.

Obviously nothing is guaranteed in the market as much as nothing is guaranteed in life. No one can guarantee me that they won't get sick or get a car accident this winter. However, if I study years of your past life style I would have a good idea/probability of that possible outcome.

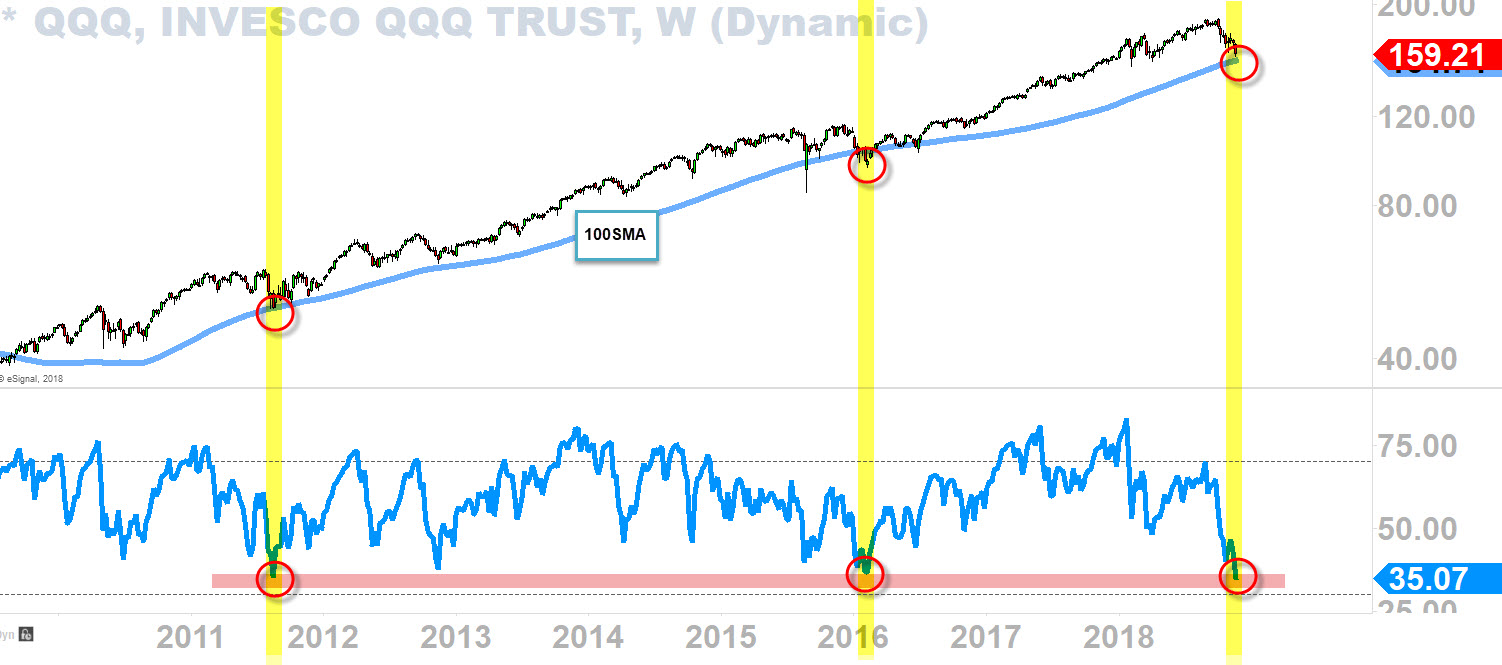

So, let's study last 10 years of NASDAQ's life here. You can see the moving average and the indicator I have depicted for this topic.

There were three occurrences (including today) where the indicator hit the oversold level. Just like today, 2011 and 2016 there were tremendous fear and uncertainty while many traders were calling for the major crash and probably threw around the word "Black Monday".

If someone would have told you back in 2011 that it was a buying opportunity, you wouldn't have believed in him/her. If someone would have told you back in 2016 it was a buying opportunity (I did back in May 2016 - here, here and here), you wouldn't have believe in him/her.

Because, think about it, if market was due for a major crash in 2011, then it's more so crash is coming in 2013. If crash was suppose to come in 2013, then for sure it's long over due for a crash in 2016.

It might not be tomorrow or next, but I believe the tide going to turn. Like 2011 and 2016, I look at this as a opportunity to accumulate more longs for the next bullish run that could last for the next few years.