European and US indices gained back some of the losses from the pain they have been feeling over the last few days, gaining solidly across the board with the Dow up 89.46 points or .7% and the S&P up 10.12 points or .74%. Investor fears were temporarily allayed as the ECB commented on buying more bonds which gave some underpinnings to the struggling region.

Oil was the big winner of the day with news of larger-than-expected drops in US inventories gaining $1.70 to close at $102.54 on the day. Gold and silver trotted in place holding around closing levels yesterday. It should be noted the PBOC has been scooping up gold out of Hong Kong rising almost 13 fold as reports for imports to China out of Hong Kong shows 40 metric tons or 40,000 Kilos of bullion in February, alone. This should support the shiny metal on dips as it looks like the Chinese are happy to scoop up at these prices.

The euro was mostly range-bound which is interesting considering the positive comments about the ECB bond buying program as an option if needed. The lack of major support for the pair after the positive comments tells us the market is not excited about buying euros. Keep in mind how big a threat Spain is to Europe. To list a few facts:

We also have a slew of economic announcements out tomorrow and Friday so expect volatility to be strong to close the week.

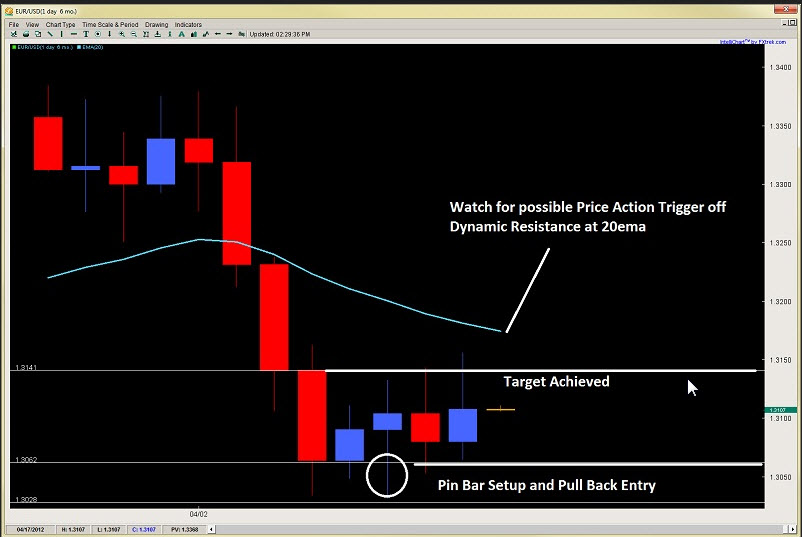

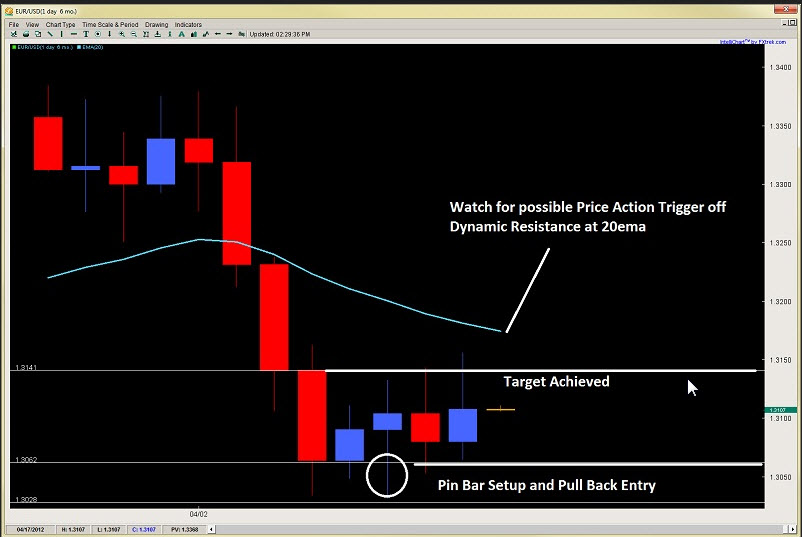

EURUSD – Pin Bar Setup Plays Out, Now Have Bear Flag Pattern

The EUR/USD price action pin bar reversal that we talked about on Monday played out giving us a good pullback entry at the 1.3062 level with a stop about 35 pips below and a target of 80 pips, giving over a 2:1 R:R play which many of our price action traders got in on.

Now the market has formed a bear flag pattern which suggests likely downside continuation. The upside wicks over the last two candles further intimate this point as the bears are continually hemming in the downside looking to sell on rallies. We like waiting for a pullback to the dynamic resistance and the 20ema above looking for a possible price action trigger to get short for another move down to 1.3030 lows and a possible break of the big figure at 1.3000.

Oil was the big winner of the day with news of larger-than-expected drops in US inventories gaining $1.70 to close at $102.54 on the day. Gold and silver trotted in place holding around closing levels yesterday. It should be noted the PBOC has been scooping up gold out of Hong Kong rising almost 13 fold as reports for imports to China out of Hong Kong shows 40 metric tons or 40,000 Kilos of bullion in February, alone. This should support the shiny metal on dips as it looks like the Chinese are happy to scoop up at these prices.

The euro was mostly range-bound which is interesting considering the positive comments about the ECB bond buying program as an option if needed. The lack of major support for the pair after the positive comments tells us the market is not excited about buying euros. Keep in mind how big a threat Spain is to Europe. To list a few facts:

- Spain’s Index is down 10% since January 1st.

- Spanish Bonds are close to yielding 6%.

- Spain’s 3 largest banks are nearly 2x as big as Spain’s entire economy (how this happened, we have no idea but think Too Big To Fail and you get the idea how important they are to the economy).

- Spain’s economy is about 5x larger than Greece.

- Spain’s unemployment rate is 23%, worse than Mozambique, Micronesia and Equatorial New Guinea.

- There are about as many unemployed in Spain as there are total employees in Greece.

- And lastly (here is the kicker), Spanish housing prices are falling massively, down almost 14% in the last year. If they fall further, the banks will need capital as they are the ones holding the mortgages and nobody knows where the money to support Spain would come from.

We also have a slew of economic announcements out tomorrow and Friday so expect volatility to be strong to close the week.

EURUSD – Pin Bar Setup Plays Out, Now Have Bear Flag Pattern

The EUR/USD price action pin bar reversal that we talked about on Monday played out giving us a good pullback entry at the 1.3062 level with a stop about 35 pips below and a target of 80 pips, giving over a 2:1 R:R play which many of our price action traders got in on.

Now the market has formed a bear flag pattern which suggests likely downside continuation. The upside wicks over the last two candles further intimate this point as the bears are continually hemming in the downside looking to sell on rallies. We like waiting for a pullback to the dynamic resistance and the 20ema above looking for a possible price action trigger to get short for another move down to 1.3030 lows and a possible break of the big figure at 1.3000.