- Equities start week on the backfoot amid uncertainties; can Powell change the mood?

- China steps up effort to boost economy but Asian stocks unimpressed

- Pound shines ahead of BoE decision, SNB coming up too, dollar crawls off lows

Cautious tone as Fed doubts take over

Another busy week has gotten underway as markets are hoping to decipher more about the Fed policy path from Chair Jerome Powell’s Congressional hearings than they did from last week’s meeting. Powell is due to address both chambers of Congress on Wednesday and Thursday in his semi-annual testimony just a week after the Fed skipped a rate hike for the first time in 10 meetings.

The pause was initially greeted with euphoria on Wall Street and the US dollar came under heavy selling pressure in forex markets, but doubts are now starting to creep in. It comes after a slew of Fed speakers on Friday kept the door wide open for further rate hikes.

Most notably, Governor Waller warned that “some more tightening” will probably be required as “inflation is just not moving”.

The comments bolstered expectations that the July meeting will be a ‘live’ one, although most investors are betting on either September or November for one final hike, while the first cut has been pushed back to January 2024.

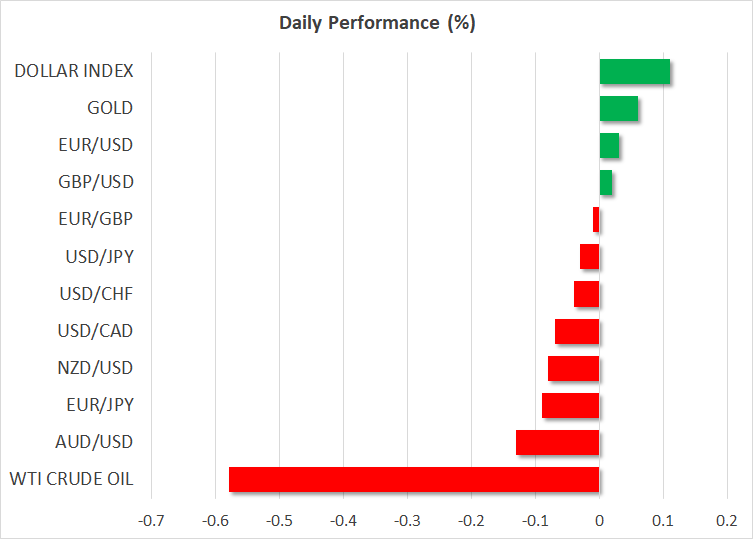

The repricing in Fed fund futures gave the greenback a modest leg up but US stocks ended Friday in the red. US markets are closed today in celebration of Juneteenth, with futures trading flat.

Euro and pound on the front foot despite stalled rallies

The euro and pound both surged last week as the European Central Bank raised rates by 25 basis points and flagged there’s more to come, while the Bank of England is expected to do the same on Thursday when it announces its decision. But even though their rally appears to have lost steam after the hawkish Fed speak, both currencies are holding firm as the ECB’s and BoE’s policy paths are clearer in the near term than the Fed’s.

The Bank of England in particular probably has the most ground to cover still amid more rampant inflation than in other countries and the ongoing resilience of the UK economy. The pound is trading above the $1.28 level for the first time since April 2022, while the euro is back above $1.09.

Heading into Thursday’s meeting, the risks for sterling are symmetrical as the BoE could surprise with a 50-bps hike, but it could also signal that it is nearing the end of its tightening cycle.

Aussie, Asian stocks weighed by China disappointment

The Australian dollar, which is the best performing currency in June, was having a somewhat tougher day on Monday as concerns about China’s economic prospects resurfaced. With many economists lowering their 2023 forecasts for GDP growth in China, the response from Beijing has so far been a half-hearted attempt to boost the economy.

The country’s central bank is widely anticipated to lower its one- and five-year loan prime rates tomorrow by 10 basis points, following similar cuts to its other lending rates in recent days. But markets are not convinced that the policy easing is sufficient enough to kick-start growth.

Investors were also disappointed that a cabinet meeting held by the State Council on Friday did not produce any decisive steps on how to tackle the slowdown. Whilst there were a lot of reassuring words, officials stopped short of announcing any new measures.

It seems that any stimulus will likely be targeted at specific sectors, such as property, and there’s no desire to bring out the big guns, at least not yet.

In a somewhat more encouraging development, US Secretary of State Antony Blinken held talks in Beijing with his counterpart in what was a postponed meeting, signalling the first significant thawing of relations between the two countries in a very long time.

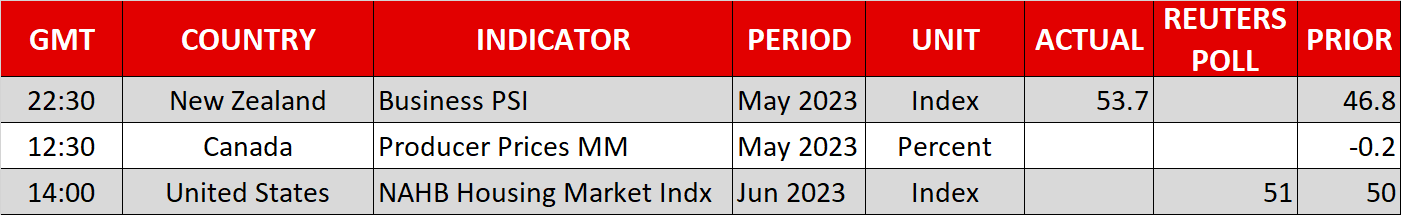

Nevertheless, Asian markets were unimpressed by all the headlines and most major indices closed in negative territory on Monday, marking a sense of caution ahead of all the other events, which include a policy decision by the Swiss National Bank on Thursday and PMI indicators at the end of the week.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI