- Surging US retail sales dampen Fed rate cut expectations

- Wall Street sinks, dollar scales fresh highs as yields jump

- China GDP beat offers only tepid support as March data disappoints

- Yen continues to tumble, risk of intervention grows

The problem with a hot economy

As markets awaited Israel’s response to Iran’s missile and drone assault over the weekend, Fed rate cut expectations took centre stage again. Specifically, it is the latest narrative of US exceptionalism that is unsettling markets as the still hot economy is wreaking havoc on rate cut hopes.

Retail sales in America surged by 0.7% month-on-month in March, handily beating forecasts of 0.3%, while the prior month’s figure was revised up in yesterday’s report.

The Fed’s Daly was the first to respond to the latest upbeat readings, warning against acting urgently to cut rates. The focus on Tuesday will be on the Fed Chair as Powell is scheduled to speak at 17:15 GMT.

Rate cut bets have been sharply scaled back in recent weeks and have even fallen below the Fed’s dot plot projection of three rate cuts. The latest pricing in Fed fund futures points to less than two cuts in 2024, with the first not anticipated before September.

Dollar stands tall as Wall Street wobbles

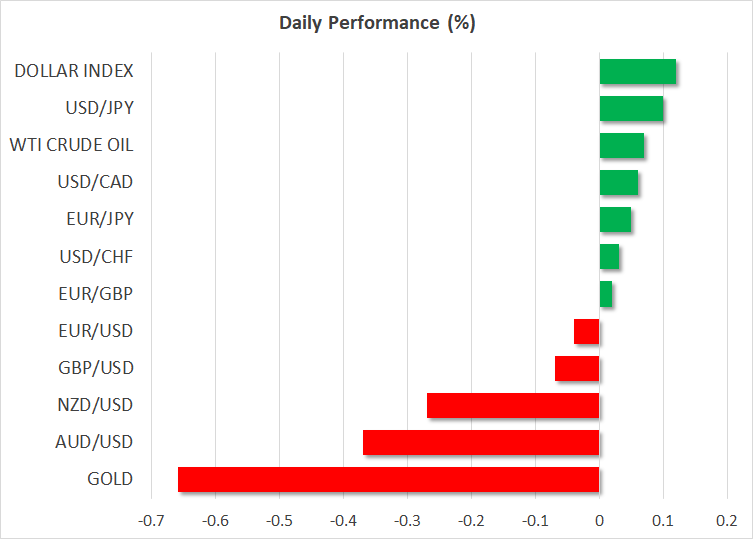

The US dollar climbed to fresh five-and-a-half-month highs against a basket of currencies on the back of the strong retail sales numbers, extending its gains today.

Equities and bonds were sold off, with the 10-year Treasury yield surpassing 4.60%, while Wall Street’s main indices slid by between 0.65% and 1.65%.

Having until recently resisted the significant repricing of Fed rate cut expectations, the bull market in US stocks is finally showing signs of stress, and with the earnings season getting off to a mixed start, there’s not much support at the moment.

The earnings spotlight on Tuesday will fall on Morgan Stanley and Bank of America.

China’s GDP data fails to impress

The selloff in equities has broadened to Asia and Europe today, with investors fretting not just about the prospect of only modest rate cuts in the US, but also about China’s struggling economy.

Chinese economic growth accelerated slightly to 5.3% y/y in the first three months of the year, but figures for March cast doubt about future growth as industrial output and retail sales slowed sharply.

Gold pulls back as yen on intervention watch

The strong greenback, meanwhile, weighed on gold prices. With tensions in the Middle East elevated and the situation likely remaining extremely fragile for some time, a stronger US currency will probably only go so far in holding the precious metal back.

A safe haven that has failed to benefit at all from the recent geopolitical risks is the Japanese yen, even as Israel looks sure to respond in some manner to Iran’s attack. The yen continues to fall to fresh 34-year lows against the dollar, breaching the 154 level, as investors don’t see Japanese yields catching up with US yields anytime soon.

The threat of intervention grows, however, the closer the dollar gets to 155 yen. But so far, there have been no clear signs of imminent action from Japanese government officials.