US markets sold off sharply overnight as they wiped out all gains and then some, from the day before. The Federal Reserve has opted to continue reducing its massive QE program at this month’s meeting as many expected.

The FOMC decided to slash its QE by another $10 billon per month to $65 billion in both treasury and mortgage backed securities purchases. They did this even though there is some distress in both domestic equity markets and turmoil in the emerging markets. This shows us the Fed has domestic policy firmly within their sites. Unless a marge larger scale crisis forms, expect the end of QE. There is a possibility the Fed will increase the size of the reductions by the summer months in order to end QE by the fall. All this depends on the economy.

Asian markets are currently being rocked by both the Fed decision and a poor PMI reading from China. The HSBC PMI has hit a six month low coming in at 49.5, down from last week’s estimate of 49.6

STOCKS

Overnight the Dow Jones Industrial Average sold off at open down 273 points. The DJIA finished 189.77 points lower at 15,738.79. We are in the middle of a five percent correction. The S&P 500 lost 18.30 points to close at 1,774.20. Consumer staples sector led losses. The Tech heavy NASDAQ Composite lost 46.53 points to finish the day at 4,051.43.

Volume was heavy as 736 million shares traded on the NYSE. Nearly 4 billion shares traded on the composite. For ever stock that rose on the NYSE 3 fell.

In Asia, the Nikkei was down as much as 3.3 percent at one point. The Japanese Benchmark is currently down 2.60 percent and below 15,000. This is a brand new 2 ½ month low as investors are reacting to a stronger yen, which is rising as a safe haven and a December retail sails that came in at 2.6 percent. It missed estimates but was up for the fifth month in a row.

The Shanghai Composite is down nearly 0.5 percent as a poor PMI in China is weighing on sentiment. The Australian benchmark was down one percent at one point trading near Monday’s one and a half month low.

Emerging markets are being hit hard this morning as the Philippine’s benchmark is down one percent near the four year low set Monday. This comes despite the GDP growing at 7.2 percent in 2013. In Indonesia, the Jakarta Composite is down 1.3 percent.

CURRENCIES

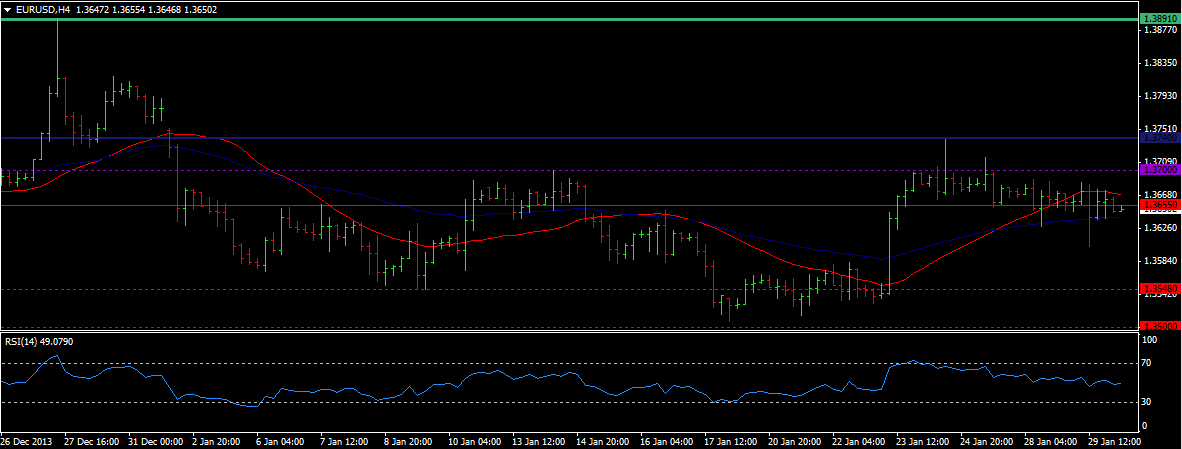

EUR/USD (1.3649) had no reaction to the Fed announcement. We are still hovering around this resistance level. We need to break above 1.3750 for a rally or risk the bears sending the market lower again.

USD/JPY (102.509) tested support at 101.60 then moved back higher again to resistance near 102.80. For any rally to occur, we need to break above 103.70. GBP/USD (1.6561) is trading sideways near resistance. The range is a tight pattern from 1.6355 to 1.67 and will continue for some time. We need a break either way for a better picture.

COMMODITIES

Gold (1262.20) recovered from support and is back above 1250. We could now test 1270/1273. However, we cannot rule out a dip back to 1250. Silver (19.515) is stable right now. We are range bound from 19.05 to 19.20. A break above 19.20 tests 20.50. Copper (3.232) has fallen further after the weak China PMI reading. We are near support at 3.20. If it holds we could bounce back to 3.25. We remain bearish here.

TODAY’S OUTLOOK

Will the equities selloff continue? Investors have gotten their 5 percent correction in US equities, is it enough or are we going to see a bear market set in? There are obviously some issues regarding the global economic recovery as the situation in China is worsening. The US will release some data today as well. At 8:30 EST we get jobless claims (initial), real Q4 GDP as well. Pending Home Sales come in at 10:00 EST.