After Monday’s plunge, stocks staged a rebound on Trump’s stimulus promises. While the bulls closed higher than the market opened on Monday, was it a resounding show of their strength?

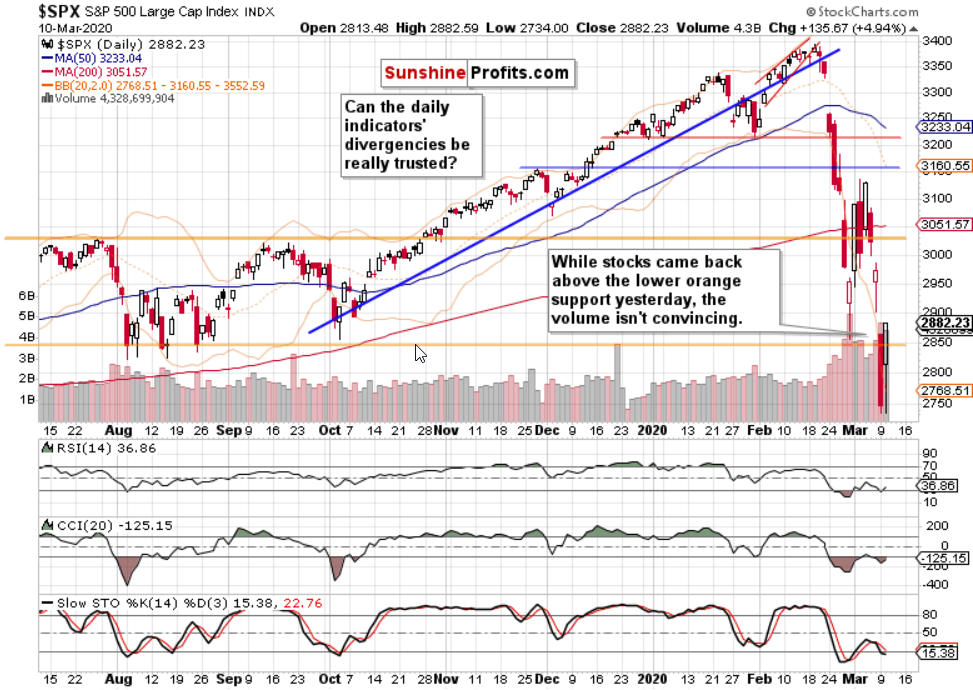

Let’s jump right into the daily chart to find out (chart courtesy of stockcharts.com).

In short, we doubt that it revealed buyers’ strength. As the traders say, even dead cats bounce. The bulls didn’t even manage to challenge the sizable Monday’s gap. Also, the volume on the upswing was lower than that of the preceding downswing, raising further doubts about the bulls’ strength.

In light of the above, we’re of the opinion that the daily indicators’ divergencies can’t be trusted and that the indicators will head to new lows instead. As a result, our open short and around 60 points in the black position remains justified. New 2020 lows are very likely ahead of us – that’s a pretty safe bet to make as the S&P 500 futures are trading at around 2770 currently.

Due to the sizable volatility, we have to work with wide enough stop-losses and initial downside targets. In these times, we’ll be better off managing the open position accordingly. As we have written yesterday, remember that you can adjust your position sizing if the short position would mean risking a higher trading account percentage than you’re comfortable with.

Summing Up

Yesterday’s upswing fueled by the contemplated stimulus, isn’t really convincing, and both the weekly and daily charts keep sending bearish messages. The downswing appears likely to have further to go on the downside before the market regains confidence in a lasting turnaround. Therefore, keeping open the profitable short positions is justified.