Anyway, at this point, the market continues grinding higher. It is making my belief of a pullback seem less likely at this point, or the very least being wrong. But it may be too early to admit defeat; we will have to wait to see what the next day or two bring.

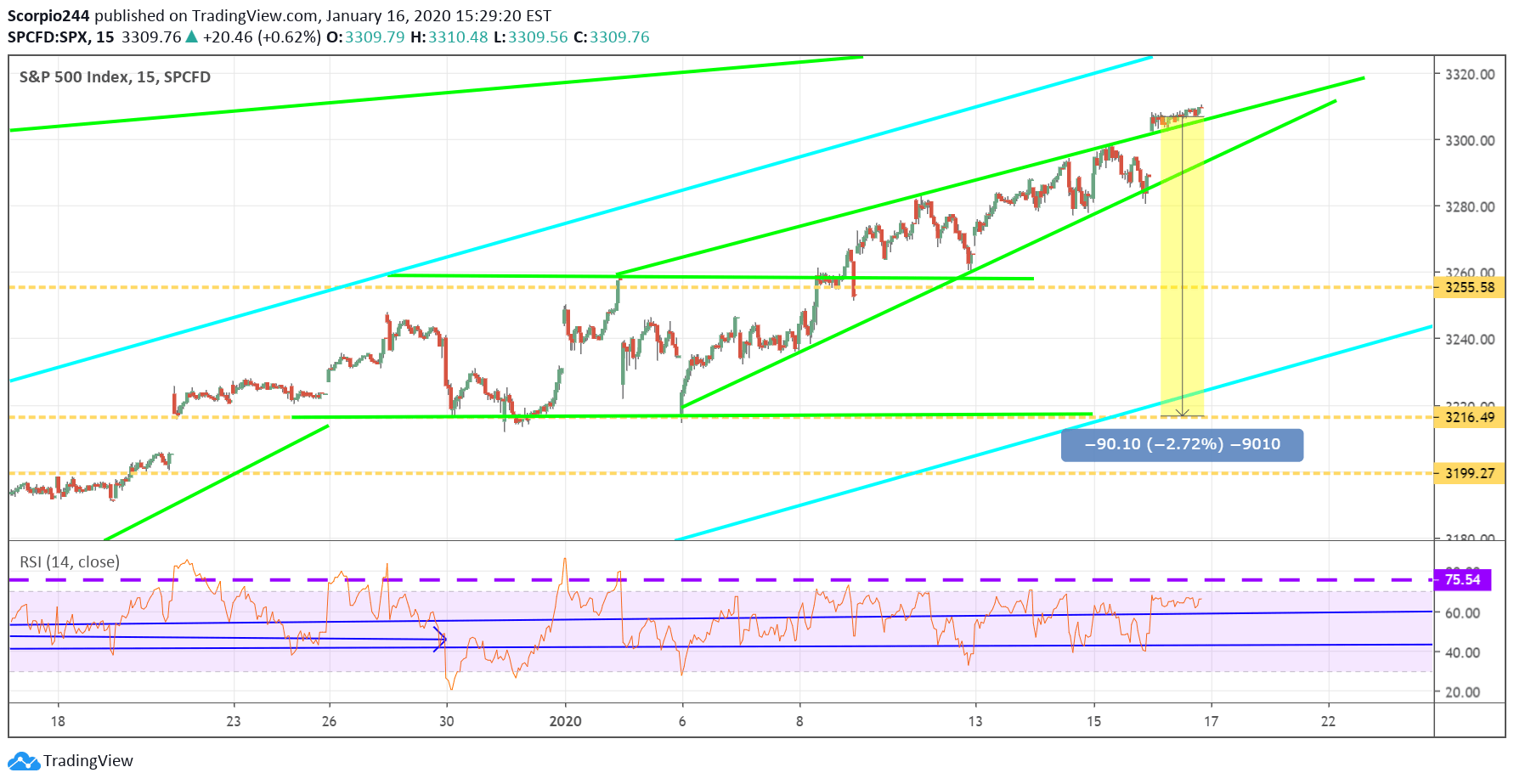

The chart shows the rising wedge I drew in; it also indicates that the index trading higher slightly above the uptrend line. There is also now a gap that needs to be filled at lower levels around 3,290.

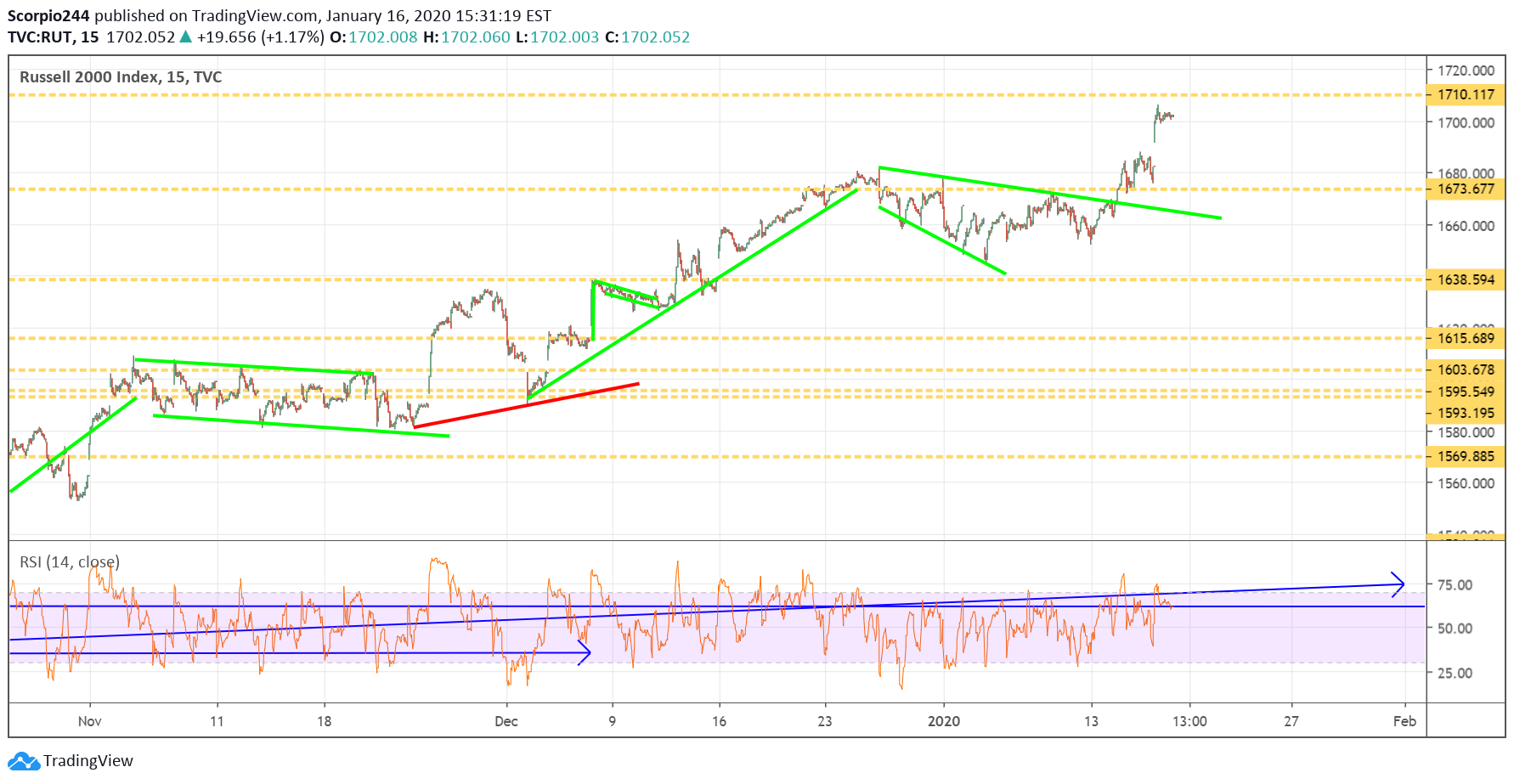

Russell 2000

The Russell also made a new 52-week high today rising just above 1700. This is a region of resistance for the index in the 1,700 to 1,710 area. We can see there is a gap to fill in the Russell back around the 1680 level.

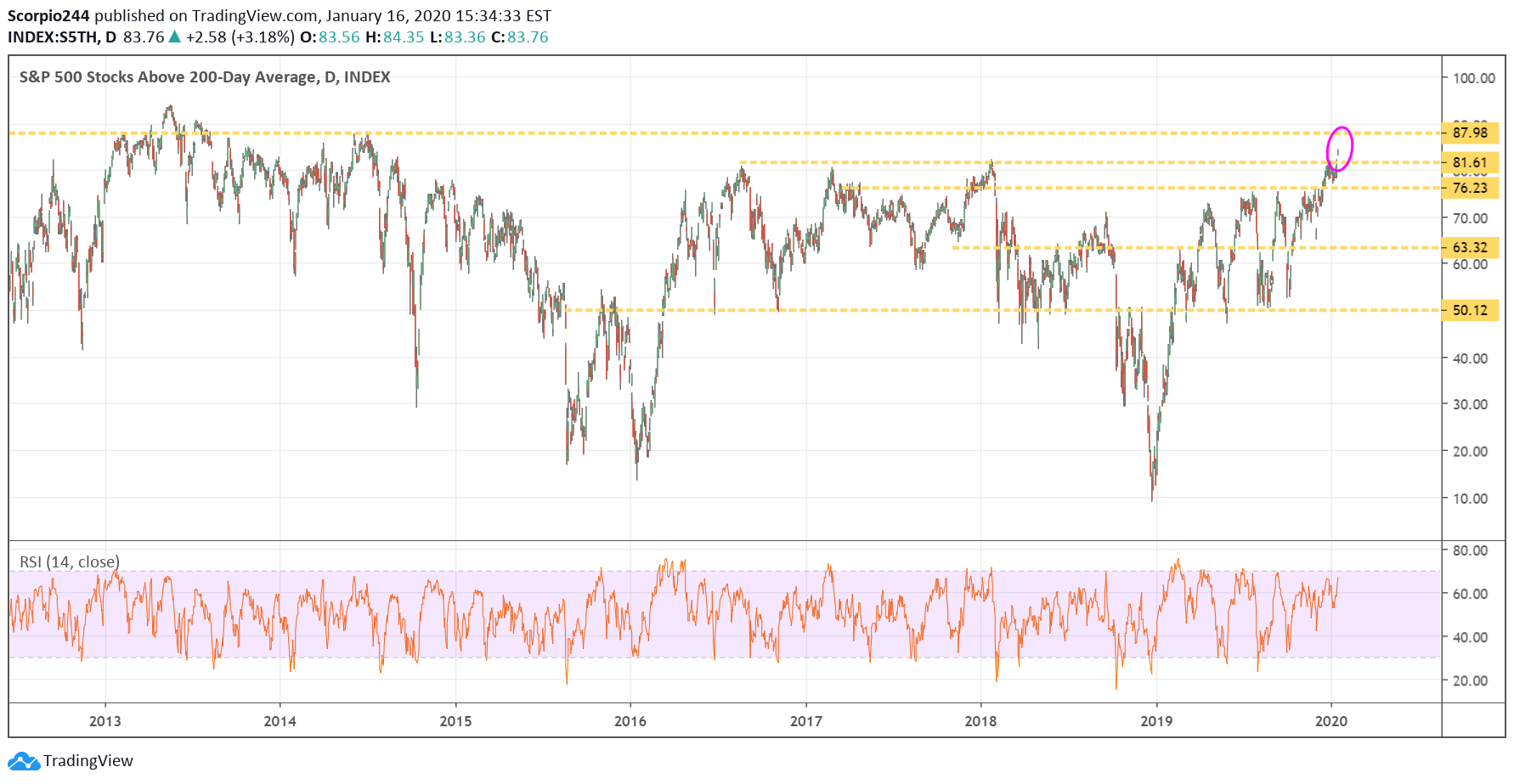

200 Day Moving Average

Additionally, one would have to go back to 2014, to find the last time the there were this many numbers of stocks above their 200 days moving average.

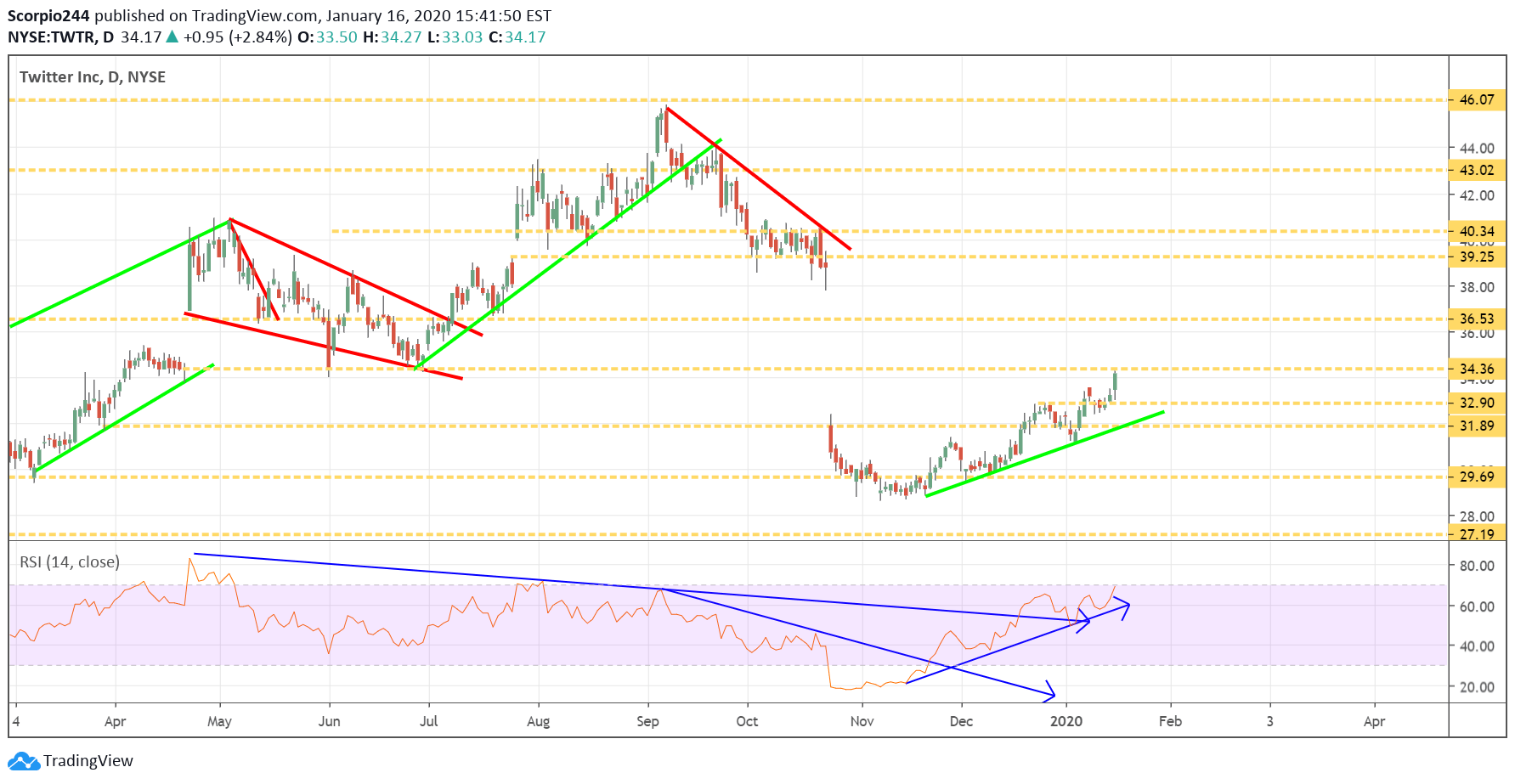

Twitter (TWTR)

Twitter is moving higher to resistance; this is a stock I was bullish on, then I turned bearish on. I should have just stuck with my original thought of the stock rising.

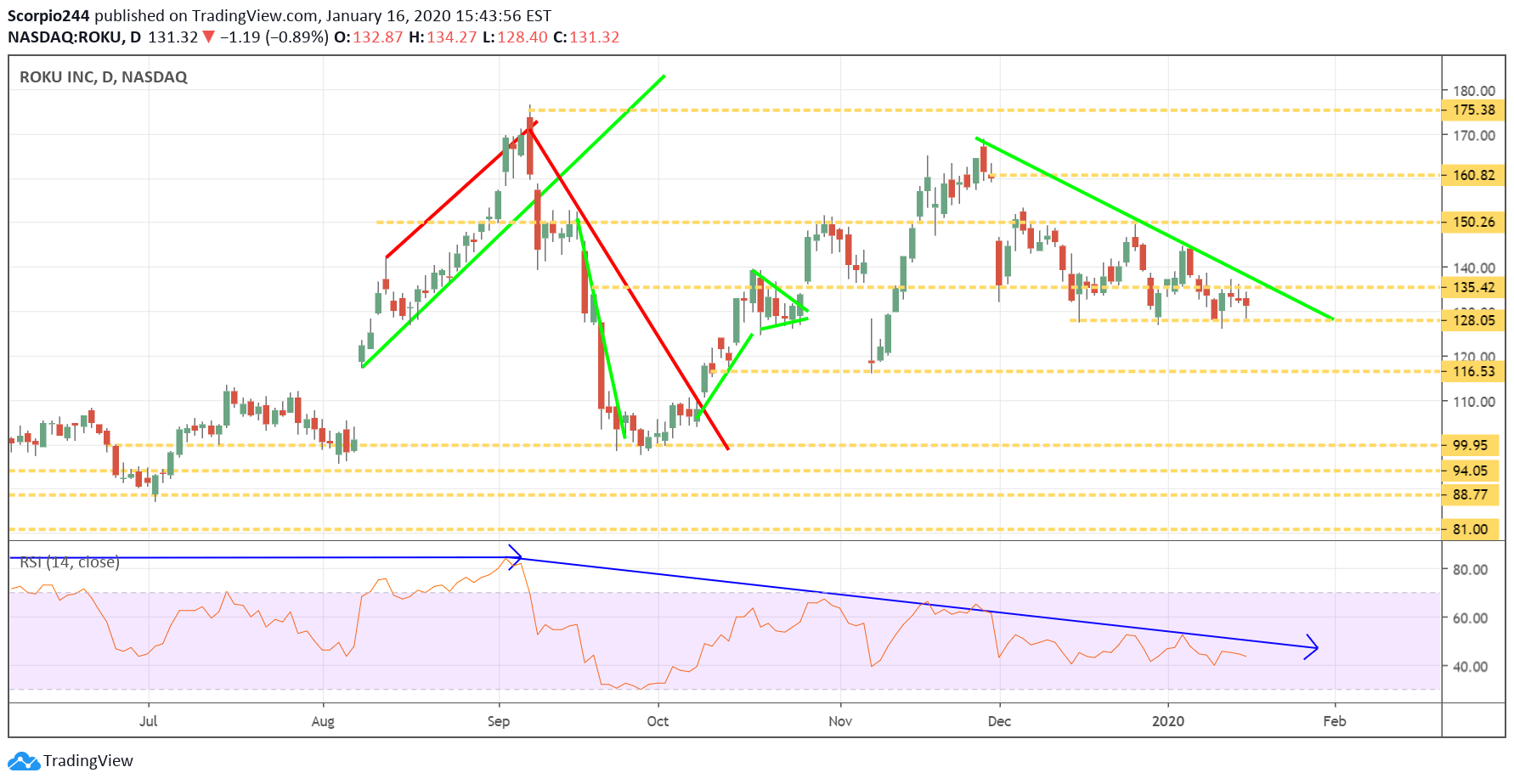

Roku (ROKU)

Here is another stock I always seem to struggle with, Roku. The stock is at support once again at $128, and still, it manages to hold.

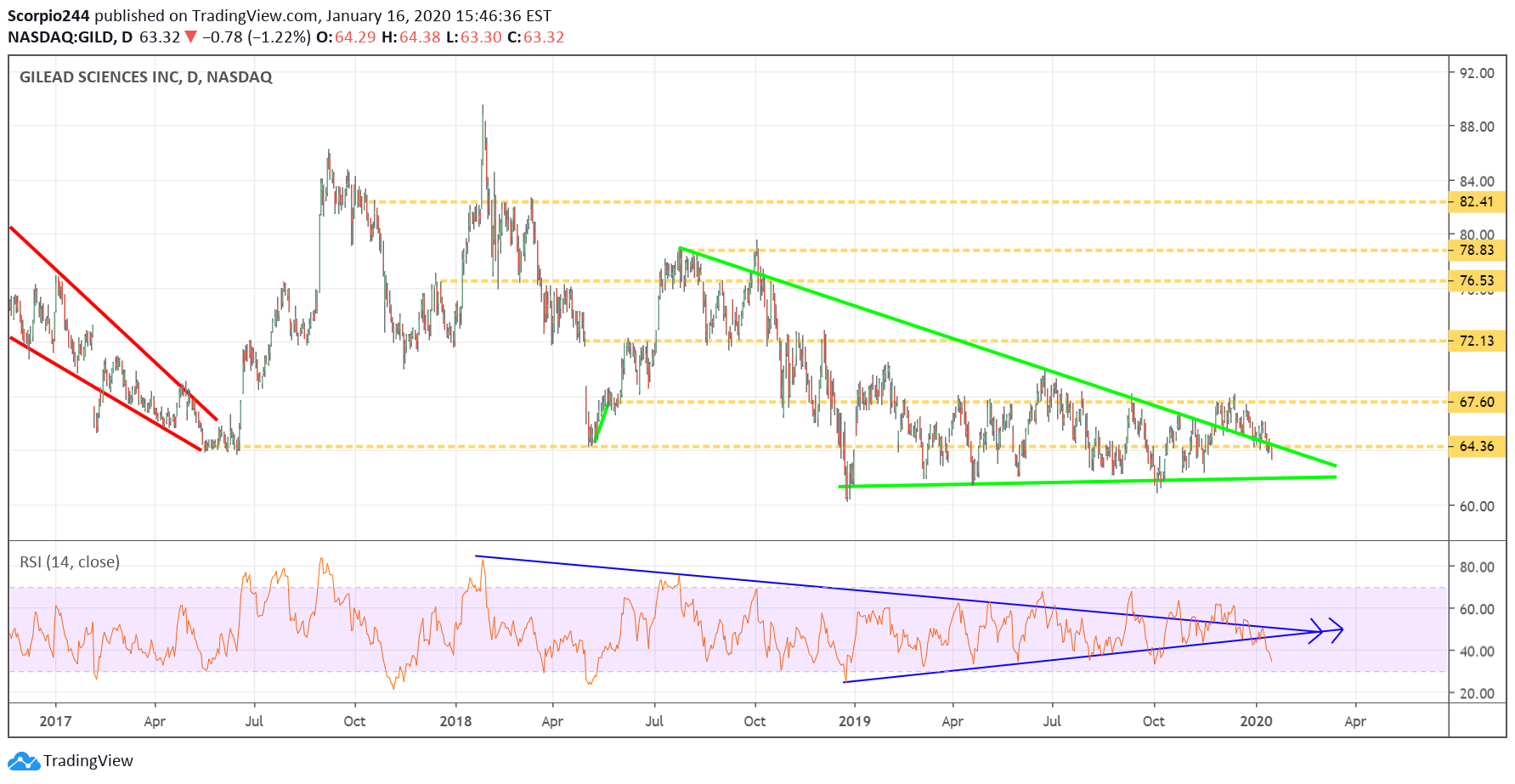

Gilead (NASDAQ:GILD)

Since we are the topic of stocks I can’t get right, we might as well keep going. Today it is Gilead (NASDAQ:GILD), first I thought the stock was going lower, then I thought the stock was breaking out, now it is going the other way. It needs to hold support at $61.88.

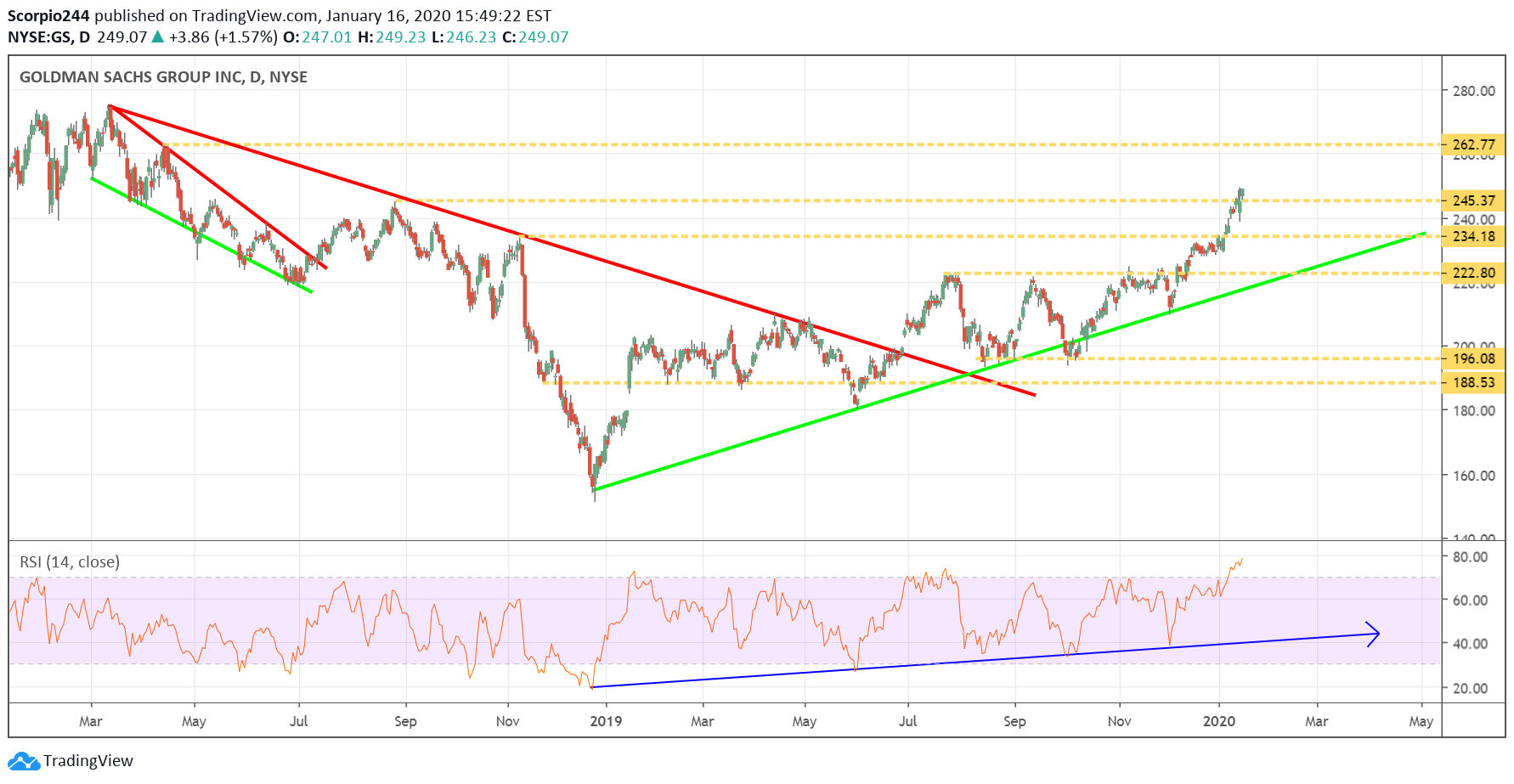

Goldman (GS)

I am moving on. Goldman looks like it breaking out, rising above resistance, and the potential to push higher towards $263.

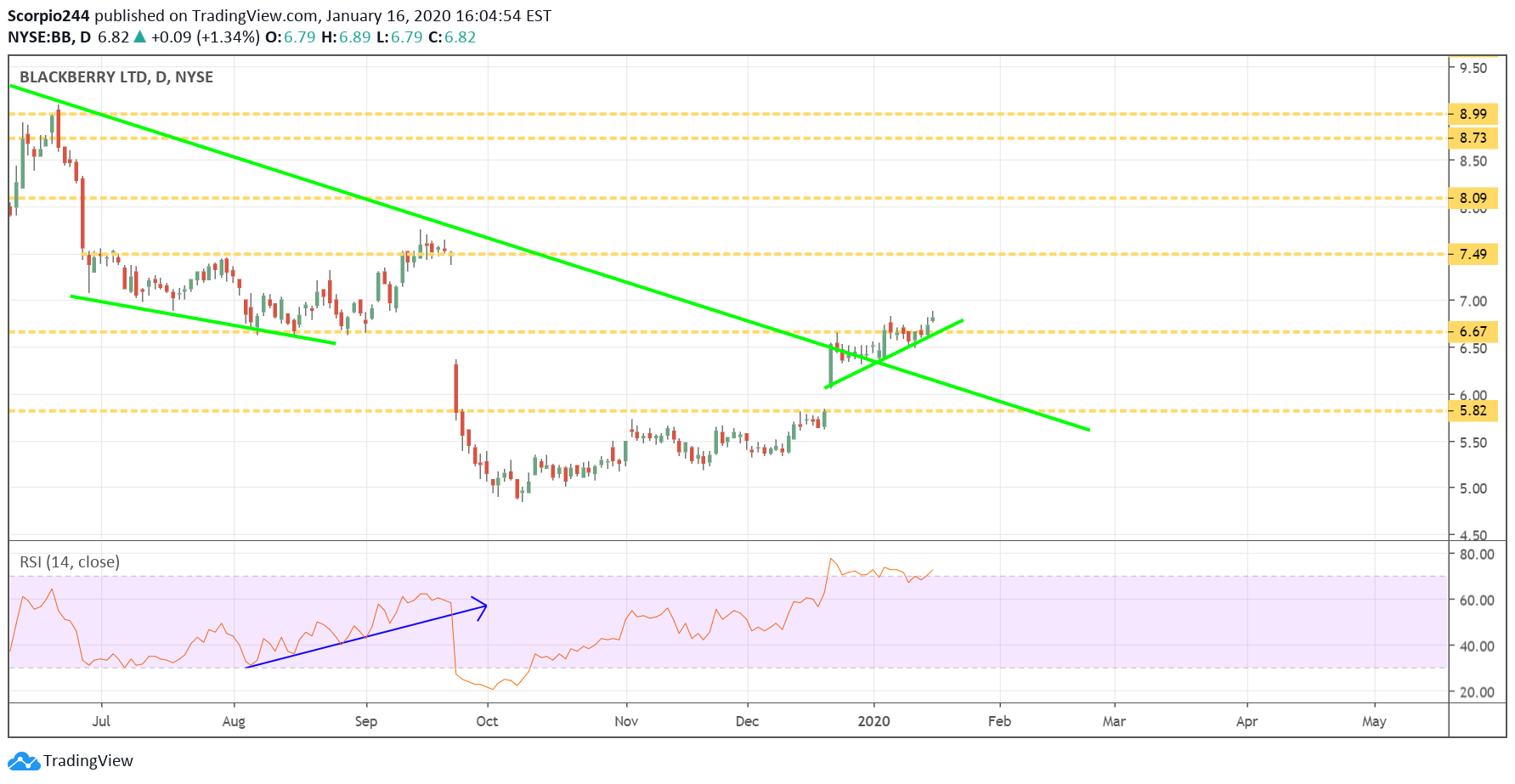

Blackberry (TSX:BB)

Here is one that had a good day, with Blackberry (TSX:BB) rising above a resistance level at $6.70, another good day tomorrow, we could result in the process of that gap fill up to $7.50.