Equities

Asian markets rose on Tuesday, despite Monday’s weak retail sales data from the US, amid hopes that the weak data would encourage new easing measures. The Nikkei rose .4% to 8755, the Kospi edged up .2% to 1822, and the ASX 200 jumped .9% to 4141. In greater China, the Hang Seng surged 1.8% to 19455, led by insurers, and the Shanghai Composite bounced .6% to 2161 after Monday’s steep slide.

European stocks ended mixed, as the FTSE sank ,6%, the CAC40 eased .1%, while the DAX rose .2%. Alacatel-Lucent shares plunged 19% after warning it would not meet its profit forecast. Nokia shares tumbled 6.1% as investors anticipate a weak earnings report, which is due on Thursday.

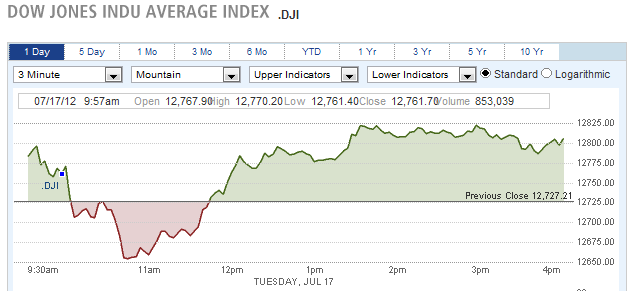

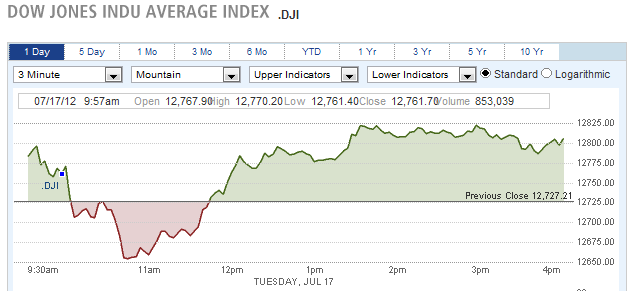

US stocks gained, erasing early losses. The Dow advanced 78 points to 12806, the Nasdaq rose .5% to 2910, and the S&P 500 climbed .7% to 1364. In his testimony to Congress, Bernanke once again failed to deliver any new easing policies, but indicated that uncertainty is increasing.

Mattel (NASDAQ:MAT) jumped 9.7% after earnings beat forecasts, and Citigroup (NYSE:C) rallied 2.1% after its profits exceeded expectations.

Currencies

The Australian dollar rallied .7% to 1.0317, as the dollar traded mostly lower against global currencies. The euro and Swiss franc edged up .2% to 1.2298 and .9770 respectively. The pound inched up .1% to 1.5656. Japanese officials warned they may intervene in the currency markets, lifting the yen .3% to 79.08.

Economic Outlook

CPI data was in line with forecasts at 0%, and industrial production rose .4%, meeting forecasts. The NAHB housing market index rose to 35 from 29, versus forecasts for a reading of 30.

Asian markets rose on Tuesday, despite Monday’s weak retail sales data from the US, amid hopes that the weak data would encourage new easing measures. The Nikkei rose .4% to 8755, the Kospi edged up .2% to 1822, and the ASX 200 jumped .9% to 4141. In greater China, the Hang Seng surged 1.8% to 19455, led by insurers, and the Shanghai Composite bounced .6% to 2161 after Monday’s steep slide.

European stocks ended mixed, as the FTSE sank ,6%, the CAC40 eased .1%, while the DAX rose .2%. Alacatel-Lucent shares plunged 19% after warning it would not meet its profit forecast. Nokia shares tumbled 6.1% as investors anticipate a weak earnings report, which is due on Thursday.

US stocks gained, erasing early losses. The Dow advanced 78 points to 12806, the Nasdaq rose .5% to 2910, and the S&P 500 climbed .7% to 1364. In his testimony to Congress, Bernanke once again failed to deliver any new easing policies, but indicated that uncertainty is increasing.

Mattel (NASDAQ:MAT) jumped 9.7% after earnings beat forecasts, and Citigroup (NYSE:C) rallied 2.1% after its profits exceeded expectations.

Currencies

The Australian dollar rallied .7% to 1.0317, as the dollar traded mostly lower against global currencies. The euro and Swiss franc edged up .2% to 1.2298 and .9770 respectively. The pound inched up .1% to 1.5656. Japanese officials warned they may intervene in the currency markets, lifting the yen .3% to 79.08.

Economic Outlook

CPI data was in line with forecasts at 0%, and industrial production rose .4%, meeting forecasts. The NAHB housing market index rose to 35 from 29, versus forecasts for a reading of 30.