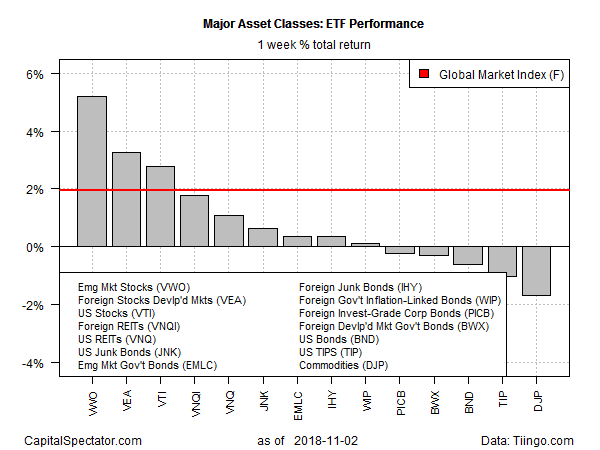

Led by equities in emerging markets, stocks around the world rebounded last week, based on a set of exchange-traded products that represent the major asset classes. The positive results for equities follows a wave of selling in the previous week for global stock markets. Meanwhile, last week’s big losers: broadly defined commodities and investment-grade bonds in the US.

Vanguard FTSE Emerging Markets (NYSE:VWO) topped the winner’s list for the trading week through Friday, Nov. 2. VWO posted a strong 5.2% gain – the first weekly increase for the ETF in six weeks.

The biggest setback last week for the major asset classes was posted for broadly defined commodities. The iPath Bloomberg Commodity Total Return Exp 12 June 2036 (NYSE:DJP) tumbled 4.3%, the fourth straight weekly loss for the exchange-traded note.

Last week’s positive bias for stocks helped lift an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights logged its first weekly gain since mid-September via a 1.9% return.

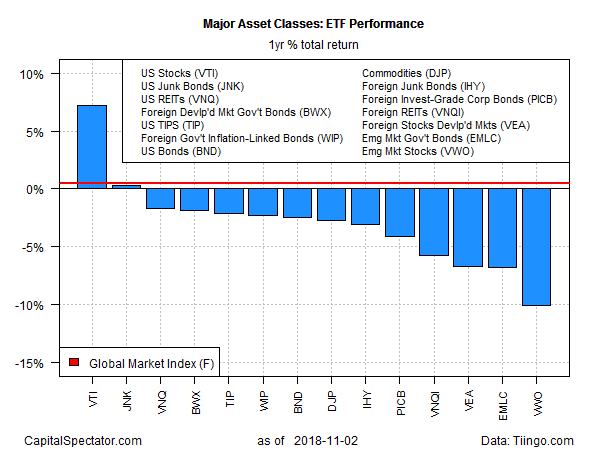

For the one-year trend, only US stocks and US junk bonds are posting gains, as of last week’s close.

Vanguard Total Stock Market (NYSE:VTI) is up 7.3% on a total-return basis for the year through Nov. 2. US junk bonds posted the second-strongest return for the 12-month change. SPDR Bloomberg Barclays (LON:BARC) High Yield Bond (JNK) is up a slight 0.3% for the one-year change after factoring in distributions.

The rest of the major asset classes are nursing losses for the trailing one-year change. The biggest setback is for emerging-markets stocks. VWO is down 10.1% as of Friday’s close vs. the year-earlier level.

GMI.F moved back into positive territory (just slightly) last week for the one-year change. The benchmark posted a 0.5% total return for the trailing 12-month window through Friday’s close.

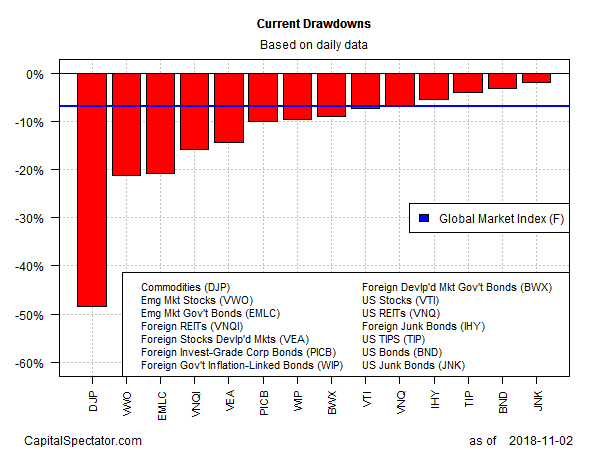

For the current drawdown, US junk bonds continue to post the smallest peak-to-trough slide for the major asset classes – roughly 1.9%, based on SPDR Barclays High Yield Bond (NYSE:JNK) after factoring in distributions.

Broadly defined commodities are still posting the steepest slide from the previous peak. The iPath Bloomberg Commodity (DJP) posted a 48% drawdown at Friday’s close.

GMI.F’s current drawdown is a relatively modest at -6.9% at the moment.