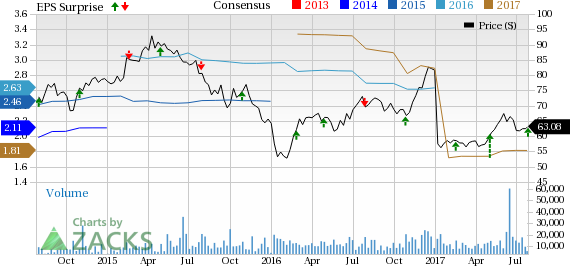

Hilton Worldwide Holdings Inc. (NYSE:HLT) reported better-than-expected second-quarter 2017 results with both earnings and revenues surpassing the Zacks Consensus Estimate.

We note that in January, Hilton completed the spin-offs of Park Hotels & Resorts, Inc. (NYSE:PK) and Hilton Grand Vacations Inc. (NYSE:HGV) , resulting in three independent publicly traded companies. On the same day, the company also affected the previously announced 1-for-3 reverse stock split.

All these changes are expected to make Hilton a fee-based, capital efficient, and resilient business having enormous growth potential worldwide.

Earnings and Revenue Discussion

Adjusted earnings per share (EPS) of 52 cents per share beat the Zacks Consensus Estimate of 50 cents by 4%. Moreover, earnings soared 30% year over year primarily owing to higher revenues. Also, the same came above management’s guided range of 47 cents to 51 cents.

Total revenue of $2.35 billion rose 20.3% year over year and topped the Zacks Consensus Estimate of $2.30 billion by nearly 2%.

Inside the Headlines

In the second quarter, system-wide comparable revenue per available room (RevPAR) increased 1.8% on a currency neutral basis, driven by 0.4% growth in occupancy and 1.2% rise in average daily rate (ADR). Notably, strength at the company’s international hotels drove ADR. The figure was within the management’s guided range of an increase of 1–3% on a constant dollar basis.

RevPAR at comparable managed and franchised hotels increased 1.7% in the quarter. Both occupancy rate and ADR witnessed a rise of 0.4% and 1.2%, respectively.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) was $519 million, up 10% year over year.

Third-Quarter 2017 Outlook

Share-based metrics in Hilton's outlook for third-quarter and full-year 2017 do not include the effect of potential share repurchases.

For the third quarter, earnings per share are estimated between 47 cents and 51 cents. The Zacks Consensus Estimate of 50 cents is pegged within the guided range.

Hilton projects system-wide RevPAR to be flat to up 2% on a comparable and currency neutral basis. Meanwhile, adjusted EBITDA is anticipated in the range of $490–$510 million.

Moreover, the company expects management and franchise fee revenues to increase in the band of 7–9% year over year.

2017 View Lifted

Given solid second-quarter results, the company increased its full-year 2017 outlook.

For full-year 2017, Hilton now anticipates adjusted earnings in the band of $1.78 to $1.85 per share, up from the earlier guided range of $1.73–$1.81. The Zacks Consensus Estimate for 2017 is pegged at $1.81.

The company has also increased its full-year 2017 EBITDA expectations, and now projects the same to be between $1,880 million and $1,920 million (earlier $1,860--$1,900 million).

Notably, the company expects management and franchise fee revenues to increase between 8% and 10% in 2017 (earlier 7–9%).

Meanwhile, system-wide RevPAR is still anticipated to be in the range of 1–3% on a comparable and currency neutral basis.

Hilton currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Another hotel giant, Marriott International, Inc. (NASDAQ:MAR) is scheduled to report its second-quarter 2017 numbers on Aug 7. The Zacks Consensus Estimate for the quarter’s bottom line is pegged at $1.02.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Marriott International (MAR): Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT): Free Stock Analysis Report

Hilton Grand Vacations Inc. (HGV): Free Stock Analysis Report

Park Hotels & Resorts Inc. (PK): Free Stock Analysis Report

Original post

Zacks Investment Research