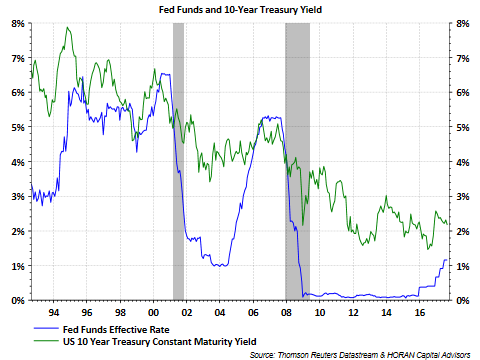

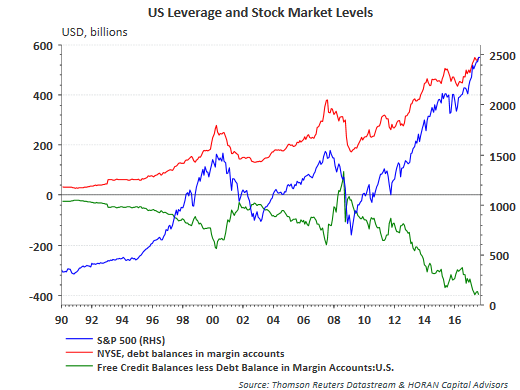

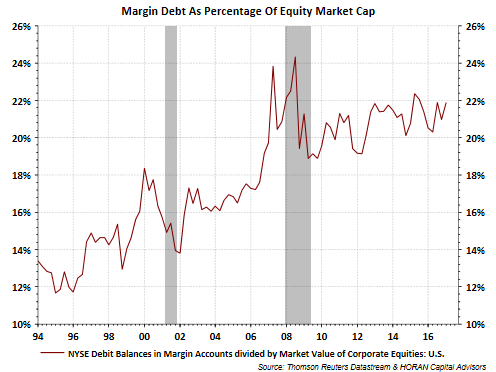

It seems a day does not go by where various strategists lament the market's valuation and lack of any significant pullback in over a year and a half. Not only are the valuations of a number of equity indices above their long term average, some might say the valuations are indicative of the speculative froth in the market. One data point highlighted is the margin debt level. Certainly margin debt has increased as can be seen in the first chart below. However, the second chart shows that margin debt as a percentage of total equity market capitalization has remained fairly stable since 2010. A good article on evaluating margin debt can be found in a MarketWatch article from a few years back, Cash vs. margin debt is the real problem for this market.

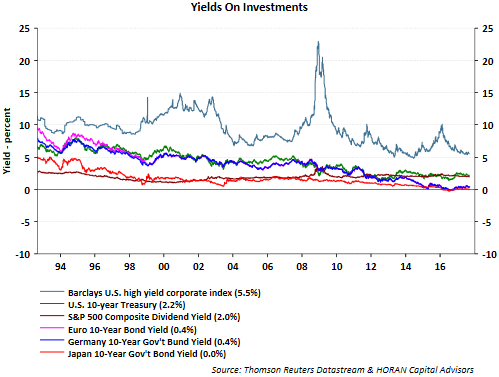

I have discussed in a number of prior posts that equities can trade at higher valuations in a low interest rate environment like we are experiencing at this point in time. Therein lies the issue with stocks. Interest rates around the world are at low levels and negative yields on many debt issues. Investors that desire a decent income return on their investments are hard pressed to find that in the bond market. The below chart compares yields on selected investments in the U.S. and around the globe. Excluding the yield on high yield investments, 5.5%, all the other yields in the below chart are 2.2% or lower.

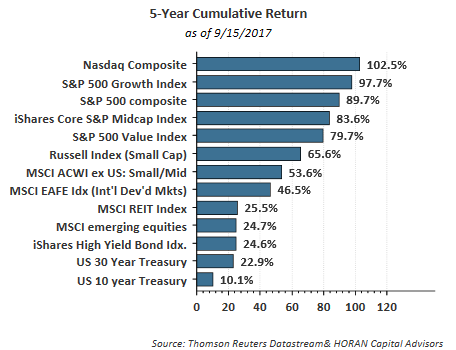

So income yields on many bond investments are at rock bottom levels, and then compare these yields to total returns and investors can see stocks have far outpaced bonds. This disparity in returns has led some bond investors to position assets in what they would call bond-like stocks, that is, higher yielding equities such as utility stocks. These bond-like stocks are not bonds and are highly correlated to the broader equity market.

Historically, an investor might hold bonds in a portfolio to serve as a shock absorber in an equity market pullback. This shock absorber benefit remains an important reason to own bonds today even though yields are low. The other reason investors, and specifically retirees, would hold bonds, is they felt they were receiving adequate income from the bonds to support their spending needs. However, today, receiving a 4%-5% yield on a U.S Treasury seems like a far fetched idea at the moment.

Next week the Federal Reserve has a two day FOMC meeting culminating with an interest rate announcement on Wednesday afternoon. The market is not expecting a rate increase coming out of this meeting; however, we believe rates need to continue their trend higher and believe the Federal Reserve is behind the curve on increasing rates in this cycle. This low level of interest rates has led many investors to conclude this is a T.I.N.A. market, i.e, There Is No Alternative to stocks.

As the final chart below shows, the Fed has been able to get the Fed Funds rate back to a level last seen in 2003/2004. Much work is yet to be done to get rates back to a more normalized level of say 2%-3% though. By allowing longer term Fed assets to roll off the balance sheet, a reasonable possibility exists that longer term rates could move higher as well. Higher rates could provide some healthy and need competition for stocks.