U.S. equity markets continued to move higher in what has become known as the “Santa Rally.” The Dow Jones saw its 48th record close and the Nasdaq Composite has now seen a 13 year high. This helped to propel Asia higher this morning as the Nikkei led the way touching a 6 year high.

In Asia, this morning, Investor nerves were calmed as they had been worrying about another credit crunch in China. The benchmark 7 day REPO rate opened at 5.5 percent. This is way below yesterday’s nine percent. Yesterday the People’s Bank of China (PBOC) injected nearly $4.7 billion into the economy through open market operations. They had missed this for three weeks leading investor to wonder about a looming credit crunch.

STOCKS

The DJIA was up 73.47 points to close at a new high at 16,294.61. Nearly all of the Dow component were higher on the day, 22 out of 30. The S&P 500 continues to climb. The index was up 9.67 points to finish the day at 1,827.99. For the year the S&P 500 is now up 28 percent.

The Nasdaq Composite rallied as well. The tech heavy index hit a 13 year high at 4,148.90. Led by industry heavy weights like Apply (NASDAQ: AAPL) which closed up 3.84 percent after winning a contract with China’s biggest mobile carrier to sell their flagship iPhone. This will now compete head to head with Samsung in one of the world’s biggest mobile phone markets.

The most traded averages are continuing their usual Christmas rally. We have only one week to go in the trading year and this might be a good year for equities. We have not seen some of these gains since the 1990s.

Looking at Asian markets today, The Nikkei was above 16,000 at one point for the first time since November of 2007. The markets is currently up 0.7 percent at 15,980 as investors are really liking a weakening yen. Exporters are moving higher today. The USD/JPY Forex pair is around 104.37 at the time this report was written.

The Shanghai Composite on mainland China is up 0.73 percent at 2,104.45. This market has been very bearish for some time now and we fear a steeper correction in 2014.

The Australian ASX was up 0.7 percent to a new one month high. However, trading volumes are awfully light as markets closed early for the Christmas Holiday.

CURRENCIES

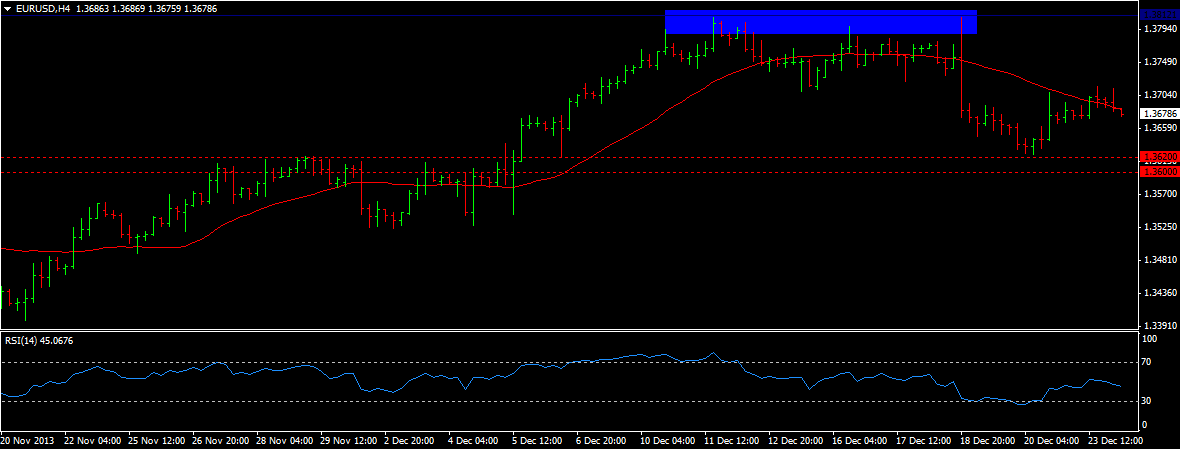

EUR/USD (1.3678) the support at 1.3620/1.36 is holding nice. This keeps us bullish for another recovery. We see strong resistance near 1.3812. A break below 1.36 could confirm a double top. Bottom line we need to break above 1.38/3812 area to continue the rally. Right now we appear to be consolidating.

USD/JPY (104.307) is firmly above 101.50 and now above 104. This is a new five year high for this market. We are now targeting 105 and then 105.50. If those areas break we aim for 109/110 in the next few weeks. We see weakness on a move back below 102.50.

AUD/USD (0.8912) we failed to rise above 0.8918 as we thought would happen. This means a rally to 0.8975 will not happen as we remain firmly bearish in this market. This is good news for the exporter nation as Australia relishes a weak AUD.

COMMODITIES

Gold (1198.40) fell more overnight as we remain bearish with the yellow metal. We have a target at 1185 as long as we are below 1220. We need a break above 1225/1250 for strength and the bulls to come out.

Silver (19.36) was stable overnight. This should continue for some time as we are range locked. We are trading from near 19 down towards 18.575. Copper (3.314) has moved higher and well above the key 3.30 level. We are now targeting 3.33. A break there aims for 3.4.

TODAY’S OUTLOOK

All European and American Financial markets are trading on a holiday shortened day. We wish all of our friends a Merry Christmas and we will bring a special report tomorrow right here on Binary Options Strategy.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Stocks Move Higher, Nikkei Touches A 6 Year High

Published 12/24/2013, 02:01 AM

Updated 05/14/2017, 06:45 AM

Stocks Move Higher, Nikkei Touches A 6 Year High

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.