(Tuesday Market Open) The market closes the books on 2019 today, marking the final chapter in a record-breaking year.

As we enter the new year, investors may want to keep an eye on the U.S. embassy situation in Iraq as situations in the Middle East can escalate and perhaps affect the oil market and, if they get big enough, the stock market as well. But the crude market doesn’t appear to be pricing in any potential supply disruptions just yet—crude oil futures (/CL) are pointing down about 1% in early trading.

In corporate news, Boeing (BA) and Turkish Airlines have reached an agreement on 737 MAX-related losses. While BA still has a ways to go in dealing with the repercussions from deadly crashes of the jet, incremental steps like the deal with the Turkish carrier are steps in the right direction.

Year In Review

During 2019, better-than-expected earnings have done what earnings usually do in the long term—drive the market. Corporate profits may have been drowned out at times by the headlines about geopolitical events or economic worries, but without the strong earnings underpinning it’s doubtful the major indices would be as high as they are at the end of 2019.

Solid corporate earnings have come against a backdrop of a relatively strong domestic economy. Economic data, especially in terms of consumer health and the jobs market, have helped ease investor worries about the United States slipping into a recession. Instead, domestic consumer spending, fueled by a strong employment situation, has helped the U.S. to remain a bright light for the global economy even as the trade war took a toll at home and abroad.

The market in 2019 has also been underpinned by a Federal Reserve that has been accommodative in its monetary policy. Lower interest rates make borrowing easier for companies that want to use the money to expand operations, which can mean hiring more people, buying other companies, and purchasing equipment or other goods. (Of course, low rates can also encourage share buybacks.)Interest rates aside, companies have been facing a good deal of uncertainty—sometimes clouding business decisions—because of the ongoing trade war between the U.S. and China. While shadows still linger, many of those clouds parted recently when the world’s two largest economies announced a “phase one” agreement that’s expected to be signed next month.

Optimism surrounding that deal has helped foster a string of record highs in the stock market heading into the end of the year, bringing us to the Santa Claus rally period that we’re in now. It gets its name from the last five trading days of the year and the first two of the new year when stocks historically have tended to do well.

On Monday, however, investors were perhaps more interested in booking some profits from recent gains. Each of the main three U.S. indices lost ground. And it appears some of that sentiment has crept into this morning’s trading, as equity index futures were pointing to a slightly softer open.

Deficit and Manufacturing

In trade-related news, government data showed that the U.S. trade deficit in goods fell 5.4% in November to $63.2 billion. The surprise narrowing of the deficit came as the U.S. imported fewer farm, consumer, and industrial items and exported more automobiles and industrial supplies, as well as crops.

One feature of the trade deal expected to be signed next month is for China to buy more U.S. agricultural products. But if the U.S. eases its tariff stance further, that could increase imports.

The trade deficit with a single nation can be a tricky metric to use to try to gauge the economy. For example, the trade war with China decreased imports from the Asian nation, but imports from other countries rose.

Amid the fallout from the trade war, which has pitted the world’s two largest economies against each other for the better part of two years, the U.S. manufacturing sector has taken a hit. (See more below.)

On Monday, a gauge of midwestern manufacturing rose more than expected. The Chicago Purchasing Manager Index for December registered 48.9—up from 46.3 the prior month—beating a Briefing.com consensus expectation of 47.3.

While the rise is welcome news for the domestic manufacturing sector, the fact that the Chicago number remains below 50 indicates the midwestern area’s manufacturing is still in a contractionary state.

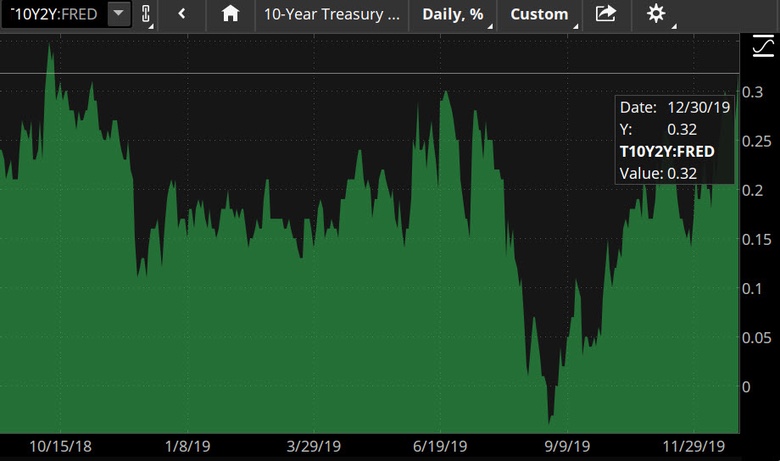

FIGURE 1: REMEMBER THE YIELD CURVE? Earlier in the year, there was much hand-wringing—and a good bit of market concern—over a yield curve that continued to narrow. At one point this summer, the spread between the 2-year and 10-year Treasury notes (the "2/10 spread") flipped negative—a phenomenon which has in the past been a sign of a coming recession. Since then, however, the yield curve has been quietly steepening. On Monday, the 2/10 spread widened to 0.32%, its highest level since the fall of 2018. Data source: Federal Reserve's FRED database. Chart source: The thinkorswim® platform from TD Ameritrade. FRED® is a registered trademark of the Federal Reserve

TD Ameritrade® commentary for educational purposes only. Member SIPC. Options involve risks and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options.