Stocks are drifting lower on July 22 as tensions between the US and China are on the front page over the closure of a Chinese consulate in Houston. The SPDR S&P 500 (NYSE:SPY) ETF is trading down by about 20 bps, while the QQQ ETF is up 50 bps.

S&P 500

At this point, a decline below 3230 in the S&P 500 futures likely triggers a drop to around 3,150.

Copper

Copper needs to be watched closely as well, as it failed at resistance now two times around $2.99. A decline below the uptrend at $2.90 setups a drop to around $2.80. A break down in copper would be a big negative for the risk-on trade.

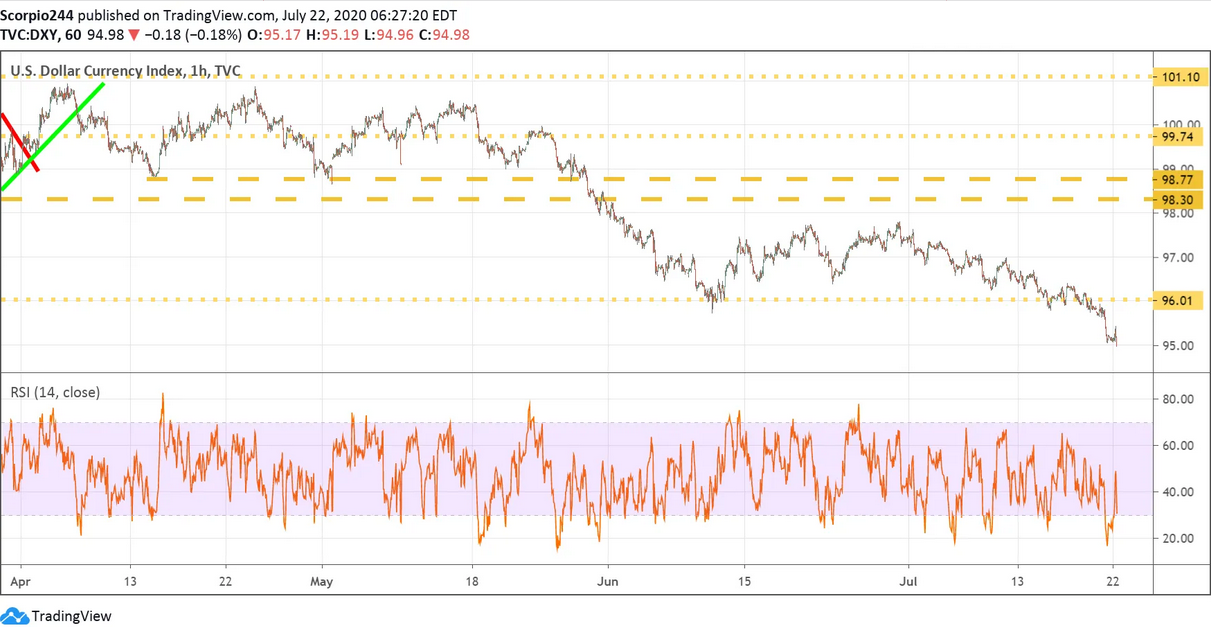

Dollar

The dollar continues to weakening, and while the equity market seems unconcerned at this point, we will continue to monitor.

10-Year

The 10-year continues to drift slowly lower and is now trading around 59 basis points. I see a drop below 55 basis points as a negative for the risk-on trade and headwind for the equity market.

JD

JD.com Inc (NASDAQ:JD) has broken its uptrend and then failed to recapture it. The most important region to watch for in this stock is at $58.20. A break sets up a further decline to around $49.

Freeport

Freeport (NYSE:FCX) is flattening and breaking its uptrend. If copper price starts to fall off, then perhaps the stock can fall back to around $12.70.

Tencent

Tencent (NYSE:TME) fell by 4% last night and looks like it may fill a gap down to 520HKD. That probably means that Amazon (NASDAQ:AMZN) will be due to fall today as well, to around 2950.

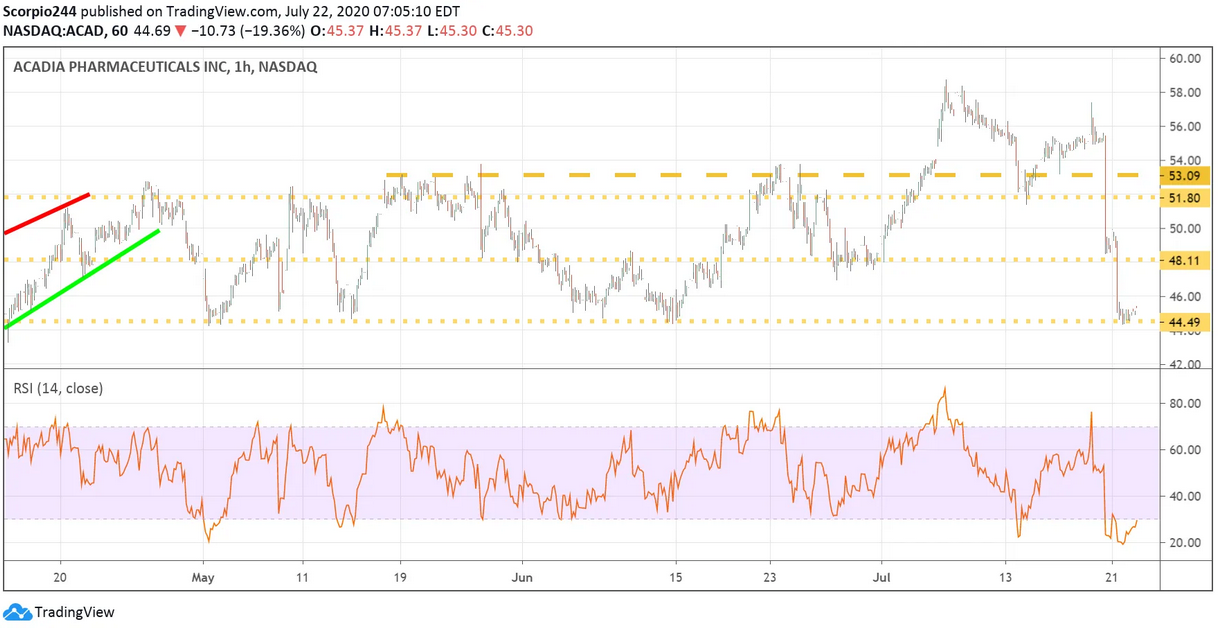

ACADIA

The sell-off in ACADIA Pharmaceuticals (NASDAQ:ACAD) yesterday seemed a bit severe and overdone. While the data miss on the depression study was disappointing, Acadia has a bright future with Dementia-related psychosis and potentially negative symptoms of schizophrenia. As long as $44.50 holds, then I think the worst is past, and we can start to rebound back to $48.