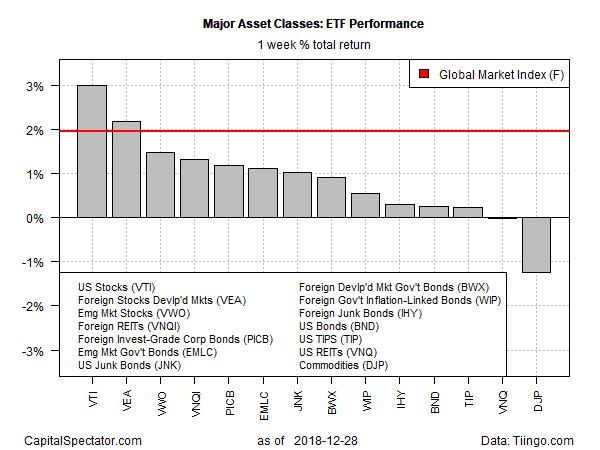

Most of the major asset classes posted gains last week, providing a respite after the previous week’s rout. Led by the US equities, stock markets around the world posted solid advances during the trading week ended Dec. 28, based on a set of exchange-traded products.

Vanguard Total Stock Market (NYSE:VTI) led the way with a strong 3.0% rally last week. The gain marks the first weekly advance for VTI in December. Nonetheless, the fund continues to trade sharply lower compared with its previous peak, set in September.

Last week’s biggest decline for the major asset classes: broadly defined commodities. The iPath Bloomberg Commodity (NYSE:DJP) fell 1.3% — the third straight weekly decline. Friday’s trading left DJP at its lowest close in over two-and-a-half years.

The upside bias in most markets last week lifted an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights rose 2.0% — the first weekly gain for GMI.F in December.

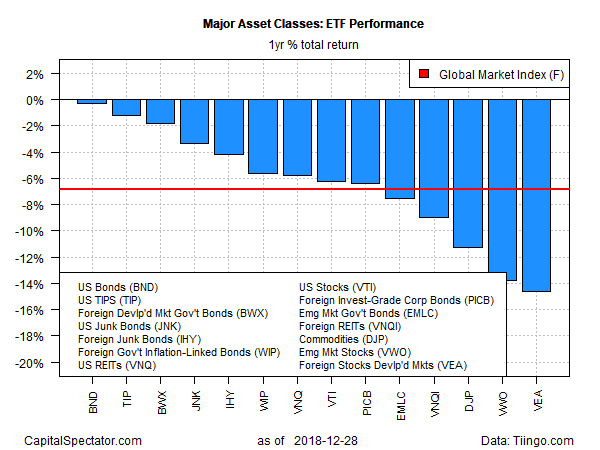

Despite last week’s widespread rally, all the major asset classes have lost ground over the trailing one-year window. The smallest decline, as of Friday’s close, is the slight loss for a broad measure of investment-grade US bonds. Vanguard Total Bond Market (NYSE:BND) is down 0.4% over the past year.

The deepest one-year setback for the major asset classes is a hefty 14.9% slide for foreign stocks in developed markets, based on Vanguard FTSE Developed Markets (NYSE:VEA).

GMI.F is also down on a year-over-year basis, posting a 6.9% decline at Friday’s close vs. the year-earlier level.

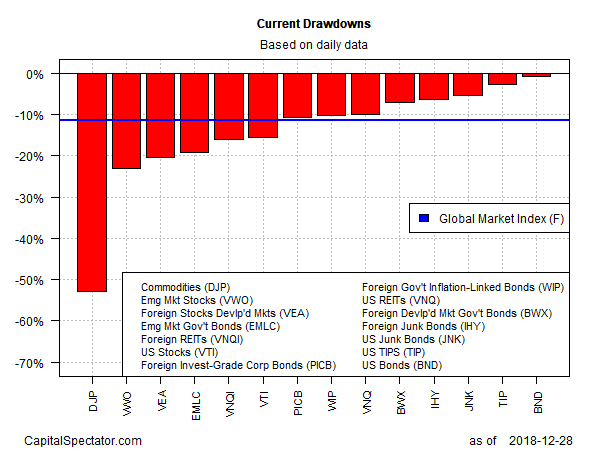

For current drawdown, investment-grade US bonds are still posting the smallest decline: BND is down 0.8% from its previous peak.

Meanwhile, the biggest drawdown continues to be found in broadly defined commodities: iPath Bloomberg Commodity (NYSE:DJP) has lost more than 50% relative to its previous peak.

GMI.F’s current drawdown: -11.5%.