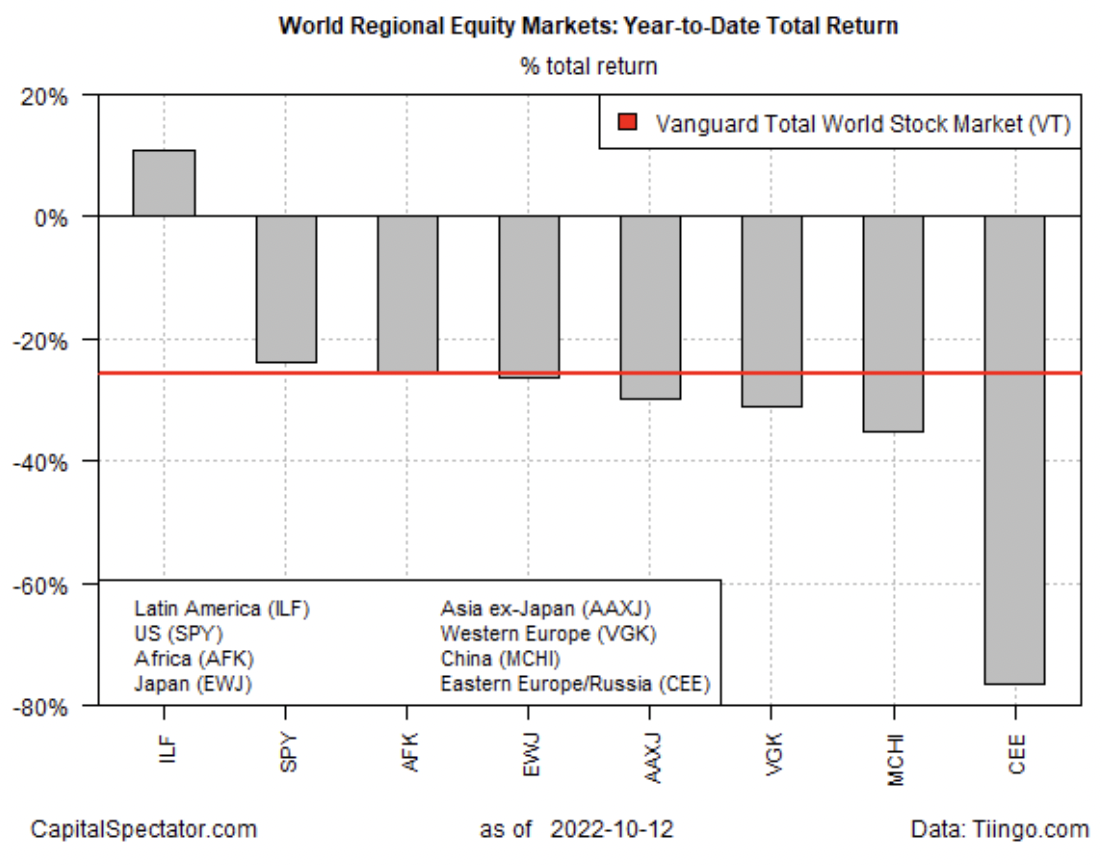

It’s been a tough year for the stocks, in the US and around the world – with a glaring exception: shares in Latin America.

Using a set of exchange-traded funds as proxies shows that iShares Latin America 40 (iShares Latin America 40 ETF (NYSE:ILF)) is an upside outlier. While markets overall are suffering in 2022, ILF has managed to post a handsome gain year to date, rising nearly 11% through Wednesday’s close (Oct. 12).

ILF’s performance is the more striking in relative terms. Comparing the fund against US stocks (SPDR S&P 500 (NYSE:SPY)) and global equities overall (Vanguard Total World Stock Index Fund ETF Shares (NYSE:VT)) is a study in sharp contrasts. Indeed, both SPY and VT are deeply in the red so far in 2022, tumbling 24% and nearly 26%, respectively.

Looking at stocks across the world’s major regions tells a similar story, which further highlights ILF’s strong run this year.

What’s driving the region’s stock prices higher? “It’s a combination of higher commodity prices and also attractive interest rate carries in Latin America,” says Brendan McKenna, international economist and FX strategist at Wells Fargo Securities.

Brazil makes up roughly two-thirds of ILF’s country weights, followed by Mexico with 20%-plus, according to iShares. Profiling the ETF by sectors, financials are the leading allocation (30%), followed by materials (24%) and energy (15%).

Brazil’s central bank has been an early hawk in the current cycle, and continued raising its target rate in August to a steep 13.75%. In turn, that’s supported the currency. Despite a surging US dollar this year, the Brazilian real has been stable so far in 2022 vs. the greenback.

ILF’s performance has been choppy lately, but in contrast with most other markets the ETF has held on to its summer rally.

Note, too, that Brazil – South America’s largest economy — is seen as a safe haven of sorts within Latin America. The upcoming second round of the country’s presidential election is keeping investors guessing about the policy outlook, but for the moment the country enjoys a bullish aura from a global investment perspective.

Dina Ting, senior vice president and head of Global Index Portfolio Management at Franklin Templeton, says:

“We still think that Brazil is undervalued compared to other emerging markets and even developed markets.”

There are risks to consider as well, starting with the elephant in the room: a slowing global economy and the possibility of recession. Brazil is hardly immune to spillover effects. But for now, at least, the crowd sees the country’s strengths outweighing the weaknesses. In the current climate, particularly for emerging markets, that’s a rare bird.