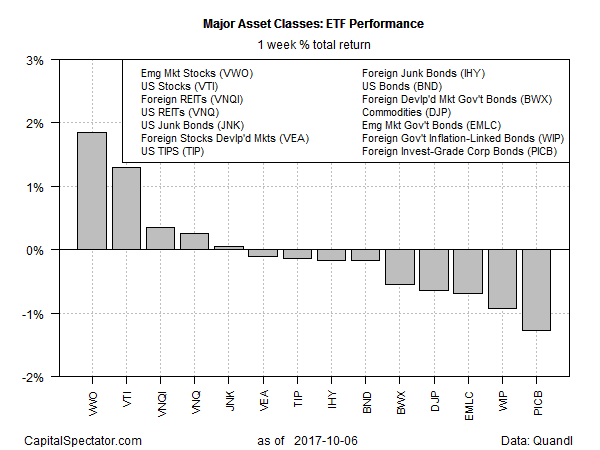

Equities in emerging markets posted a solid gain in the first week of October, marking the strongest weekly advance among the major asset classes, based on a set of exchange-traded products.

Vanguard FTSE Emerging Markets (NYSE:VWO) jumped 1.8% for the five trading days through Oct. 6. The advance marks the first weekly increase for the fund in three weeks.

US stocks delivered the second-strongest advance last week. Vanguard Total Stock Market (NYSE:VTI) rose 1.3% – the fourth straight weekly gain for the ETF.

Last week’s bottom performer: investment-grade corporate bonds in foreign markets. PowerShares International Corporate Bond (NYSE:PICB) fell 1.2% last week, the ETF’s third consecutive weekly slide.

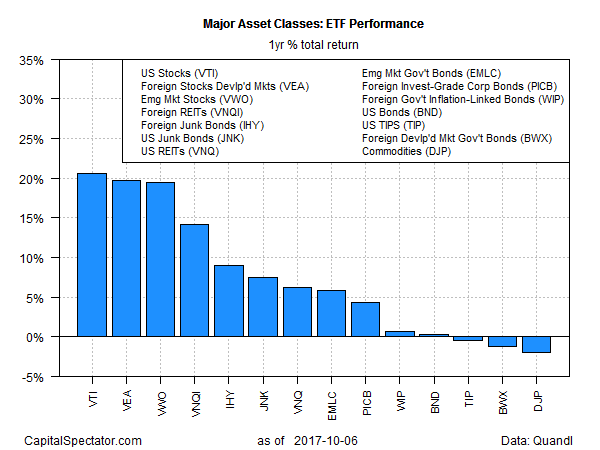

For the one-year window, US equities moved back into first place. VTI’s recent gains lifted the fund to a strong 20.6% total return over the trailing 12 months through Oct. 6.

US equities are again posting the strongest one-year gain, but stocks in foreign developed-markets (Vanguard FTSE Developed Markets (NYSE:VEA)) and emerging markets (Vanguard FTSE Emerging Markets (NYSE:VWO)) aren’t far behind, holding the second- and third-strongest one-year returns, respectively, at last week’s close.

Meanwhile, broadly defined commodities slipped back into last place for one-year results among the major asset classes. After last week’s slump, iPath Bloomberg Commodity Total Return Exp 12 June 2036 (NYSE:DJP) was off 2.0% at Friday’s close vs. the year-earlier price.