Asian markets traded mostly higher on Thursday. The Kospi inched up .1% to 1964, despite a 6.2% drop in LG Electronics, and the ASX 200 gained .3% to 4375. The Hang Seng rallied .8% to 20810, while the Shanghai Composite eased .1%, and the Nikkei closed flat.

European markets closed mixed, as banks fell 2.3% following lackluster earnings from Deutsche Bank. The FTSE and DA advanced .5%, while the CAC40 declined .1%. Automakers extended their gains from the previous session, rising 2.7%, after Volkswagen reported strong earnings, pushing the stock up 7.8%.

US stocks rallied, as the Dow jumped 114 points to 13205, ad the Nasdaq and S&P 500 both climbed .7%.

Dow Tacks on 114 Points

H&R Block tumbled 10.7% to 14.95 after announcing it would close stores and layoff employees to cut costs.

Currencies

The dollar declined against global currencies on Thursday. The pound edged up .2% to 1.6195, while the euro and Swiss franc inched up .1%. The yen spiked .5% to 80.95, and the Australian dollar climbed .3% to 1.0396.

Economic Outlook

Weekly unemployment claims dropped by 1K to 388K, significantly worse than expectations for a drop to 374K. However, pending home sales surged by 4.1%, blowing past analyst forecasts for a 1.2% gain.

Stocks Rise Despite GDP Disappointment And Ratings Cuts

EquitiesThe Bank of Japan announced it would expand its current asset purchase program by another $124 billion, but the news had little lasting impact on the region’s markets. The Nikkei closed down .4% to 9521, surrendering a brief gain following the announcement. The Kospi rose .6%, boosted by Samsung Electronics 2.5% gain, after announcing a record $5.2 billion profit for the first quarter. The Shanghai Composite slipped .4% to 2396, and both the Hang Seng and ASX 200 declined .3%.

S&P cut its debt ratings on peripheral European countries by 2 notches, although the equity markets failed to notice. Spain’s IBEX jumped 1.7%, the CAC40 gained 1.1%, and the DAX rose .9%. Trailing behind, the FTSE posted a respectable .5% gain. Superb earnings by Swedish engineering firm, Sandvik, helped push stocks higher, as the stock rose 12.5%.

US stocks closed higher, despite disappointing GDP data. The Dow added 24 points to 13228, the Nasdaq climbed .6% to 3069, and the S&P 500 gained .2% to 1403. The Nasdaq rallied 2.3% this week, its biggest gain in 3 months.

Currencies

The dollar fell against all major currencies on Friday. The yen and Australian dollar both jumped an impressive .9%, to 80.29 and 1.0467, respectively. Meanwhile, the Swiss franc, euro, Canadian dollar, and pound moved up .5% in an unusually synchronized effort.

Economic Outlook

US GDP grew at an annualized 2.2% rate in the first quarter, slower than the 2.6% expected. On a brighter note, consumer sentiment climbed to 76.4, exceeding forecasts.

European Shares Sink As Spain Slips Into A Recession

EquitiesAsian markets opened the week solidly, led by Hong Kong’s Hang Seng, which rallied 1.7% to 21094, a 6-week high. The ASX 200 climbed .8% to 4397, and the Kospi gained .3% to 1982. Markets in Japan and mainland China were closed for holidays.

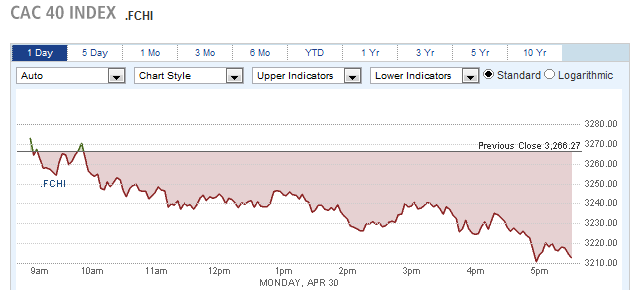

GDP data from Spain showed the economy shrunk by .3% in the first quarter, indicating it had slipped into a recession. The news sent the IBEX down 1.9%, and pressured European stocks across the region. The CAC40 fell 1.6%, the FTSE dropped .7%, and the DAX slid .6%.

France's CAC40 Drops 1.6%

US stocks snapped a 4-day winning streak, closing moderately lower. The Dow erased 15 points to 13214, the S&P 500 shed .4% to 1398, while the Nasdaq skipped .7% to 3046.

Currencies

The dollar traded mostly higher on Monday. The euro eased .1% to 1.3232, and both the pound and Swiss franc declined .2%. The Australian dollar sank .5% to 1.0415 ahead of the central bank’s rate decision, and the Canadian dollar dropped .6%, following disappointing GDP data. The Japanese yen rallied .6%, breaking through the 80 price barrier to 79.83.

Economic Outlook

Midwest business activity slowed last month according to the Chicago PMI report, which fell to 56.2 from 62.2. Personal income rose .4%, more than expected, while personal spending rose .3%, less than expected.

Dow Closes At Highest Level Since December 2007

EquitiesAustralia’s central bank, the RBA, cut interest rates by 50 basis points, more than expected, pushing up the ASX 200 by .8%. In contrast, the Nikkei tumbled 1.8% to 9351, as the recent advance in the yen weighed on exporters. Honda and Toyota both fell more than 3.4%, and Sharp plunged 9.3% after releasing a disappointing outlook. Markets in greater China were closed for holidays. Factory activity in China rose to a 13-month high, according to the April PMI report.

Most European markets were closed for May Day holidays, but in the UK, the FTSE rallied 1.3% on light volume. Lloyd’s spiked 8.3% after releasing upbeat earnings, with profit more than doubling during the first quarter.

The Dow climbed to a 4-year high, ticking up 66 points to 13279, as US stocks gained. The S&P 500 climbed .6% to 1406, and the Nasdaq edged up .1% to 3050.

Currencies

The Australian dollar slumped .9% to 1.0330, more than erasing the previous session’s gains, while most other currencies traded in narrow ranges. The euro and Swiss franc both eased less than .1%, and the pound slipped .1% to 1.6217. The yen declined .4% to 80.12, and the Canadian dollar ticked up .1% to .9859.

Economic Outlook

Manufacturing activity increased to 54.8 from 53.4 according to the ISM’s PMI report. Construction spending rose less than expected, inching up .1% vs. forecasts for a .5% gain. Total auto sales were flat from last month at 14.4M, slightly below expectations.

Employment Data For Europe And US Disappoints

EquitiesAsian markets advanced on Wednesday, following Tuesday’s upbeat factory data from the US and China. In greater China, the Shanghai Composite surged 1.8% to 2438, after returning from a 2-day holiday, and the Hang Seng rallied 1% to 21309. The Nikkei rose .3% to 9380, the Kospi climbed .9% to 1999, and the ASX 200 inched up .1% 4436, closing at a 9-month high.

European markets traded mostly lower, as unemployment in the Euro zone jumped to 10.9%, its worst level in 15 years. Banks led the declines, dropping 2.9%. The FTSE fell .9%, the DAX dropped .8%, while the CAC40 bucked the trend, rising .4%. Indexes in debt-laden Spain and Italy fell 2.6%.

US stocks opened down following a disappointing employment report from ADP, but largely recovered throughout the day. The Dow slipped 11 points to 13269, the S&P 500 eased .3% to 1402, while the Nasdaq gained .3%.

Chesapeke Energy plunged 14.6% after reporting earnings which fell short of expectations. The stock has dropped more than 25% over the past month.

Currencies

European currencies fell, as the euro and Swiss franc both declined .6%, and the pound eased .1% to 1.6201. Meanwhile, the Australian dollar, Canadian dollar and yen all traded fractionally lower.

Economic Outlook

The ADP employment report showed a gain of 119K jobs last month, far below the 178K expected by analysts. The report is generally seen as a barometer for the official nonfarm payroll report which will be released on Friday. Adding to the negativity , factory orders fell by 1.5%, their biggest drop in 3 years, but the results were in line with estimates.