- Dollar wavers post Chinese data

- 10-year Treasury yield down 2.3 points to 3.809%

- JPMorgan (NYSE:JPM) extends gains post Friday’s earnings

US stocks are slightly higher after some disappointing Chinese GDP data raised concerns about the global economy but supported the argument that disinflation pressures are firmly in place. The disinflation story won’t be going away after Ford announced some big cuts with their electric F-150 truck prices. The disinflation process should remain intact and that should support calls that the Fed will be done after one more rate hike at the end of this month.

Wall Street is bracing for some big bank earnings that might not mirror what JPMorgan said last week. The key to the stock market remains the mega-cap tech trade and many traders won’t do any major positioning until we hear from Netflix (NASDAQ:NFLX) and Tesla (NASDAQ:TSLA).

China’s slowdown dragged European stocks. Another record high for China’s youth unemployment won’t do any favors for demand for European goods in the coming months. China still expects growth around 5% to be reached but that will be hard unless the PBOC delivers more stimulus.

US Data

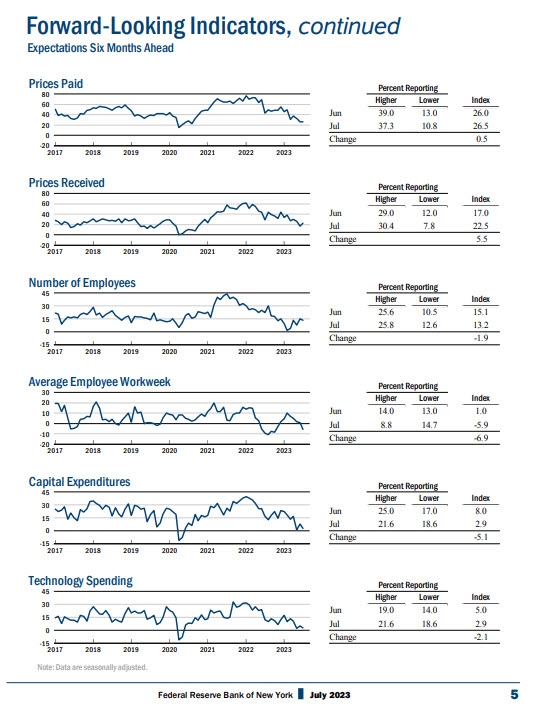

The first Fed regional survey showed that NY state factory activity managed to stay in expansion territory, while prices paid fell to the lowest levels since August 2020. The headline general business conditions index dropped 6 points to 1.1. The manufacturing sector is expected to rebound here despite a slight rise with new orders and as shipments expanded. The report noted that optimism remained subdued and that capital spending will remain soft.

The rest of the Fed regional surveys will likely show overall weakness in the manufacturing sector, along with optimism that pricing pressures are easing.