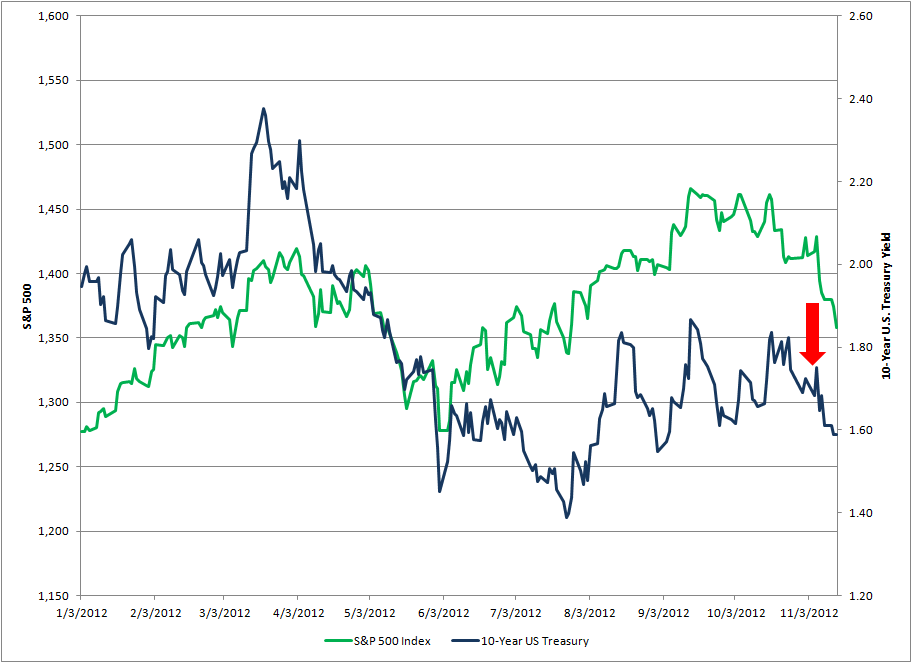

After the last week of stocks taking a beating, it is safe to say that risk is back off. The S&P 500 has declined by 67 points or 4.7% once the market moved past the Presidential election and was able to place all of its focus on the impending Fiscal Cliff. With this move, the S&P 500 is now well past its intermediate trend-line, suggesting the recent run by the bulls is over for now.

So how low can stocks go? If the bond market has anything to say about it and based on the action in the 10-Year U.S. Treasury, stocks can drop a lot more.

Typically stock prices and bond yields move in tandem like two people dancing hand in hand and in lockstep. When the economy is growing, stocks rise due to increasing expectations of better future profits.

Along the same lines, higher growth expectations may at some point stoke the inflation flames. Rising prices of everyday items mean less purchasing power if you assume income growth fails to keep pace. Rising inflation expectations usually results in higher bond yields. This occurs because bond buyers want higher yields in order to be compensated for the rising prices of items they can buy in the future. As holders of fixed income securities, the value of their bond investments falls as prevailing market yields are higher.

Conversely, when inflation is flat or declining (via disinflation or deflation), yields decrease which in turn lead to an appreciation in bond prices. In addition, yields may fall in a flight to quality bid as market participants seek safe-haven assets in fear of some type of shock that is disruptive for both the economy and stocks. (For more information on the relationship between interest rates and stock prices, check out this post from Learnbonds.com)

This relationship for the most part holds true over time. Intuitively, investors are well aware of this relationship as long-term investing usually includes some form of asset allocation between the two distinct but related asset classes. To quantify this, the correlation between the change in yield on the U.S. Treasury 10-Year and the percentage change in the S&P 500 is around 60 to 65% over the past several years. As a source of context, zero means no correlation while 100% means they move perfectly in lockstep. So there is a high degree of correlation between the two assets based off of the last few years of data.

However, since the onset of summer bond yields and stock prices started to diverge. The yield on the 10-Year closed out May at 1.56% while its equity counterpart finished the month at 1310.33. Soon after, the 10-Year sank lower to 1.46% by the end of July on fears of an economic slowdown.

Given these fears, one would expect stocks to be negatively affected. Yet equity prices continued to move higher as the S&P 500 closed at 1379.32 at the conclusion of July.

Even with the recent slide, the performance between the two remains pretty far apart. The 10-Year is currently trading at 1.59% which is basically the same level as at the end of May. The S&P 500 on the other hand is still lofty by comparison and closed out the day at 1355.49.

If the two were to join hands once again where the correlations begin to re-establish themselves, we could see the S&P 500 trading back closer to its May level of around 1300. Of course that assumes a stable 10-Year Treasury.

Given the severity of the Fiscal Cliff which could push the U.S. economy back into a recession, it would be reasonable to expect even more demand for safe-haven assets and even lower Treasury yields than where they are now. This in turn could push stock prices even lower as risk assets fall completely out of favor.

Disclaimer: The above content is provided for educational and informational purposes only, does not constitute a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in such content, and does not represent the opinions of Bondsquawk or its employees.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Stocks Further To Fall If Bond Yields Have Their Say

Published 11/15/2012, 12:39 AM

Updated 07/09/2023, 06:31 AM

Stocks Further To Fall If Bond Yields Have Their Say

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.