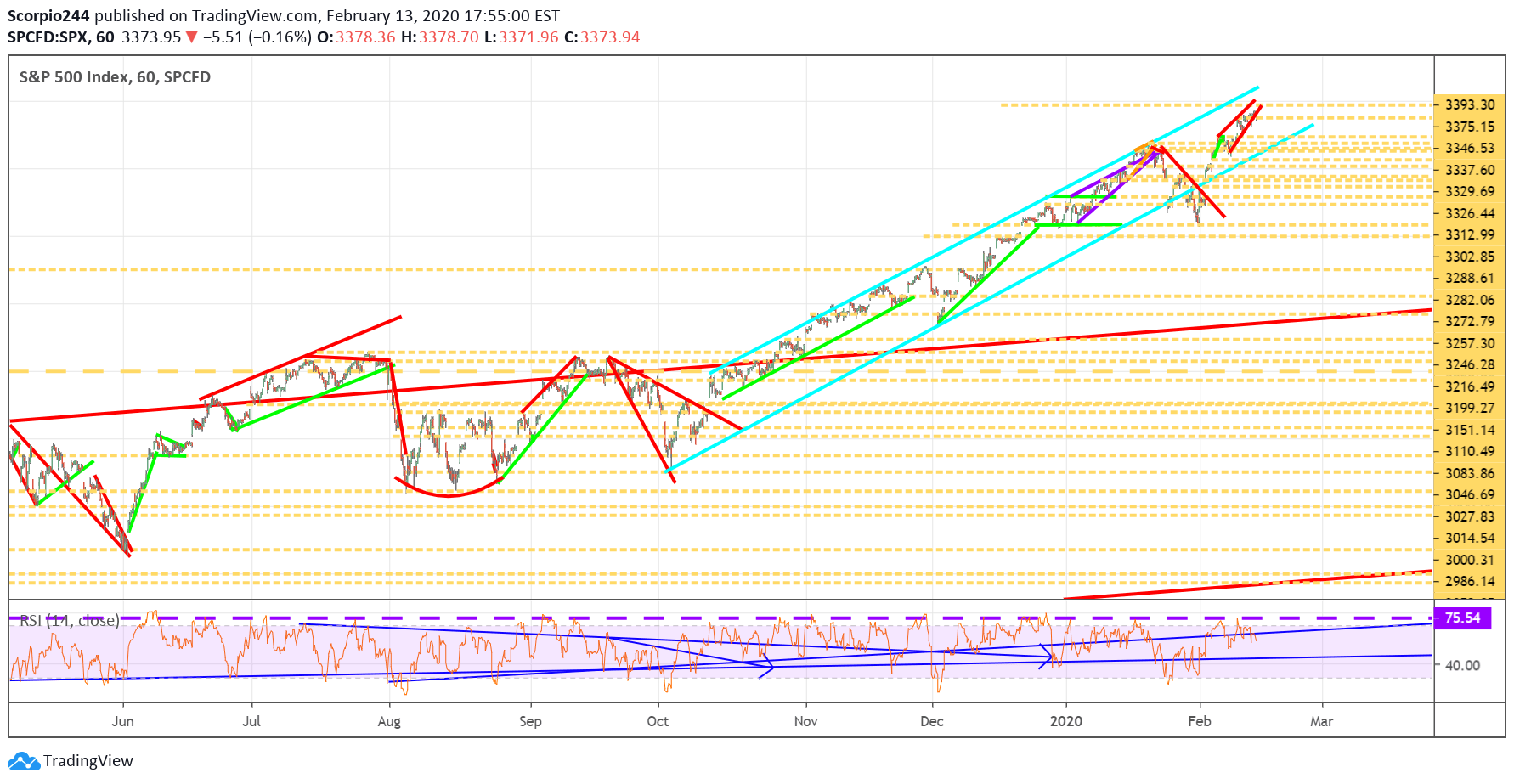

S&P 500 (SPY (NYSE:SPY))

Stocks finished the day mostly flat after that sharp lower opening to start the day. It was pretty much as I called it this morning, a day to fill the gap. Again, this is a market that wants to go higher, that’s it, and that may be all you need to know. Will we see a pullback of 2 or 3% here and there, yes. But I think beneath all of the bearishness, kicking, and screaming investors are mainly trying to get long stocks becuase at the end of the day, what other choices do they have? None.

I think the trend is pretty clear, and now 3,400 is the next level that will be taken out.

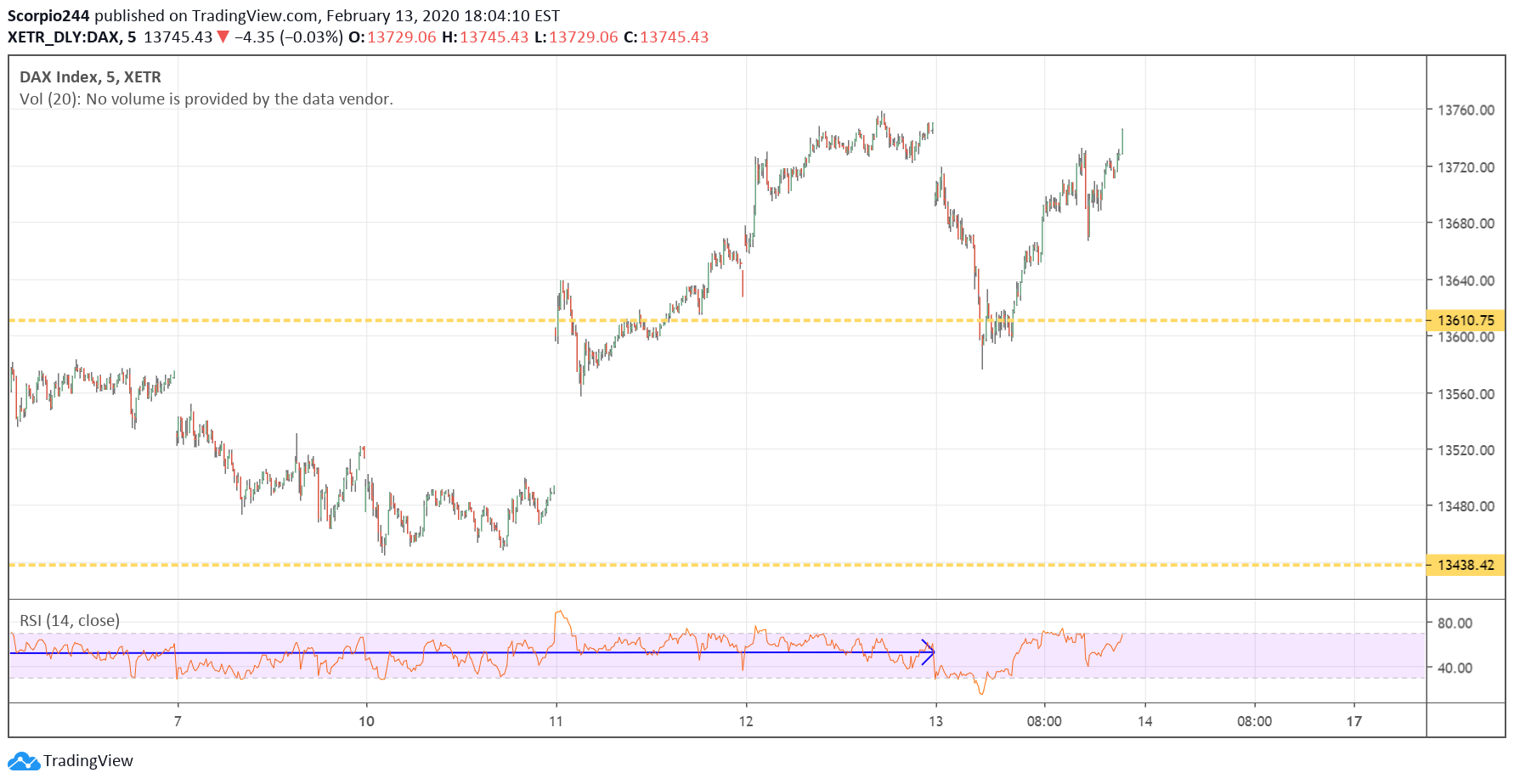

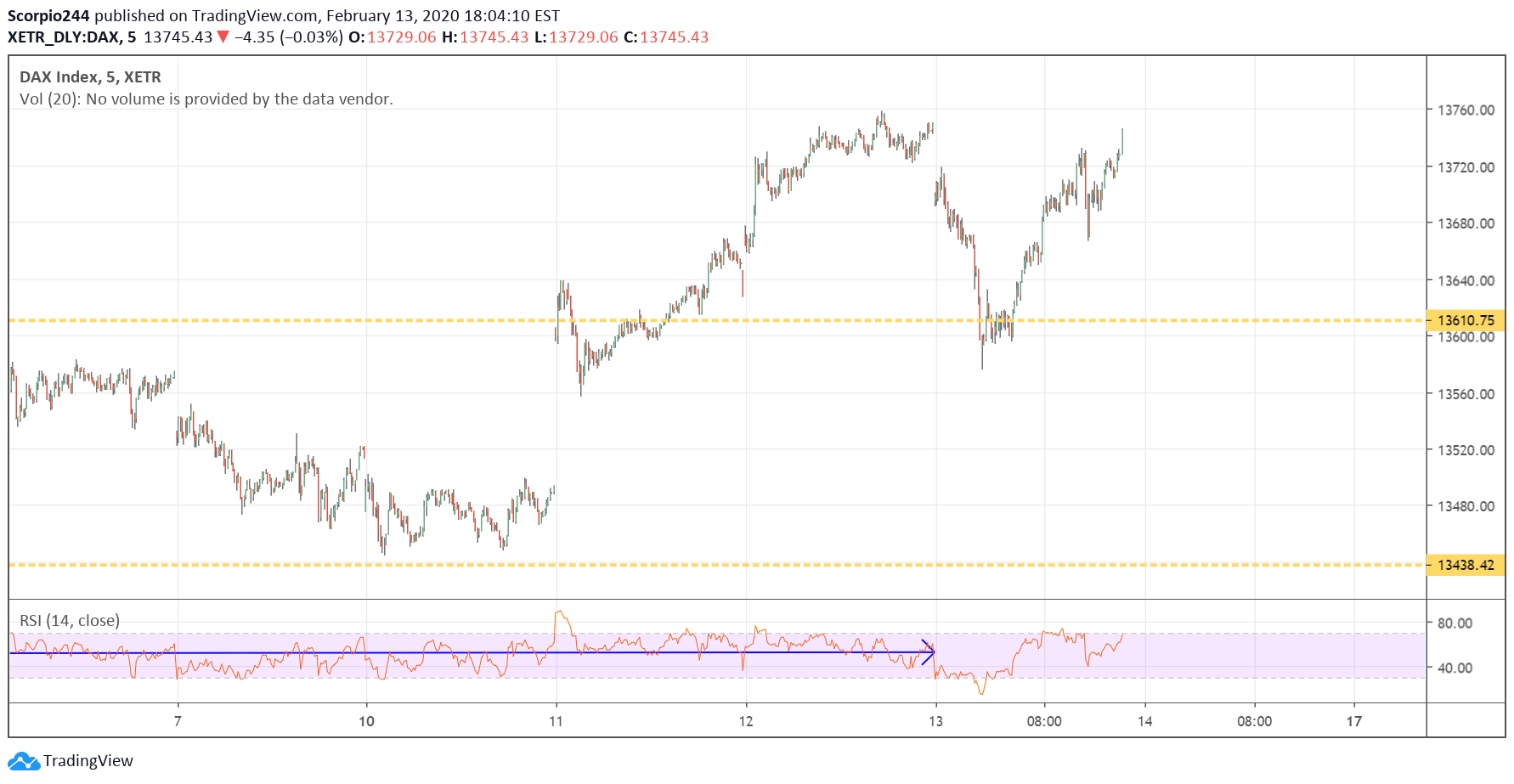

By the way, it wasn’t just our market that recovered. Europe did too.

That means something!

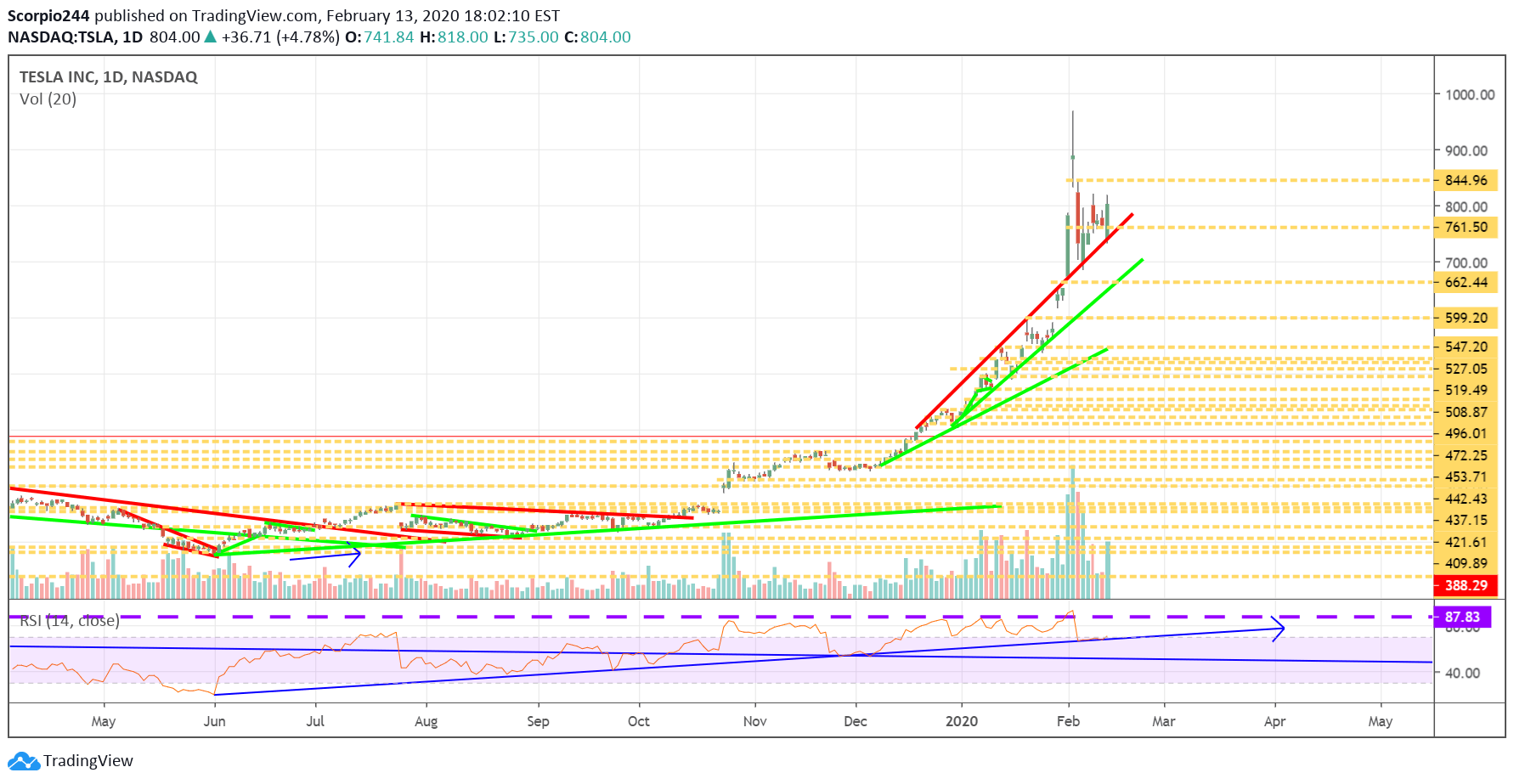

Tesla (NASDAQ:TSLA)

The way Tesla (NASDAQ:TSLA) traded today was something I can honestly say; I don’t think I have ever seen before. I can’t remember the last time a stock went up 5% on the announcement of a secondary offering. Typically, on a hot deal, the stock can rise after the secondary is priced because investors don’t get their full allocation, and they want in at that discounted price. Trust me; I have traded more than my fair share of those. But running a stock up ahead of the pricing, I can probably count it on my hands. It tells me two things 1) the shorts want out, or 2) the demand for this stock is higher than the float out there. We will find out tonight how this hot deal is, and you will know ever early tomorrow just how many people got their full allocation.

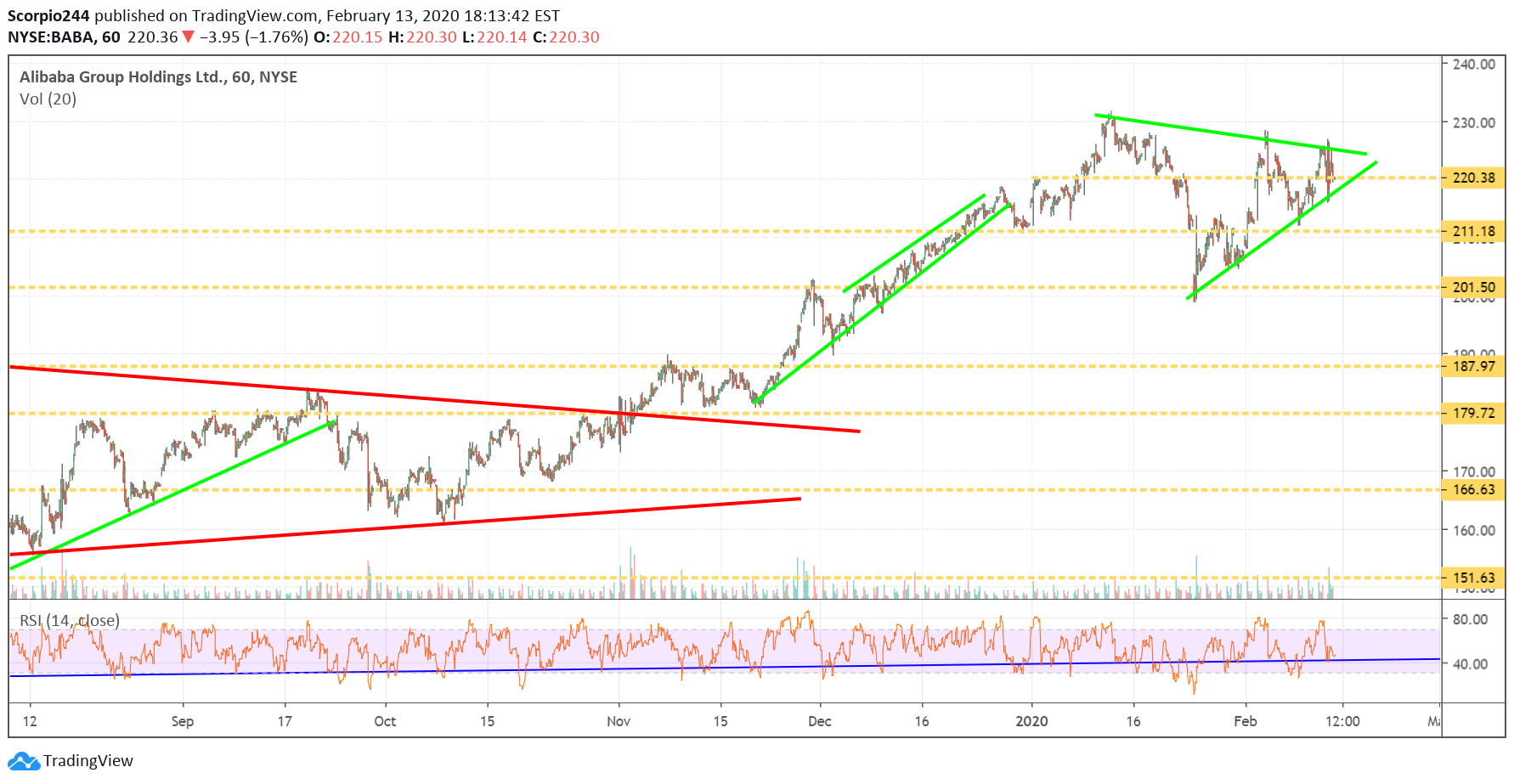

Alibaba (NYSE:BABA)

Alibaba (NYSE:BABA) fell today, I think on a day without corona headlines, the stock would have likely gone higher. However, the good news is that the trends remain higher, and I was impressed by that the stock held the uptrend. You can read more in this article for Forbes I wrote. Alibaba’s Post-Earnings Pullback Shouldn’t Last Very Long

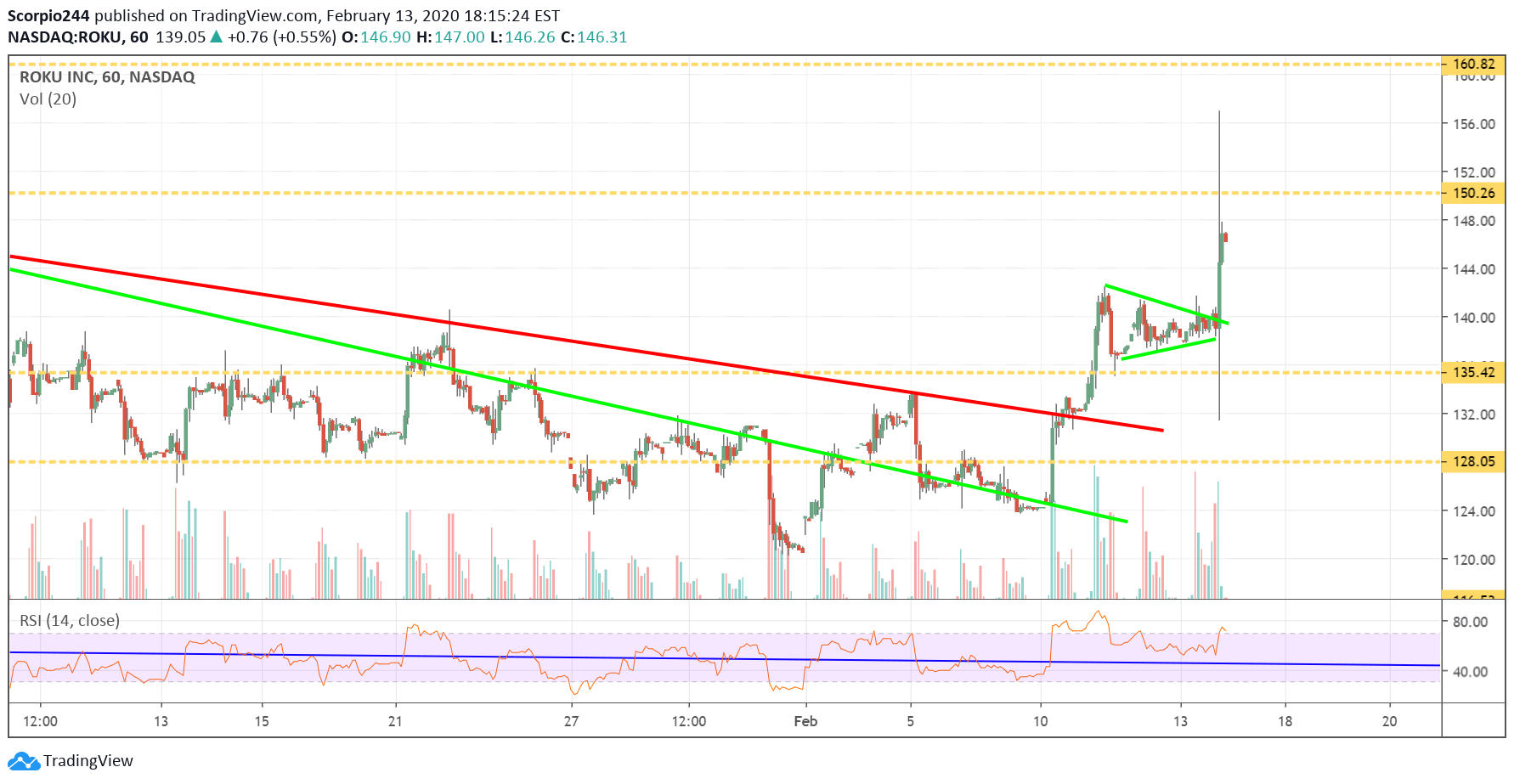

Roku (ROKU)

It looks like I made the right call switching from bearish to bullish on Roku on Tuesday. I noted in the mid-day update the stock was forming a bullish flag too, and sure enough, the stock jumped higher after hours, but $150 remains resistance for now.

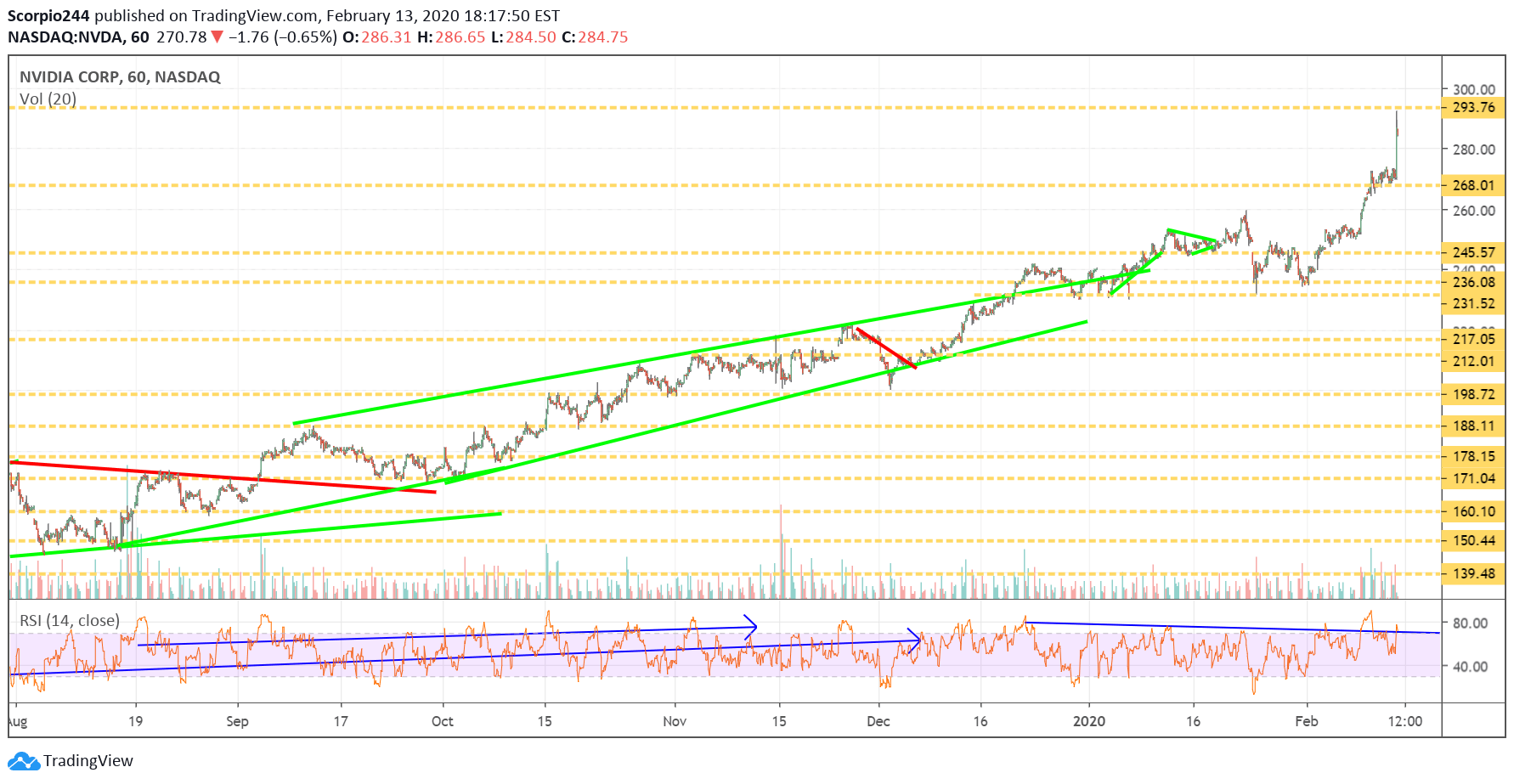

Nvidia (NVDA)

Nvidia, I screwed up today. I noted it was going to $300 the other day, and now today, I got cold feet after seeing a little bit of bearish betting. What bothered me more was how much the stock ran up ahead of results, and I was worried that the company would have a tough living up to expectation. Wrong. The stock is flying after hours and trading just below resistance at $294. I’m not perfect, that’s for sure.

There is a very good chance there will be no commentary in the morning. I’m going to be up late with the live webinar tonight.

Have a good one.