According to Gallup, consumer spending dropped 15% from mid-August and it has been flat since the Federal Reserve’s tapering talk in May. Casual dining expenditures declined 3.5% in July as well as 2.0% in June. Meanwhile, Warren Buffett has been rapidly exiting stocks that are tied to consumer purchasing activity.

Many market watchers recognize that there has been enormous strength in big-ticket consumption like auto and home. However, with wage growth stagnant, we’ve been making those acquisitions on credit with Fed-manipulated lending rates. And those lending rates are moving noticeably higher as the Fed prepares to pull back from its bond buying intervention.

It follows that consumer-oriented stocks may be in a bit of a bind. Rising rates will not make big-ticket items easier to acquire. Similarly, the absence of personal income increases makes it difficult for consumers to fuel discretionary purchasing.

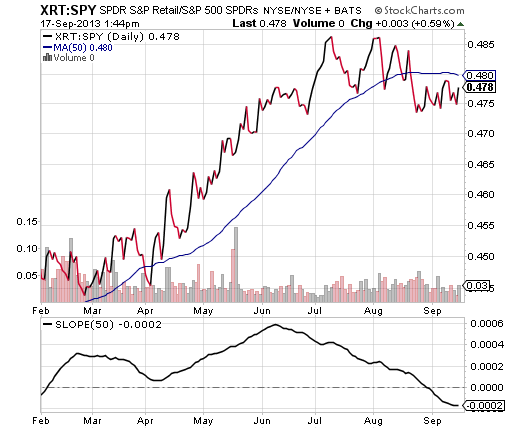

Consider the waning momentum of retail ETFs like SPDR S&P Retail (XRT). Until August of this year, SPDR S&P Retail (XRT) had been comfortably outpacing the S&P 500 SPDR Trust (SPY) as depicted in the price ratio below. For the last month, however, the XRT:SPY ratio has demonstrated relative weakness, by remaining below a key trendline. Similarly, the slope of the XRT:SPY 50-day moving average has declined steadily since June.

Not a chart fan? Then consider the fundamentals. The Forward P/E for XRT as well as for SPDR S&P 500 Sector Select Consumer Discretionary (XLY) both hover near 19. Of the 9 S&P 500 sectors in the SPDR series, consumer discretionary is the most expensive.

Truth be known, no segment of the economy will thrive in a broad market correction… and we’re certainly due for something with a bit more bite than 5%. That said, with two-thirds to three-fourths of the U.S. economy dependent on household consumption, it’s no wonder that Wall Street is addicted to ultra-low rates; Americans must keep borrowing to eat cake because significant wage growth is unlikely to occur anytime soon.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.