- Pound’s rollercoaster ride not over as new UK finance minister’s statement awaited

- Dollar gets off to a softer start despite elevated Fed rate hike bets, yen in focus

- US equity futures rise but cautious mood prevails

Pound looks to new chancellor to restore some order

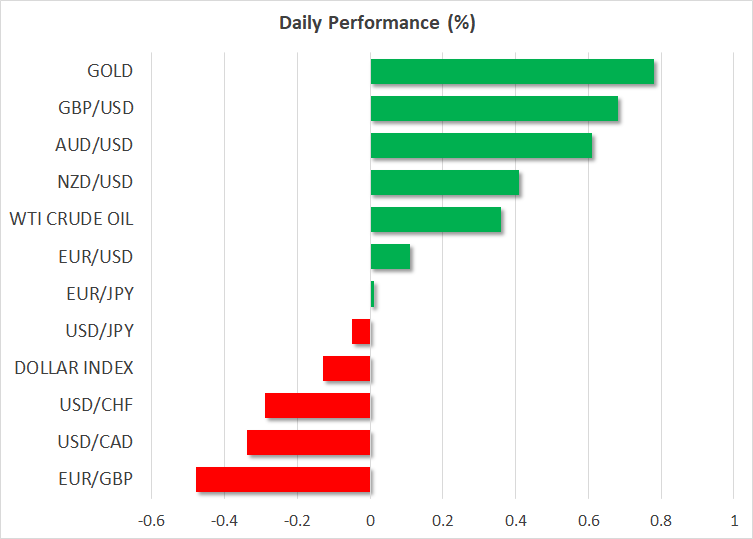

There was no escaping the political drama at Westminster as the pound remains gripped by the unfolding crisis sparked by the Truss government’s irresponsible policies. Investors initially cheered the reports on Friday that Prime Minister Liz Truss wants to reinstate the planned increase in the corporation tax from 19% to 23% in a bid to ease concerns about high borrowing. But the subsequent sacking of Kwasi Kwarteng as chancellor and a less-than-reassuring press conference by Truss failed to calm markets, with yields on long-dated gilts spiking even as the Bank of England wound up its emergency bond-buying operation.

Barely into his post, new finance minister Jeremy Hunt seems to have had some success at least in appeasing the markets, signalling over the weekend that some difficult decisions lie ahead on tax and spending. The focus now is on Hunt’s statement at 10:00 GMT where he will outline some of the measures from the medium-term fiscal plan, which will be announced in more detail on October 31.

The new chancellor is going out of his way to avoid a repeat of September 23 when his predecessor set off a global bond market rout with his highly inflationary mini budget. But more importantly, Truss has had to abandon her economic ideology, cornered not only by the markets, but also by the Bank of England, which refused to extend the support measures to steady the bond market beyond October 14.

The Bank’s governor Andrew Bailey hinted on Saturday that a “stronger response” will be needed at the November rate-setting decision following the recent turmoil. Moreover, if Hunt goes far enough today with unveiling some prudent policies, the pound might just be able to stabilize after rebounding to the $1.1250 region.

However, there’s still a huge amount of political uncertainty with many predicting that Truss won’t be able to survive as prime minister for much longer, so the pound’s reprieve may be very short-lived.

Softer dollar takes pressure off yen, for now

The US dollar meanwhile fell back slightly on Monday as the 10-year Treasury yield slipped a few basis points below 4.0%. US data once again surprised on the upside last week, with Friday’s retail sales beat coming just a day after the hotter-than-expected CPI report. Also worrying was the uptick in consumer inflation expectations in the University of Michigan’s October survey.

Some Fed officials have started to actively talk about the possibility of the terminal rate being higher than the 4.5%-4.75% range projected in the September dot plot and a 75-bps rate hike is looking increasingly likely not just in November but in December too.

But with money markets already pricing in a terminal rate of just under 5%, the dollar has taken a step back for now, which has probably come as a relief to Japanese policymakers as the yen’s slide has slowed as it approaches the 149 per dollar level.

Japan’s finance minister stepped up his verbal intervention on Monday following the yen’s big drop on Friday. It’s very likely that the Bank of Japan will try and stop the yen from weakening past the 150 level, though how long the threat itself manages to ward off the dollar is another question.

Stocks attempt a rebound as earnings season gets into full gear

Nevertheless, it’s been a relatively calmer start to the week with some cautious risk appetite providing a much-needed boost to battered equity markets. The S&P 500 plunged by 2.4% on Friday and the Nasdaq by 3.1% as fears of Fed overtightening intensified.

Better-than-expected results from the major banks, including JPMorgan Chase (NYSE:JPM) and Wells Fargo (NYSE:WFC), failed to lift the broader market. But e-mini futures were climbing on Monday, with investors turning their attention to the big tech earnings as Netflix (NASDAQ:NFLX) and Tesla (NASDAQ:TSLA) will report their results on Tuesday and Wednesday, respectively.

European shares gained too but Asian stocks were mixed as there was little indication from China about a change in either its economic or zero-Covid policies as the Communist party congress got underway on Sunday.