- Stocks edge higher as gold benefits from geopolitical risks

- Pound rallies despite shock claimant count change

- French political issues return to the foreground

- RBNZ meeting could lead to significant Kiwi underperformance

Stocks Edge Higher as Gold Climb Continues

It was another uneventful session yesterday with most stock indices continuing to recover from last week’s rout. Not much has changed from last week as the market and most investment houses are still looking for a strong Fed rate cut in September.

There seems to be a lack of appetite for aggressive positioning, mostly due to the low liquidity conditions and the summer lull. Most investors are also preparing for Wednesday’s US CPI report, which could prove crucial ahead of next week’s Jackson Hole Symposium.

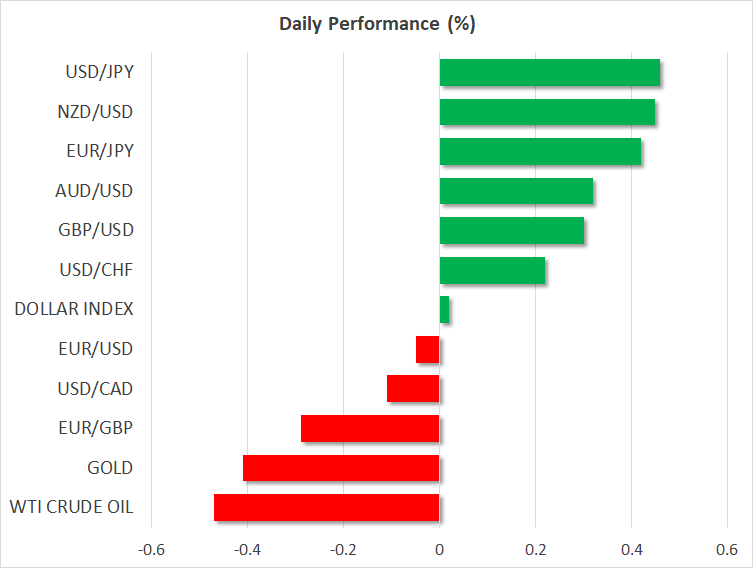

What really moved yesterday was gold and oil. Sooner or later, Iran is expected to launch an attack on Israel with a Fox News report yesterday evening triggering both commodities to spike higher, with oil prices reaching the highest level since July 19.

The report was refuted later but this reaction shows the high sensitivity of the commodities market to geopolitics at this juncture.

Pound Benefits From Strong Average Earnings Print

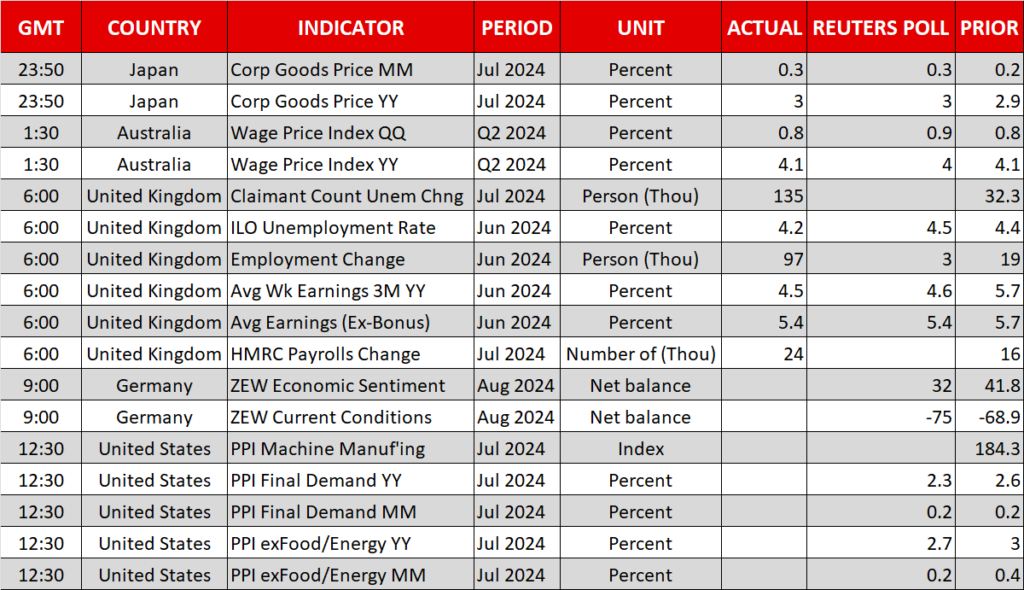

Despite the shocking 135k increase in claimant counts, the strongest level since 2009 if one excludes the 2020 COVID-caused recession, the pound is on the front foot against both the euro and the US dollar.

The market decided to focus on the June unemployment rate unexpectedly dropping to 4.2% and the average earnings indicator that excludes bonuses printing at 5.4%.

The focus now turns to Wednesday's session when both the CPI and PPI reports for July will be published at 06:00 GMT.

Economists expect a small acceleration to the headline CPI indicator to 2.3% from 2% in July with the core printing at 3.4% year-on-year change.

Following the finely balanced rate cut by the BoE on August 1, both the market and the BoE doves are thirsty for more easing. The doves are probably satisfied with the recent performance of inflation, but a strong set of data at tomorrow's CPI report could significantly dent market expectations for more rate cuts.

RBNZ Meeting Coming Up

The RBNZ holds its rate-setting meeting during tomorrow’s Asian session and the market is currently assigning a 75% probability for a 25bps rate cut, the first one since 2020. Economists are split about the outcome because of non-tradable inflation being still too high.

There is a strong case for the RBNZ to wait until the October 9 gathering and examine the actions from the Fed and the other key central banks during September.

Should the RBNZ hold rates steady tomorrow, the Kiwi could benefit significantly with its outperformance potentially tempered only if the quarterly forecasts show numerous cash rate cuts planned during 2024.