Asian markets closed mostly higher on Wednesday in anticipation of the ECB’s latest injection of liquidity. The Kospi rallied 1.3% to 2030, a fresh 6-month high, and the ASX 200 gained .8%. In China, markets were mixed, as the Shanghai Composite slumped 1%, ending an 8-day winning streak, while the Hang Seng closed up .5%. Japan’s Nikkei closed flat at 9723, surrendering a substantial 140-point advance from earlier in the day.

In Europe, markets traded lower in the afternoon, taking the lead from Wall Street. The FTSE sank 1% to 5872, the DAX skidded .5%, and the CAC40 eased fractionally. Banking shares bucked the downtrend, rising .5%.

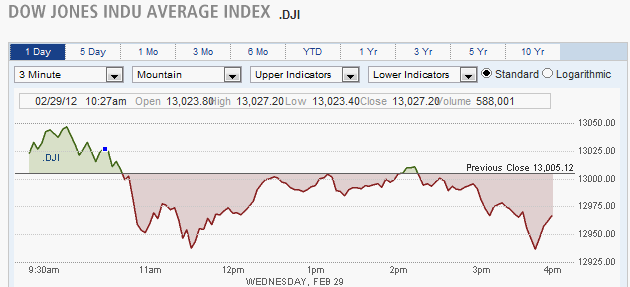

US stocks fell, as remarks by Fed chairman, Ben Bernanke, made investors nervous. Bernanke said the job market is “far from normal” and may require additional stimulus, but failed to offer any plans of additional easing at this point. The Dow lost 54 points to 12952, the Nasdaq shed .7%, and the S&P 50 declined .5% to 1366.

Dow Falls Below 13000, Down 54 Points

Apple shares gained 1.3% to 542.44, pushing the companies market cap past the half-trillion mark to $506 billion, in anticipation of the company’s iPad 3 launch.

Currencies

The Dollar rallied nearly across the board. The Euro slumped 1.1% to 1.3321, the Swiss Franc dropped 1% to 1.1055, and the Yen shed 1% to 81.29. The Australian Dollar and Canadian Dollar both fell .5%..

The Bank of England’s governor, Marvin King, said he sees no need for further quantitative easing. The upbeat outlook helped the Pound overcome the broader sell off, inching up fractionally to 1.5907.

Economic Outlook

GDP data for the 4th quarter showed the economy grew at 3%, better than the 2.8% forecast by analysts. Chicago PMI rose to 64 from 60.2, significantly better than the 61.6 expected.

Report Suggests Europe Headed for Another Recession

Equities

Asian markets traded mostly lower on Thursday, as doubts over Europe’s economic health weighed on stocks. The Kospi slumped 1% as heavyweight Samsung Electronics tumbled 3% in a broad tech drop. The ASXX 200 slipped .2%, ending a 4-day winning streak, and the Hang Seng closed down .8% to 21381. China’s Shanghai Composite managed a gain of .3% and the Nikkei rose .4% to 9596.

European markets traded mixed as DAX declined .5% to 6809, the FTSE gained .4%, and the CAC40 traded flat. A European Commission report indicated that Europe is headed for a second recession, with an expected contraction of .3% over the next year. Shares in Belgian bank, Dexia, slumped 6.5%to 6.5% after saying it may go out of business.

US stocks advanced, as stocks recovered from early losses. The Dow added 46 points to 12985, the Nadaq climbed .8% to 2957, and the S&P 500 rose .4 to 1363.50.

Currencies

The Euro rallied .9% to 1.3367 despite the negative outlook for the region. , The Swiss Franc climbed .9% as well, and the Australian Dollar rose .7% to 1.0706. The Pound and Yen both gained .4%, to 1.5736, and 79.98 respectively.

The Euro Gained another .9%, adding to its Recent Rally

Economic Outlook

Weekly unemployment claims were flat from last week at 351K, marginally better than forecast. The OFHEO home price index rose by .7% more than the .2% expected.

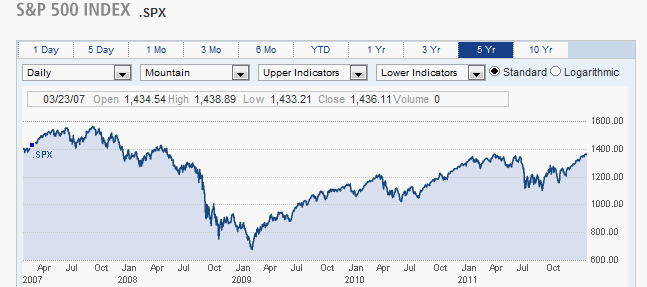

Upbeat Economic Data Pushes S&P 500 to Multi-Year High

Equities

Asian markets advanced on Friday, following Wall Street’s gains on Thursday. The Nikkei rose .5% to 9647, the Kospi climbed .6%, and the ASX 200 gained .5%. China’s Shanghai Composite rallied 1.3% to 2440, while the Hang Seng inched up .1% to 21507.

In Europe, shares closed mostly higher, encouraged by strong earnings results from Telecom Italia, which rose 7.3%. The DAX advanced .8%, the CAC40 gained .6%, and the FTSE closed flat. Deutsche Bank jumped 4.6% after Merill Lynch upgraded the stock to “buy”.

US markets posted smaller gains, and the S&P 500 closed at its highest level in 3.5 years. The S&P 500 rose .2% to 1365.50, the Nasdaq edged up .2% to 2964, and the Dow closed flat at 12983.

S&P 500 Closes at Highest Level in 3 1/2 Years

Gap shares sank 4% after reporting a sharp drop in 4th quarter income. Salesforce.com rallied 9% on solid earnings data, and garnered several analyst upgrades.

Currencies

The Yen fell 1.5% to 81.20, as the recent downtrend intensified. The Dollar traded lower against its European counterparts, as the Pound advanced .8% to 1.5872, while the Euro and Swiss Franc climbed .6%. The Australian Dollar and Canadian Dollar both eased .3%.

Economic Outlook

Consumer sentiment rose to 75.3 a significant jump from last month’s 72.5 reading, hitting its highest level since February 2011. New home sales clocked in at 321K, 5K more than expected, but slightly lower than last month’s gain of 324K.

Stocks Trade Mixed as Oil Pulls Back

Equities

Asian markets traded mostly lower on Monday, as the recent spike in oil prices took its toll on stocks. The Nikkei declined .1% to 9633, although exporters gained as the yen continued to slide against the dollar. The Kospi slumped 1.4%, the ASX 200 dropped .9%, and the Hang Seng shed .9% to 2128. The Shanghai Composite bucked the downtrend, rising .3% to 2447, a 3 month high.

European markets closed lower as well. The CAC40 sank .7%, the FTSE fell .3%, and the DAX eased .2%. German Chancellor, Angela Merkel, said there was no guarantee Greece’s bailout package would succeed, dampening spirits. Banks fell 1.4%, with Societe Generale dropping 3%.

US stocks overcame early losses to close modestly higher. The Dow rose points to 12996, erasing a 100-point loss from earlier in the day The S&P 500 advanced .2% to 1369, and the Nasdaq inched up .1% to 2967.

Currencies

The Dollar rose against most European currencies amid uncertainty for the region. The Euro and Swiss Franc slid .4% to 1.3397 1.1119, and the Pound declined .3% to 1.5820. The Australian Dollar gained .5% to 1.0758, and the Yen bounced .6% to 80.54. The Canadian Dollar rose fractionally to .9991.

Economic Outlook

Pending home sales blew past forecasts, climbing 2% to its highest level since April 2010.

Global Stocks Rise, Energy Slides

Equities

Asian markets rallied on Tuesday, despite a bankruptcy filing by Elpida memory, in Japan. The Nikkei gained .9% to 9722, recovering from early losses, after chip-related stocks initially sold off, but later recovered. The Kospi rose .6%, as Hynix memory jumped 6.8%, and the Hang Seng surged 1.7% to 21569. The Shanghai Composite edged up .2%, and the ASX 200 posted a narrow loss.

Upbeat US consumer confidence data helped boost European markets in the afternoon. The DAX climbed .6%, the CAC40 gained .4%, and the FTSE rose .2%. The ECB will be injecting additional liquidity on Wednesday to help regional banks, which are expected to borrow 500 billion euros.

In the US, the Dow managed to close above 13000 for the first time in nearly 4 years, settling at 13005, up 24 points. The S&P 500 rose .4%, and the Nasdaq climbed .7%.

Currencies

European currencies closed higher on Tuesday, as the Pound, Euro, and Swiss Franc all rose .5%. The Australian Dollar inched up .1% to 1.0771, and the Canadian Dollar gained .4% to .9952. The Yen settled flat at 80.48, after swinging up and down by .5% during the day.

Economic Outlook

Consumer confidence blew past forecasts, jumping to 70.8 from last month’s 61.5 reading, a 1-year high. The Richmond manufacturing index surged to 20 from 12, whereas analysts had expected a slide to 11.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Stocks Ease as Bernanke Fails to Offer New Stimulus

Published 03/04/2012, 04:38 AM

Updated 05/14/2017, 06:45 AM

Stocks Ease as Bernanke Fails to Offer New Stimulus

Equities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.