Equities

Asian markets tumbled on Thursday, as growth fears weighed on stocks. The Kospi slumped 2.2% to 1785, despite a surprise rate cut by South Korea’s central bank. The Hang Seng fell 2% to 19025, and the Nikkei sank 1.5% to 8720. The ASX 200 slid .7% to 4068, after a disappointing employment report. China’s Shanghai Composite bucked the downtrend, rising .5% to 2185.

European stocks dropped as well, particularly resource related companies. The FTSE fell 1% to 5608 the CAC40 lost .7% to 3135, and the DAX declined .5% to 6419. The basic resource index slumped 2.8%.

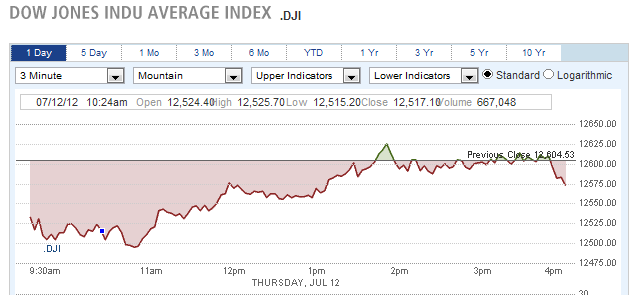

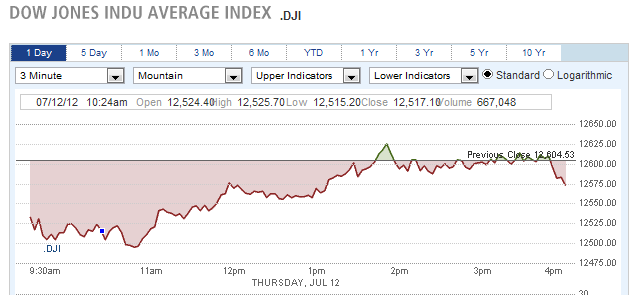

In the US, the major indexes closed down for their 6th straight day, but were well off their session lows. The Dow eased 31 points to 12573, largely recovering from a 100+ point drop in the morning. The Nasdaq dropped .8% to 2866, nd the S&P 500 shed .5% to 1335.

Dow Claws Back From Sharp Drop

Supervalu (NYSE:SVU) shares plunged 49% after announcing plans to sell portions of its business in order to pay off debt. The supermarket chain reported a staggering 45% drop in first-quarter earnings.

Currencies

The Australian dollar fell .9% in reaction to a weak jobs report. The pound fell .5% to 1.5434, while the Swiss franc and euro declined .3% to .9838 and 1.2207 respectively. The yen gained .6% to 79.26, and the Canadian dollar inched up 8 pips to 1.0183.

Economic Outlook

Weekly unemployment claims blew past forecasts, dropping to 350K from 376K, although many analysts attributed the drop to the July 4th weekend. Import prices tumbled 2.7% last month, the biggest drop since December 2008.

Asian markets tumbled on Thursday, as growth fears weighed on stocks. The Kospi slumped 2.2% to 1785, despite a surprise rate cut by South Korea’s central bank. The Hang Seng fell 2% to 19025, and the Nikkei sank 1.5% to 8720. The ASX 200 slid .7% to 4068, after a disappointing employment report. China’s Shanghai Composite bucked the downtrend, rising .5% to 2185.

European stocks dropped as well, particularly resource related companies. The FTSE fell 1% to 5608 the CAC40 lost .7% to 3135, and the DAX declined .5% to 6419. The basic resource index slumped 2.8%.

In the US, the major indexes closed down for their 6th straight day, but were well off their session lows. The Dow eased 31 points to 12573, largely recovering from a 100+ point drop in the morning. The Nasdaq dropped .8% to 2866, nd the S&P 500 shed .5% to 1335.

Dow Claws Back From Sharp Drop

Supervalu (NYSE:SVU) shares plunged 49% after announcing plans to sell portions of its business in order to pay off debt. The supermarket chain reported a staggering 45% drop in first-quarter earnings.

Currencies

The Australian dollar fell .9% in reaction to a weak jobs report. The pound fell .5% to 1.5434, while the Swiss franc and euro declined .3% to .9838 and 1.2207 respectively. The yen gained .6% to 79.26, and the Canadian dollar inched up 8 pips to 1.0183.

Economic Outlook

Weekly unemployment claims blew past forecasts, dropping to 350K from 376K, although many analysts attributed the drop to the July 4th weekend. Import prices tumbled 2.7% last month, the biggest drop since December 2008.