Everyone is talking about the growth/reflation theme that has taken place post election. Did this theme really start improving after election? The chart below looks at the TR Commodity index over the past 40-years. The index hit support at (1) and started moving higher. The monthly low took place at the end of February 2016, 9 months “before” the election.

The index remains in a downtrend since the highs back in 2011, which looks to have formed the head of a multi-year head-and-shoulder topping pattern. The swift decline that started in July 2014 took it down to support at (1). That's where a counter-trend rally started, which many call the reflation/growth rally. Regardless of the label applied to the rally, the index hit triple resistance in a downtrend at (2) and has recently turned south.

The growth/reflation theme would be put into question if neckline support at (1) gives way. A support break at (1) would suggest that dis-inflation or de-flation is in play.

So far, weakness in the index since the highs back in 2011 has not impacted stocks in a negative way. Stocks and the index did bottom together at (1) and both have struggled a little as resistance was hit at (2) in the chart above.

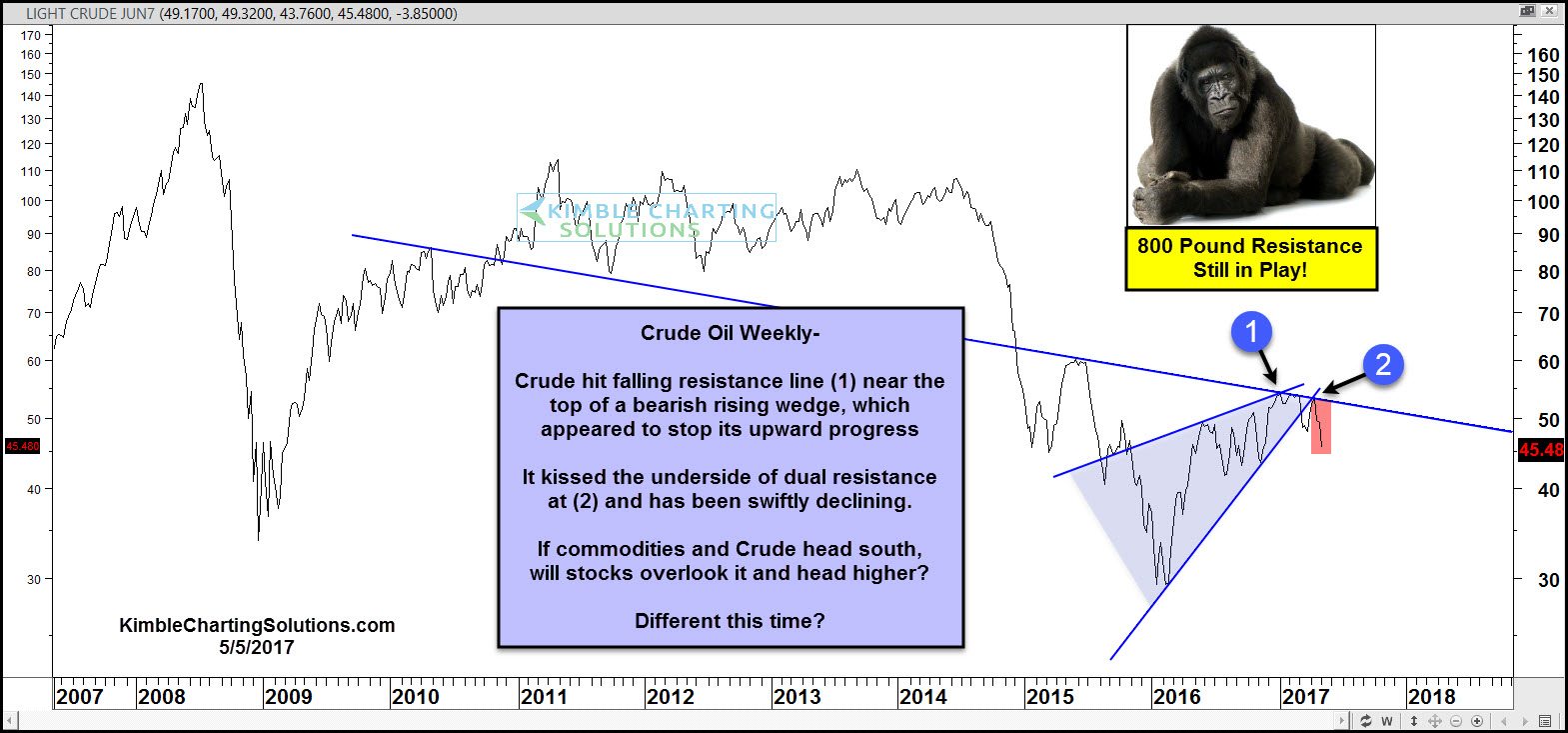

Below looks at crude oil over the past decade and its 800-pound resistance line.

Oil and the NYSE index don’t always correlate. But they have over the past two years. With crude kissing the underside of resistance at (2) and turning lower, stock bulls hope that either crude bounces back or the correlation between the two ends.