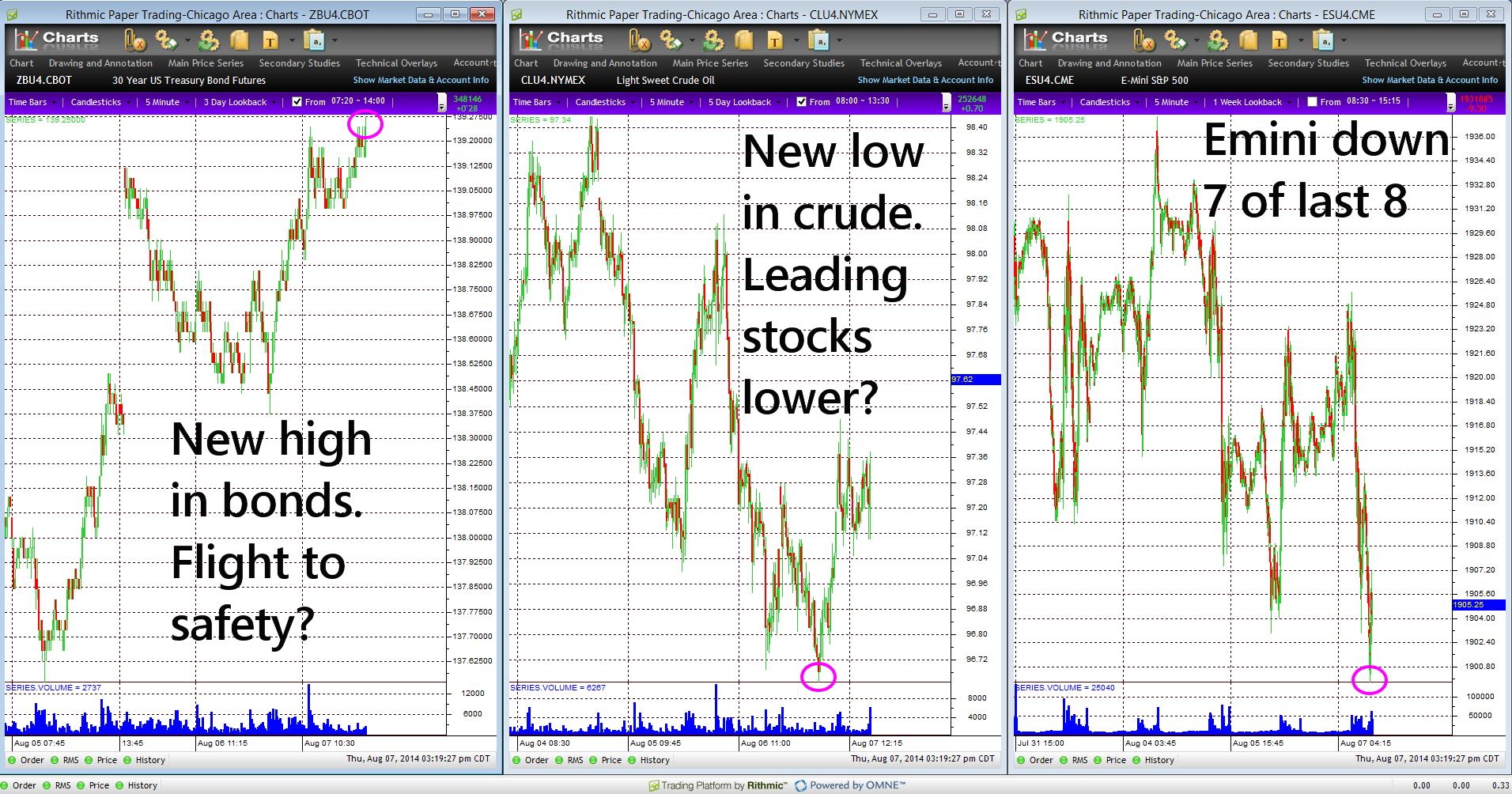

As I said in today’s Opening Print, the stock market did continue its downtrend, but not without over 10 handles of short-covering and perhaps some new buying. Once the Emini S&P 500 reached strong resistance at 1925, it began dropping through a series of support levels, which we called in advance in the MrTopStep Trading Room: 1917, 1914, 1907, 1901. The MiM showed a small buy imbalance, which showed up at 2:30PM CT and caused a small rally back to 1907.

Unrest in Ukraine and Iraq were on everyone’s mind. Crude Oil had a strong bounce after making another low, as news of ISIS’s advance in Iraq and attacks on Kurds and Yazidis continued to come out. Crude and stocks seem to be tracking each other lately.

Usually,Gold and crude tend to move together, but today gold made another new high. Bonds also broke into 139 territory after news that the ECB and Bank of England would leave rates unchanged.

While it was hard not to be aware of the news, even if you weren’t actively trading the news, today still had well-behaved markets that followed technical levels with great reliability. Very little guesswork involved, especially if you had the support of a good group like our trading room. Okay, that’s enough of a plug. Bur seriously, give it a try.