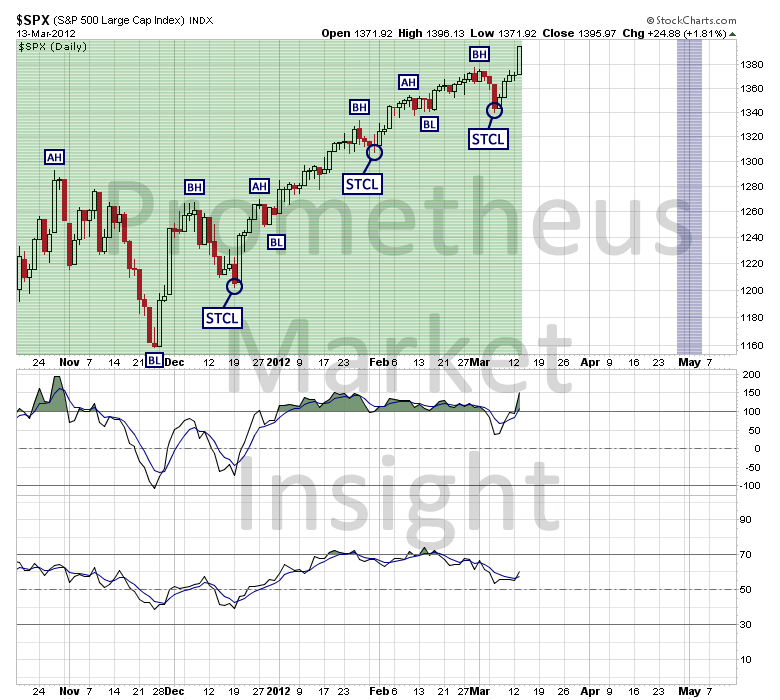

The S&P 500 index closed sharply higher yesterday, moving up to a new high for the cyclical bull market from early 2009. Technical indicators are moderately bullish overall on the daily chart, favoring a continuation of the advance. However, the rally from October is extremely overextended on a short-term basis and it will almost certainly be followed by a violent overbought correction.

With respect to cycle analysis, the strong move higher yesterday confirms that the latest Short-Term Cycle Low (STCL) occurred on March 6 as suggested by the character of the rebound last week. Additionally, the close well above the last Beta High (BH) reconfirms the bullish translation that has persisted since October and favors additional short-term strength.

However, the advance has developed an extremely speculative character and the alpha phase rally of the new cycle has taken the form of a potential “blow-off” move, signaling that we are likely entering a period of heightened short-term volatility that will provide an important signal with respect to long-term direction.

From a big picture perspective, sentiment has reached another secular bear market extreme. After experiencing despair as the stock market bottomed in early 2009, the mainstream view is now euphoric, believing that there are substantial gains ahead for the current cyclical bull market. Unfortunately, just as the bearish sentiment extreme in early 2009 coincided with a cyclical low, the current bullish extreme is likely occurring near a cyclical high. This type of sentiment vacillation is typical during the middle stage of a secular bear market. Longtime readers will recall that, while despair gripped the majority of market participants in early 2009, we were extremely bullish as our chart analysis indicated that we were on the verge of one of the best long trading opportunities in a generation.

Make no mistake about it: being contrarian near cyclical inflection points is never easy. After all, we are emotional beings and, as such, we will always feel compelled to join the crowd, especially when short-term market behavior supports popular opinion. That is why it is so important to both remain focused on the long-term view and base your investment and trading decisions on a reliable methodology with a long, successful performance history.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Stocks Confirm Start of New Short-Term Cycle

Published 03/14/2012, 01:44 AM

Updated 07/09/2023, 06:31 AM

Stocks Confirm Start of New Short-Term Cycle

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.