Equities

Asian markets posted moderate gains after China reported GDP which was in line with forecasts, although the 7.6% growth rate was the slowest since March 2009. The Nikkei inched up 4 points to 8724, the ASX 200 rose .4% to 4082, and the Hang Seng gained .4% to 19093. South Korea’s Kospi jumped 1.5% to 1813, led by a 4.4% advance in Samsung Electronics shares. The Shanghai Composite closed flat at 2186.

European investors were far more impressed with the Chinese data. The Dax surged 2.2% to 6557, the CAC40 climbed 1.5% to 3181, and the FTSE gained 1% to 5666. Moody’s cut Italy’s credit rating to 2 notches above junk, and warned it may make further cuts in the future.

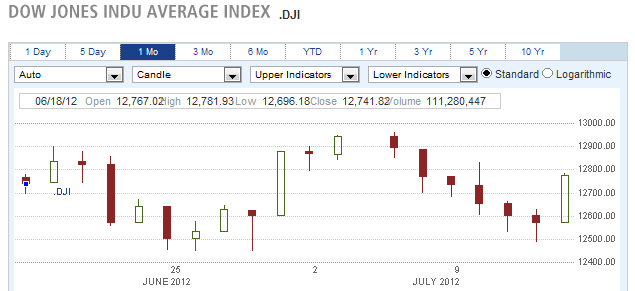

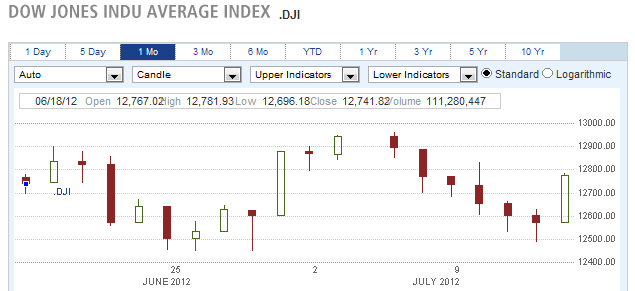

US stocks rallied as well, snapping a 6-day losing streak. The Dow bounced 204 points to 12777, the S&P 500 jumped 1.7% to 1357, and the Nasdaq advanced 1.5% to 2908.

Currencies

The Australian dollar, China’s main supplier of metals, jumped 1% to 1.0232, as investors were relieved over China’s GDP data. The pound climbed .9% to 1.5573, and the Canadian dollar rose .5% to 1.0141. The euro ticked up .4% to 1.2248, and the Swiss franc rose .3% to .9809. The yen closed flat at 79.27.

Economic Outlook

PPI unexpectedly rose .1% last month, versus forecasts for a .5% drop in prices. Consumer sentiment dropped to 72.0 from 73.2.

Asian markets posted moderate gains after China reported GDP which was in line with forecasts, although the 7.6% growth rate was the slowest since March 2009. The Nikkei inched up 4 points to 8724, the ASX 200 rose .4% to 4082, and the Hang Seng gained .4% to 19093. South Korea’s Kospi jumped 1.5% to 1813, led by a 4.4% advance in Samsung Electronics shares. The Shanghai Composite closed flat at 2186.

European investors were far more impressed with the Chinese data. The Dax surged 2.2% to 6557, the CAC40 climbed 1.5% to 3181, and the FTSE gained 1% to 5666. Moody’s cut Italy’s credit rating to 2 notches above junk, and warned it may make further cuts in the future.

US stocks rallied as well, snapping a 6-day losing streak. The Dow bounced 204 points to 12777, the S&P 500 jumped 1.7% to 1357, and the Nasdaq advanced 1.5% to 2908.

Currencies

The Australian dollar, China’s main supplier of metals, jumped 1% to 1.0232, as investors were relieved over China’s GDP data. The pound climbed .9% to 1.5573, and the Canadian dollar rose .5% to 1.0141. The euro ticked up .4% to 1.2248, and the Swiss franc rose .3% to .9809. The yen closed flat at 79.27.

Economic Outlook

PPI unexpectedly rose .1% last month, versus forecasts for a .5% drop in prices. Consumer sentiment dropped to 72.0 from 73.2.