“He who hesitates is poor.” Mel Brooks

The Fed did nothing as expected, but they are signalling a rate raise after the elections, likely in December, as is the only strategy that makes any sense at all.

Biotech stocks are on a tear once again after a spate of mergers or buyouts, so that and miners are the main sectors to be focused on for the time being from what I can see.

That said, we often see gold move up on Fed news only to see the move faded so I’d keep stops tight in any metals related trades for at least a few days.

I am still calling out my trades on twitter for free @iTraderz so be sure to follow me there.

I usually open up a paid section in the fall where I give my trades live and I may have to open that service up very soon if strength is coming early.

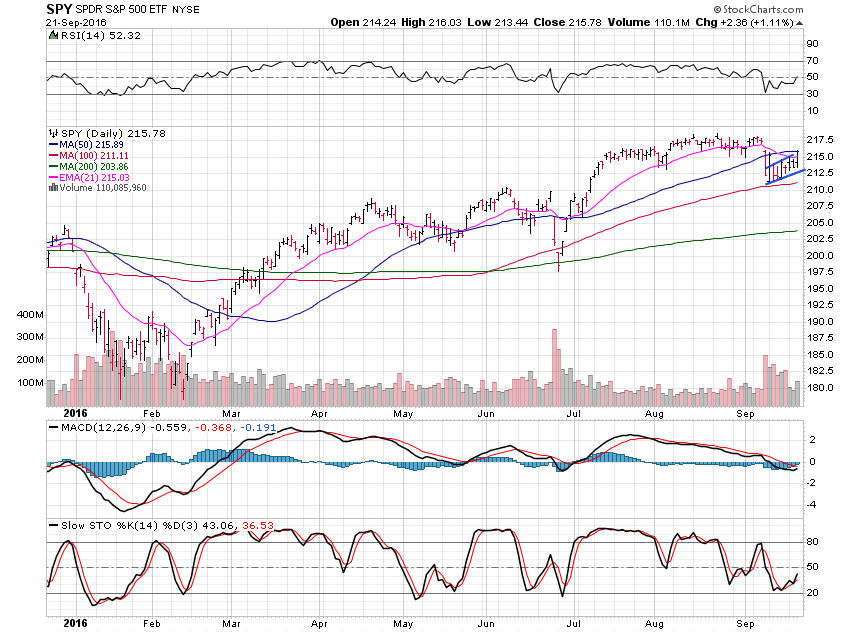

SPDR S&P 500 (NYSE:SPY) looks to be breaking this bear flag pattern and about to rip higher now instead of taking a month or two off as it often does this time of year.

Strength into elections does make sense and looks more probable.

Enjoy your evening, I plan on getting aggressive with stocks right away.