New alignments: Swiss Franc. Platinum joins the growing ranks of primary trend breakout (highlighted green) that includes junk bonds and copper. Signals will be finalized at the end of the month.

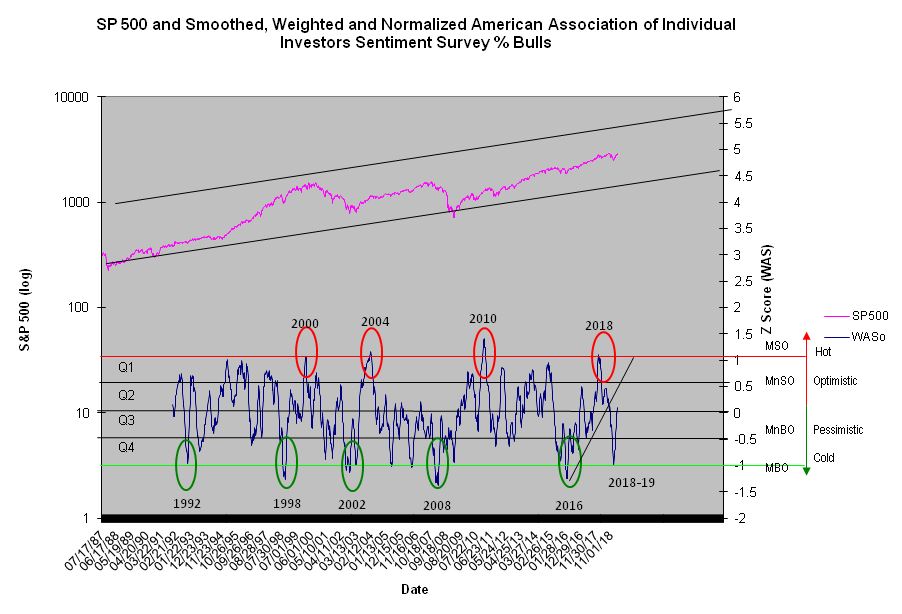

Couple of interesting points in the Matrix: (1) The EAC is showing an arrow change. This confirms the strength in junk bonds and copper. (2) The sentiment model suggests the majority is growing optimistic. This is expected as the rally climbs the wall of worry. WASo measures optimism around a zero line. WASo > 0 defines growing optimism, and WASo

BuST & BrST > 0, observations made in the daily, weekly, or monthly time frames, warn investors where upside or downside alignments are pushing against the cycle of time. The computer defines these alignments as Early, Mid, or Late. Late cycle alignments are vulnerable to reversal. A daily BuST or BrST > 2, for example, suggests a growing probability of consolidation ahead even in Early and Mid cycle alignments.

Using the Matrix

The value of the Matrix is far more than a study of price. Trends are a function of price, volume (force), volatility, and TIME. The order of their importance is as follows: (1) TIME, (2) volatility, (3) volume & price alignment. Volume and price alignment, a setup that triggers action, favors Grade A & B, early cycle markets under high compression (↓COM). ↓COM suggests extremely low volatility, a quiet trend ready to explode into high compression (↑EXP). Weekly and monthly breakout signals are not finalized until the end of the week and month, respectively. Signals generated before that could be temporary. Keep this in mind when reading alignment.