Stocks are falling today. Again, the move higher has been unprecedented, and now stocks are overbought. Can they continue to rally, anything is possible. Should they continue to rally, probably not. The markets are extremely overvalued whether you are valuing it on 2020, 2021, or 2022 earnings multiple.

South Korea (EWY)

Markets around the world are weaker, with South Korea gapping higher for the second day in a row and then fading. The MSCI (NYSE:MSCI) South Korea ETF (NYSE:EWY) is facing a tough downtrend currently that goes back to levels in 2018. So clearly, South Korea has been struggling for several years.

S&P 500 ETF

The {{0|SPDR S&P 500}} (NYSE:SPY) is also moving lower this morning to start the day off. The ETF has support both horizontally and at an uptrend at $312. It is a significant level to watch.

NASDAQ ETF

The QQQ are moving lower too and a drop below $238 takes the ETF below its rising wedge, and a drop below $234 will start making this interesting.

10-Year

Maybe the bond market realizes what I told you the other day, that jobs data was not as good as it seemed. Currently, yields have a failed break out at 0.89 basis points.

Oil

Oil is pulling back too, as it fails to hold a break out at $39.

NVIDIA

NVIDIA (NASDAQ:NVDA) is falling some this morning, and at the moment, is moving below the uptrend. Meanwhile, the RSI suggests shares move lower; it is not a flag pattern either.

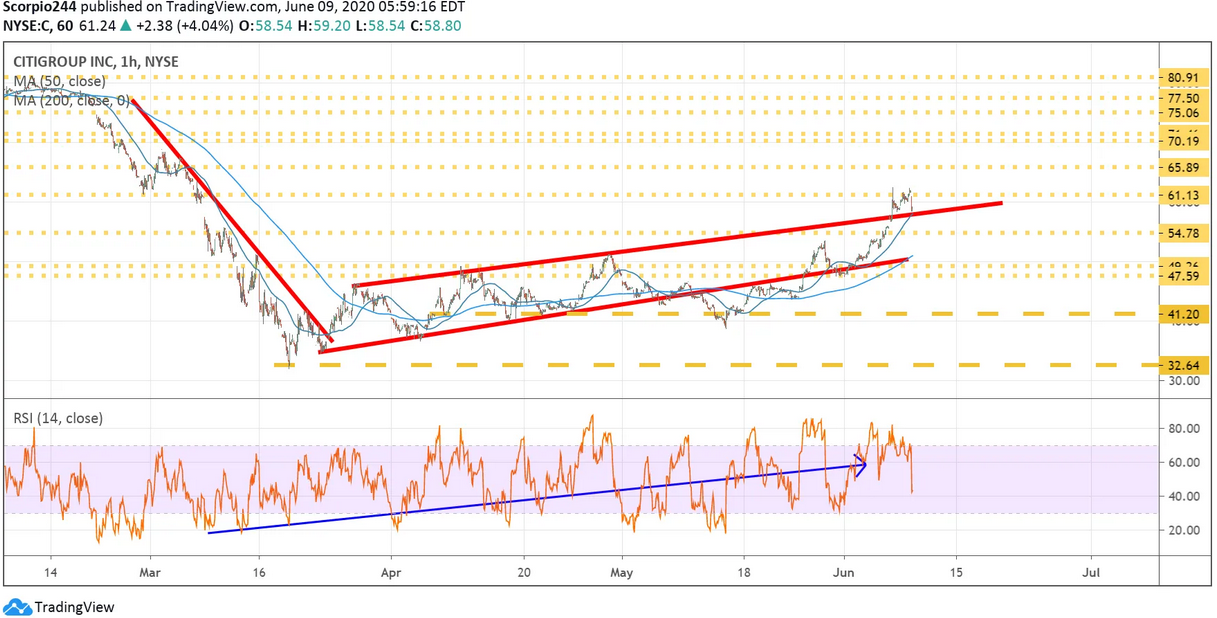

Citigroup

It will be interesting to see what happens with these bank stocks. They have been hot, and if they start to fade, that could be a big problem. Citigroup (NYSE:C) is one of those stocks, and we are likely to find out today if they are posting failed breakouts or if they are starting a new uptrend.

Wells Fargo

Wells Fargo (NYSE:WFC) has paused at resistance at $33.25, and the stock is overbought. A pullback to $29.60 seems possible.

Exxon Mobile

Exxon (NYSE:XOM) is falling today after failing to break out at around $54. I noted some bearish betting this stock yesterday, and the potential for shares to fall back to $50.