Yesterday’s trading session simulated a wrestling match as the bears fought the bulls trying to figure out how the interest rate decision is going to affect the economy. Dollar counterparts began the session on a positive note despite the strong GDP data of 3.9% in the U.S. Traders looked past any data that came out, as their eyes were focused on one event. Once again the Federal Reserve took monetary action, lowering the fund rate by an additional 0.25%. As mentioned in previous reports, the market had already priced in a 0.25% rate cut, therefore traders were scrutinizing the statement that accompanied the decision. The Fed stated that while inflation still remains, an economic slowdown could balance it out, leaving them with no alternative but to continue with their hawkish stance; analyzing the upcoming data and leaving their doors open for further monetary actions, if needed. Traders were hoping for a clearer picture but took it as a sign for further dollar weakness.

Today’s trading session should characterize an “after shock” as traders will look for reassurance regarding yesterday’s reaction, while economic data will continue to flood the markets.

Commodities received a boost from the decision as expectations of a weakening dollar helped Gold touch $800 (the first time since 1980), while crude oil futures continued to trade above $94 per barrel.

Euro | Japanese Yen | British Pound | Swiss Franc

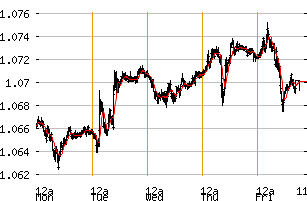

Euro

The Euros’ intraday trend was up throughout the whole of the day, trading at $1.4483 towards the end of the U.S stock market session. Even though this currency pair became very volatile around the announcement, fluctuating between a 75 pip trading range, it ended the day up around its intraday high, due the out come of the decision.

Support: 1.4400, 1.4350, 1.4300

Resistance: 1.4500, 1.4450, 1.4370

Euro | Japanese Yen | British Pound | Swiss Franc

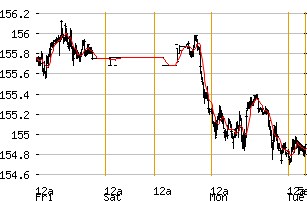

Japanese Yen

Even though most of the currencies were up against the Dollar, this currency pair managed to stand firm, closing the session at its intraday high. As mentioned above, traders will need reassurance from today’s session as the dollar refused to give up its gains to the Yen, possibly hinting that the Fed could leave rates unchanged at its next meeting.

Support: 114.95, 114.50, 113.80

Resistance: 115.50, 116.00, 116.60

Euro | Japanese Yen | British Pound | Swiss Franc

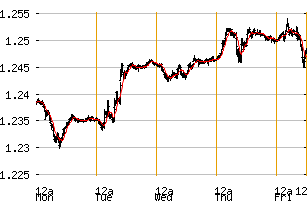

British Pound

Similar to the Euro, this currency pair also ended the session around its high’s as interest rate differentials are starting to attract money into the Pound. Even though the housing sector in England is still weighing on their economy, holding interest rates at 5.75% is starting to attract traders, allowing them to receive higher returns.

Support: 2.0750, 2.0640, 2.0560

Resistance: 2.0820, 2.0850, 2.0900

Euro | Japanese Yen | British Pound | Swiss Franc

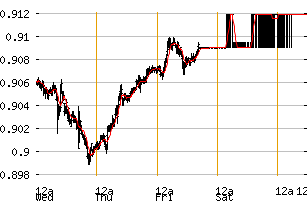

Swiss Franc

Support: 1.1580, 1.1550, 1.1500

Resistance: 1.1630, 1.1670, 1.1780