Investing.com’s stocks of the week

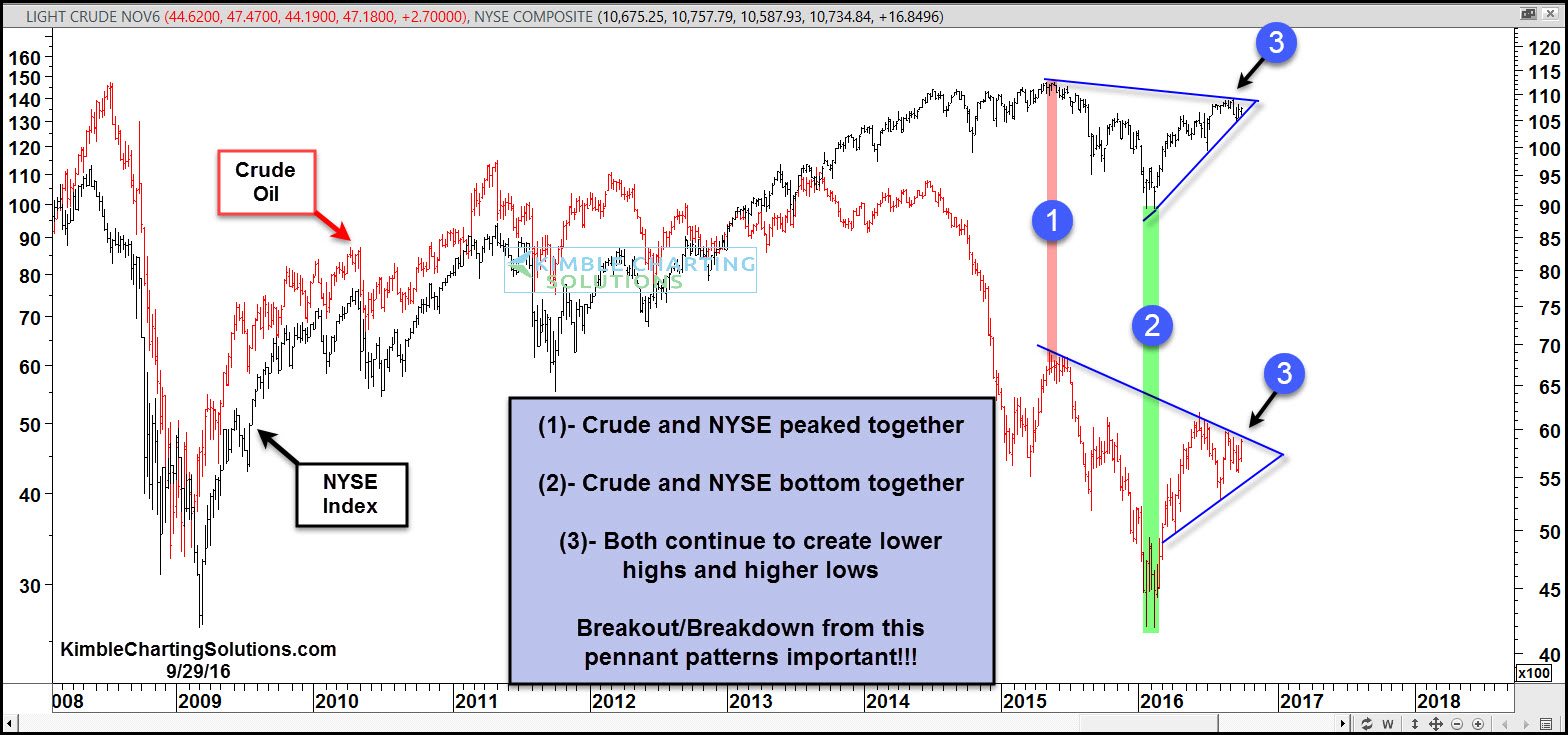

The chart below looks at the price patterns of crude oil and the NYSE Index over the past 8 years. And while crude and the NYSE don’t always correlate, they have, over the past several years, done just that and in a big way.

Since early 2015, the correlation between crude and the NYSE has been extreme. They both hit highs together in 2015 at (1) and they both created double-bottom lows together at (2).

Over the past 15 months, both appear to be creating a pennant pattern (lower highs and highs lows), which tend to frustrate both bulls and bears as the patterns are making little net progress.

Both are testing falling high resistance (top of pennant pattern) at (3) right now. The risk-on trade in stocks and crude want and need breakouts to happen. If they do, both should attract buyers.

The results of these pennant patterns (breakout/breakdown) could set the tone for portfolio construction for a good while to come and should be important on a macro basis.