There is this meme prevalent in the financial media that stocks and bonds need to move in opposite directions. So as bond prices rise stock prices must fall and vice versa. This fits well if your narrative is that stocks are operating in an economic environment where earnings estimates are increasing while bonds are ending a 35 year bull market with rates about to move higher. But is it a fact or just a story that was molded to the evidence and perception of the future?

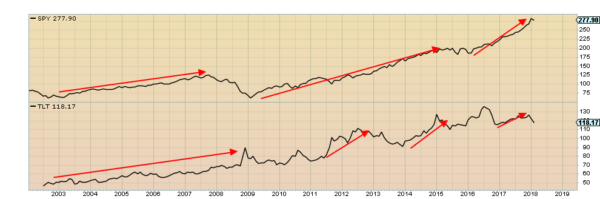

The chart above shows quite the opposite. Stocks and bonds can and have moved together. In fact over the the last 15 years it has been the case that stocks and bonds have moved together, hand in hand, more often than not. There is the long period from 2003 through the top in 2007. Then there is the period from 2011 through to 2013, followed by all of 2014 and then 2017. Each of these periods saw bond prices move up while stock prices were rising.

So as the financial media wails on about how these asset classes need to move in opposite directions, remember, like anything you here or read, look for the evidence to back up the claim. Your life in the markets will be much easier if you follow the evidence instead of the blather.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.