US stocks rebounded on Tuesday as traders awaited Ben Bernanke’s final policy meeting as Governor of the Federal Reserve. New Head, Janet Yellen is waiting in the wings and expected to continue the dovish stance. We also saw a number of corporate earnings beat expectations.

The world’s biggest drugmaker, Pfizer, advanced by 2.6% after it reported better than expected earnings as a result of cost cutting and tax rate falls. Homebuilders also surged, by as much as 5.3%, after a report suggested US home prices climbed again in the last quarter.

Financial stocks also posted gains, with AIG up 2.6% and Bank of America higher by 2.58%. It was not all green for US stocks, however, as Apple tumbled 8% on lower than expected iPhone sales. The stock is down heavily after it reported numbers after hours on Monday.

Elsewhere in the financial markets, currencies were relatively quiet, while the US dollar gained against the euro, yen and Swiss franc. Dollar strength continues to go hand in hand with equity strength, however AUD/USD bucked the trend and continued its mini-rebound. Gold dropped, but not by much and currently trades around $1255.

Gold - UP

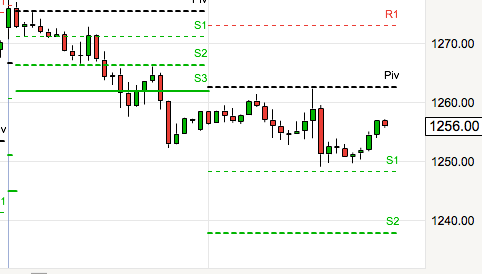

Yesterday, gold traded between it’s pivot and first support in what was a relatively tight range. The metal recorded a range of just 13 points in today’s session which is unusual given the precious metal’s recent price history.

Periods of low volatility rarely last long in gold so we may be on the brink of a break-out over the next couple of days. Inflation data, comments from the Fed, or equity weakness could all set the stage for a gold rebound. Binary options traders should look to bet UP and use the key pivot level as the guide.

GBP/USD - DOWN

Cable was unable to sustain gains on Tuesday as the currency failed to break past the first resistance level on two occasions. GBP/USD hit the first resistance and fell back to the pivot and ended the session with a bearish bias. Particularly since it has been unable to follow through on Monday’s gains.

On a longer term daily chart, GBP/USD is now at the top of it’s upper Bollinger Band and, having already reversed sharply from this band last week, there is another opportunity to sell GBP/USD here.

According to open position data from forex broker Oanda, 73.29% of traders currently hold short positions in the currency, getting close to be a significantly one-sided state. The more one-sided the market becomes the more chance there will be of GBP/USD falling back.

Binary options traders should use the moment to bet DOWN on GBP/USD and look for a move back towards the lower Bollinger Band. A possible 150 pips profit should be on the cards when the currency starts to head back down.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Stocks And Binary Options Update

Published 01/29/2014, 05:12 PM

Updated 07/09/2023, 06:31 AM

Stocks And Binary Options Update

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.