Major U.S. stock indexes and their related ETFs bounced higher on Monday to start the week on a positive note after last week’s sharp sell off.

Markets were bolstered by a better than expected retail sales report and news that the Empire State Index declined again, but not as sharply as in September. However, yesterday’s reading for October came in at -6.2 and was worse than the expected -4.0.

Earnings season is in full swing this week and so those reports will be closely watched along with a full slate of economic reports due to be released. Other issues that could be market movers are the Presidential election and the rapidly approaching “fiscal cliff,” both of which add an element of uncertainty to short term market action. Citigroup (C) rose sharply yesterday as markets liked its earnings reports.

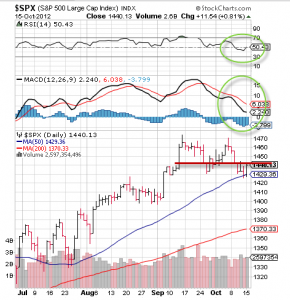

On a technical basis, it was a lackluster day as the S&P 500 (SPY) rose to recent resistance levels and momentum and relative strength marginally improved.

Major Index ETFs:

Dow Jones Industrial Average (DIA) +0.72%

S&P 500 (NYSEARCA:SPY) +0.8%

Nasdaq 100 (QQQ) +0.73%

Russell 2000 (IWM) +0.63%

Other major asset classes saw gold (GLD) decline 1% and oil (USO) mostly flat with West Texas Intermediate Crude rising 0.13% to $91.75/bbl.

Today brings consumer prices, industrial production and home builder’s reports while earnings reports continue to flow in with notables Coca Cola (KO), Goldman Sachs (GS) and Intel (INTC) due to report.

Bottom line: Major U.S. indexes and ETFs bounced back from last week’s steep drops to remain in the recent trading range as investors look to earnings, economic reports and political factors that could offer risk or opportunity going forward.

Disclaimer: The content included herein is for educational and informational purposes only, and readers agree to Wall Street Sector Selector’s Disclaimer, Terms of Service, and Privacy Policy before accessing or using this or any other publication by Wall Street Sector Selector or Ridgeline Media Group, LLC.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Stocks, ETFs Bounce Higher On Monday

Published 10/16/2012, 02:18 AM

Updated 05/14/2017, 06:45 AM

Stocks, ETFs Bounce Higher On Monday

Stocks and ETFs bounce higher to start the new week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.