Major U.S. stock indexes and ETFs finished strongly in the green yesterday as President Obama and House Speaker Boehner met at the White House and appear to be moving towards a deal to resolve the fiscal cliff issue.

For the day, the Dow Jones Industrial Average (DIA) rose 0.76%, the S&P 500 (SPY) added 1.19%, the Nasdaq 100 (QQQ) gained 1.38% and the Russell 2000 (IWM) climbed 1.37%.

Gold (GLD) was mostly flat at $1699/oz. and oil (USO) gained 1.4% to $87.98/bbl.

More news regarding the fiscal cliff is expected as the week continues and Speaker Boehner meets with Republican colleagues on Tuesday to discuss the situation. Congressman Boehner offered higher tax rates on incomes greater than $1 million over the weekend and apparently sweetened the deal with an offer of a one year increase for the debt ceiling.

Economic news remained weak with the Empire State manufacturing index remaining in contractionary territory for the fifth straight month with a reading of -8.1, widely missing a forecast gain of 1.0 and below last month’s -5.2.

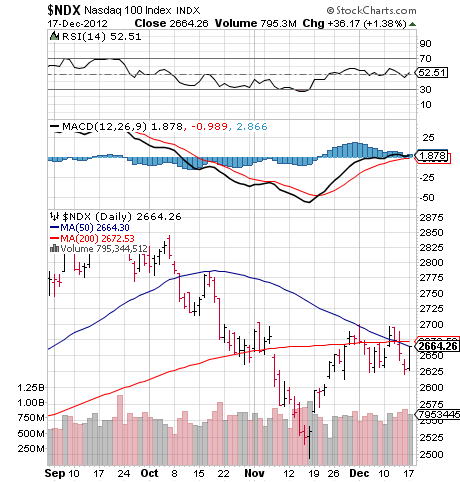

Although the recent rally in major U.S. indexes and ETFs has garnered positive headlines, nothing much has happened from a technical point of view.

The Nasdaq 100 (QQQ) remains below its 50 and 200-day moving averages and has painted a “death cross” in which the 50 is below the 200.

Regarding the major market index, the S&P 500 (SPY) the index remains in a trading range within which the up and down action is mostly noise generated by headlines on thin trading volume.

The trading range is easy to see in the chart above as resistance lies just overhead at the 1430-1440 level and support along the trend line at 1400-1415. Until this range is broken, either up or down, nothing much is really going on in major U.S. stock indexes.

Bottom line: U.S. stocks and ETFs continue to reflect hopes for a deal on the fiscal cliff while locked in a relatively tight trading range that has been underway since early November. As the Holidays approach, we can expect low volumes and headline induced volatility along with moves generated by the fiscal cliff discussion. Separating noise from significant market motion will be important as 2012 draws to a close.

Disclaimer: The content included herein is for educational and informational purposes only, and readers agree to Wall Street Sector Selector’s Disclaimer, Terms of Service, and Privacy Policy before accessing or using this or any other publication by Wall Street Sector Selector or Ridgeline Media Group, LLC.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Stocks, ETFs Boosted By Fiscal Cliff Hope

Published 12/18/2012, 01:25 AM

Updated 05/14/2017, 06:45 AM

Stocks, ETFs Boosted By Fiscal Cliff Hope

U.S. stocks and ETFs posted solid advances today on expectation of a fiscal cliff deal

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.