Forget the line about “lies, damn lies and statistics.” News headlines take the cake for the greatest potential to mislead.

Look no further than the latest unemployment data.

Last week, the Labor Department revealed that initial jobless claims spiked to 439,000. That’s the highest number in 18 months -- and almost 80,000 more than the previous week.

What gives? Wasn’t the labor market on the mend? I mean, a few weeks ago, right before the presidential election, initial jobless claims dipped to their lowest level in four years.

Such a sharp reversal must be the result of some kind of government-led conspiracy, right Mr. Welch?

Fear not. There’s no need to go there. A quick scan of the ever-trustworthy news headlines reveals it’s all a natural disaster-induced anomaly.

“Hurricane Sandy drives up first-time jobless claims.”

- MarketWatch

“Claims for jobless benefits jump as Sandy’s havoc spreads to labor market.” – The Star Ledger

“Hurricane Sandy drives up joblessness.” – Cape Cod Times

“Hurricane Sandy sends first-time unemployment benefit claims soaring to 18-month high.” – Daily Kos

So it’s all Hurricane Sandy’s fault!

Or is it?

In honor of Myth-Busting Monday, let’s dig into the numbers to figure it out.

In the process, I’ll also remind you why investors should regularly track unemployment claims data – and how to do it. (Hint: Unlike Miss Cleo, it can actually help you predict the future.)

Don’t Get Caught Up In The Blame Game

No doubt, Hurricane Sandy impacted the employment situation in the Northeast. And it’s going to continue to do so, as well.

As Citi economist, Steven Wieting, said, “The experience of Katrina suggests higher storm-related [unemployment] filings could persist for weeks.”

But the headlines make you believe the entire increase in initial claims last week is Hurricane Sandy’s fault. And that’s not the case at all.

If we dig into the data, here’s what we find.

New Jersey and Connecticut reported increases of 5,675 and 1,783 claims, respectively. And the cause was clearly stated in the press release: “Due to Hurricane Sandy.”

The highest increases, though, came in Pennsylvania (+7,766) and Ohio (+6,450). The cause?

Not the hurricane.

In Pennsylvania, claims spiked because of “layoffs in the construction, transportation, manufacturing and the food and beverage manufacturing industries.” In Ohio, it was due to “layoffs in the automobile and manufacturing industries.”

And here’s the kicker: In total, non-hurricane-caused claims outweighed hurricane-caused claims by a ratio of 3-to-1.

Yet the media’s blaming it all on the storm. Did they even take the time to read the full press release to uncover the real data? Obviously not.

The truth is, the cause for the huge increase is two-fold. It’s the hurricane and -- to a greater extent – continued weakness in our economy. That’s potentially problematic for investors.

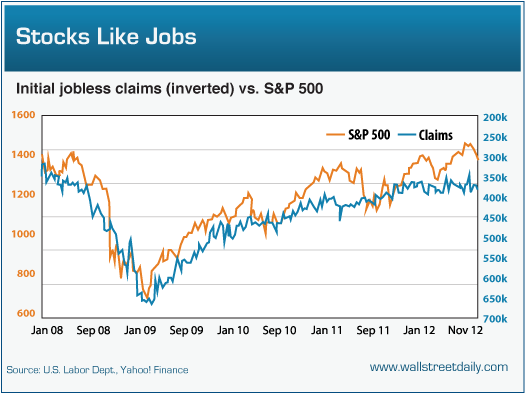

As I’ve told you before, stock prices exhibit a strong negative correlation to the four-week average initial jobless claims figure. As claims go down, stocks historically go up. And vice versa.

True to form, the latest spike in the four-week average to 383,750 claims coincides with the drop in the stock market.

Bottom line: We need to go to the source, instead of relying on the mainstream press to get the truth. When it concerns initial unemployment claims, that means visiting the Labor Department’s website, where you can access all the current and historical data.

And the reason we should even give a hoot about initial jobless claims (beyond the obvious that it’s an indication of overall economic health), is because the longer-term trend helps us predict the next move for the stock market.

Ahead of the tape,

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Stock Selloffs And The 'Sandy Myth

Published 11/19/2012, 12:05 PM

Updated 05/14/2017, 06:45 AM

Stock Selloffs And The 'Sandy Myth

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.