People talk about the stock market as if it is subject to the laws of physics. Specifically what goes up must come down. That is just wrong. In fact the S&P 500 has provided a Compounded Annual Growth Rate (CAGR) of over 10% since 1970. What goes up does not have to go down.

So why do pundits, reporters and traders think that because the market is not going higher every day that it must fall? Maybe the problem is we have all become so accustomed to the world of instant gratification that our investment timeframes are now too short. If you are making your trading decisions solely on a 5 minute chart you will likely need to change your mind several times per day. I doubt that will keep you happy in the long run, but it will keep your broker happy.

You see it in Dow Theory discussions, where a new high in the Transports must be confirmed by a new high in the Industrials to continue the uptrend. The key words there are ‘continue the uptrend.’ And from the current price action it would ‘continue’ from a consolidation. There is no ‘down’ involved there. Not yet anyway. In fact the market is trading well above the 200 day Simple Moving Average (SMA) and is even above the 50 day SMA. These are generally bullish signals.

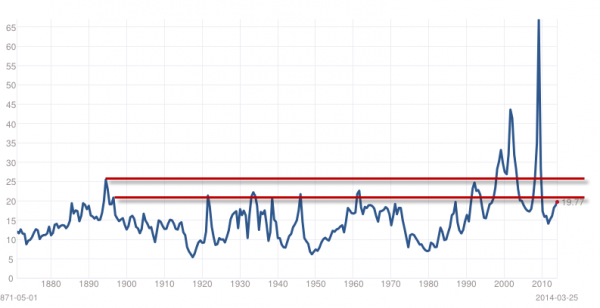

You see it in discussions of P/E ratios that are ‘too high’ or future earnings expectations that are ‘unsustainable’. When did those ever matter to the price of stocks and the level of the market. Yes you can tell me that P/E ratios capped before prior falls but be prepared to all provide how long they continued to rise and how long they were deemed to be too high. The chart of P/E ratios below seems to show that the current level is not even in the prior danger zone, much less anywhere near the two prior peaks.

The market will tell you when it is going lower. Look for a lower low. Not sideways movement. Not non-confirmation of a continuation higher (what does that even mean?). Not P/E ratios that are rising.

Until then you do not have to buy stocks (but I will selectively) but you certainly should not be selling them. Adjust your stops, like you should in any market, keep vigilant, but most of all remember Not Going Up ≠ Falling.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.